Southern Palladium Limited (ASX:SPD) insiders who purchased shares in the last 12 months were richly rewarded last week. The stock climbed by 11% resulting in a AU$29m addition to the company’s market value. As a result, the stock they originally bought for AU$7.14m is now worth AU$15.4m.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

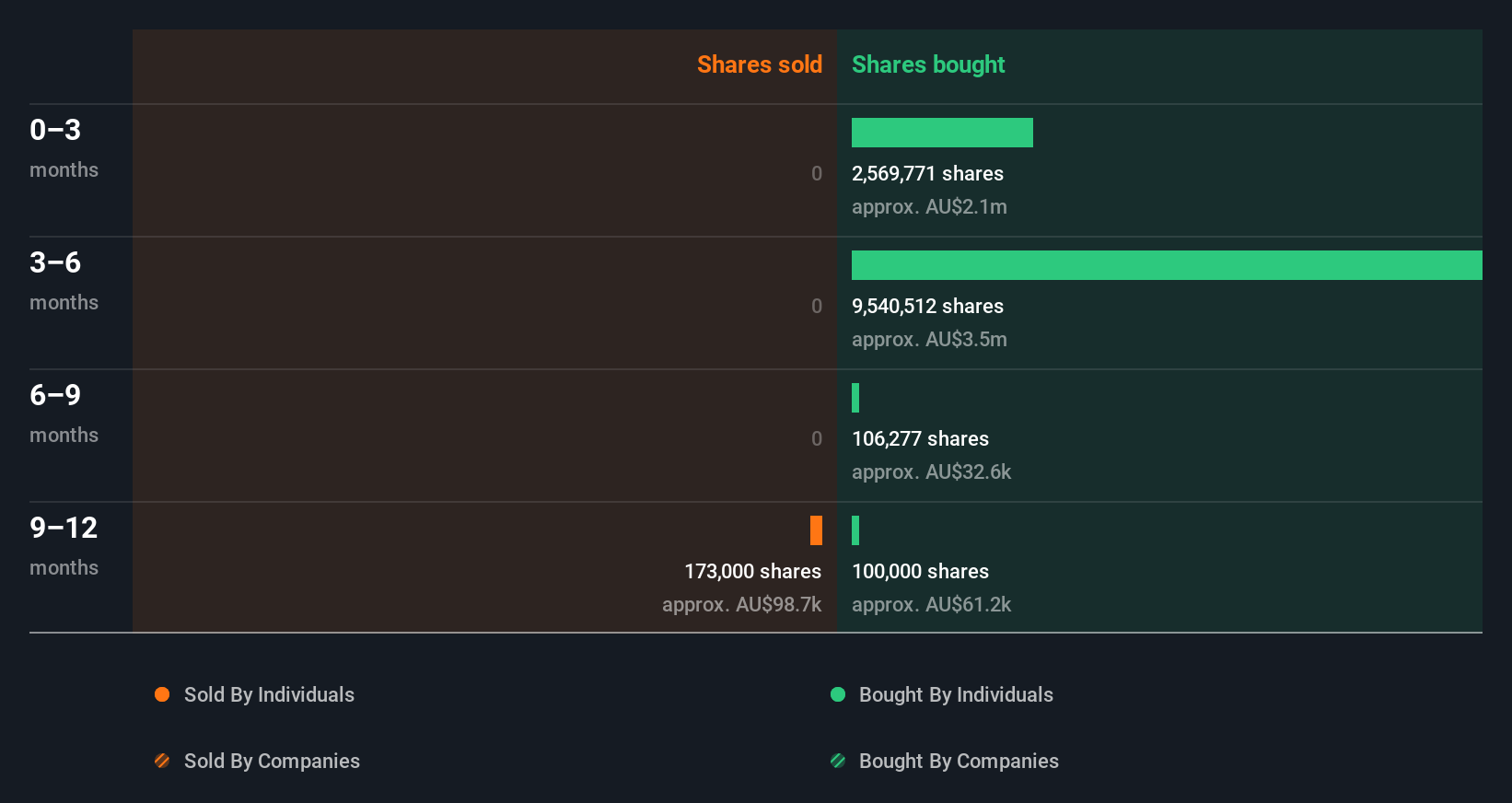

Southern Palladium Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by insider Robert Keith for AU$4.6m worth of shares, at about AU$0.50 per share. We do like to see buying, but this purchase was made at well below the current price of AU$1.25. While it does suggest insiders consider the stock undervalued at lower prices, this transaction doesn't tell us much about what they think of current prices.

Over the last year, we can see that insiders have bought 12.32m shares worth AU$7.1m. But insiders sold 173.00k shares worth AU$104k. Overall, Southern Palladium insiders were net buyers during the last year. The average buy price was around AU$0.58. We don't deny that it is nice to see insiders buying stock in the company. However, you should keep in mind that they bought when the share price was meaningfully below today's levels. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

Check out our latest analysis for Southern Palladium

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Insiders At Southern Palladium Have Bought Stock Recently

It's good to see that Southern Palladium insiders have made notable investments in the company's shares. In total, insiders bought AU$2.3m worth of shares in that time, and we didn't record any sales whatsoever. This could be interpreted as suggesting a positive outlook.

Insider Ownership Of Southern Palladium

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Southern Palladium insiders own about AU$29m worth of shares. That equates to 18% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Southern Palladium Tell Us?

It is good to see recent purchasing. And an analysis of the transactions over the last year also gives us confidence. But we don't feel the same about the fact the company is making losses. When combined with notable insider ownership, these factors suggest Southern Palladium insiders are well aligned, and that they may think the share price is too low. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. For instance, we've identified 4 warning signs for Southern Palladium (3 are concerning) you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SPD

Southern Palladium

Engages in the exploration and development of platinum group metals.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026