- Australia

- /

- Metals and Mining

- /

- ASX:SVL

We Think Silver Mines (ASX:SVL) Needs To Drive Business Growth Carefully

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Silver Mines (ASX:SVL) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Silver Mines

Does Silver Mines Have A Long Cash Runway?

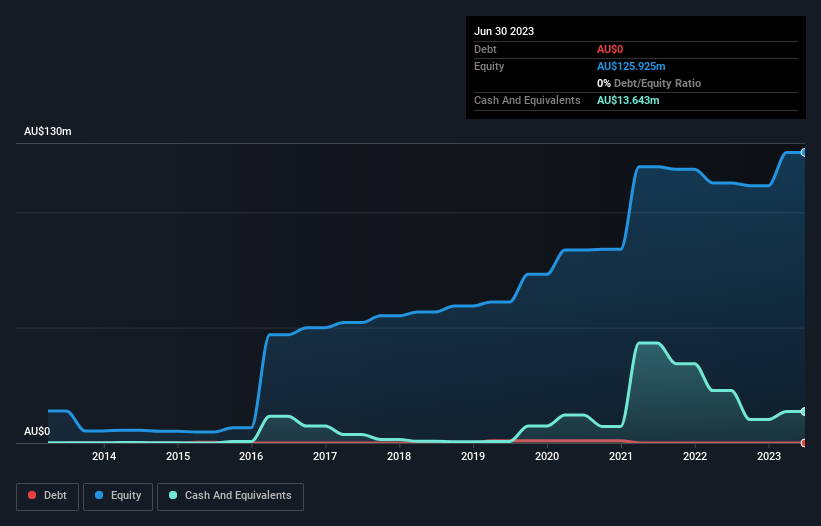

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Silver Mines last reported its balance sheet in June 2023, it had zero debt and cash worth AU$14m. Looking at the last year, the company burnt through AU$12m. That means it had a cash runway of around 14 months as of June 2023. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Importantly, if we extrapolate recent cash burn trends, the cash runway would be noticeably longer. You can see how its cash balance has changed over time in the image below.

How Is Silver Mines' Cash Burn Changing Over Time?

In our view, Silver Mines doesn't yet produce significant amounts of operating revenue, since it reported just AU$172k in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. The skyrocketing cash burn up 151% year on year certainly tests our nerves. It's fair to say that sort of rate of increase cannot be maintained for very long, without putting pressure on the balance sheet. Admittedly, we're a bit cautious of Silver Mines due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Easily Can Silver Mines Raise Cash?

While Silver Mines does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Silver Mines has a market capitalisation of AU$197m and burnt through AU$12m last year, which is 5.9% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About Silver Mines' Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Silver Mines' cash burn relative to its market cap was relatively promising. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Silver Mines (2 are potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SVL

Silver Mines

Engages in the acquisition, exploration, and development of silver projects in Australia.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026