- Australia

- /

- Metals and Mining

- /

- ASX:SGQ

St George Mining (ASX:SGQ) Is Up 25.4% After US Rare Earths Offtake Deal Announcement – Has The Bull Case Changed?

Reviewed by Simply Wall St

- St George Mining recently announced a collaboration and offtake deal with US-based REAlloys for the Araxá niobium-rare earths project in Brazil, including metallurgical testing and an offtake option covering up to 40 percent of future production.

- This partnership could provide St George Mining with a pathway into the US clean energy and defence supply chains as demand rises for rare earth elements.

- We'll explore how the REAlloys alliance strengthens St George Mining's investment narrative through potential access to the US magnet supply chain.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is St George Mining's Investment Narrative?

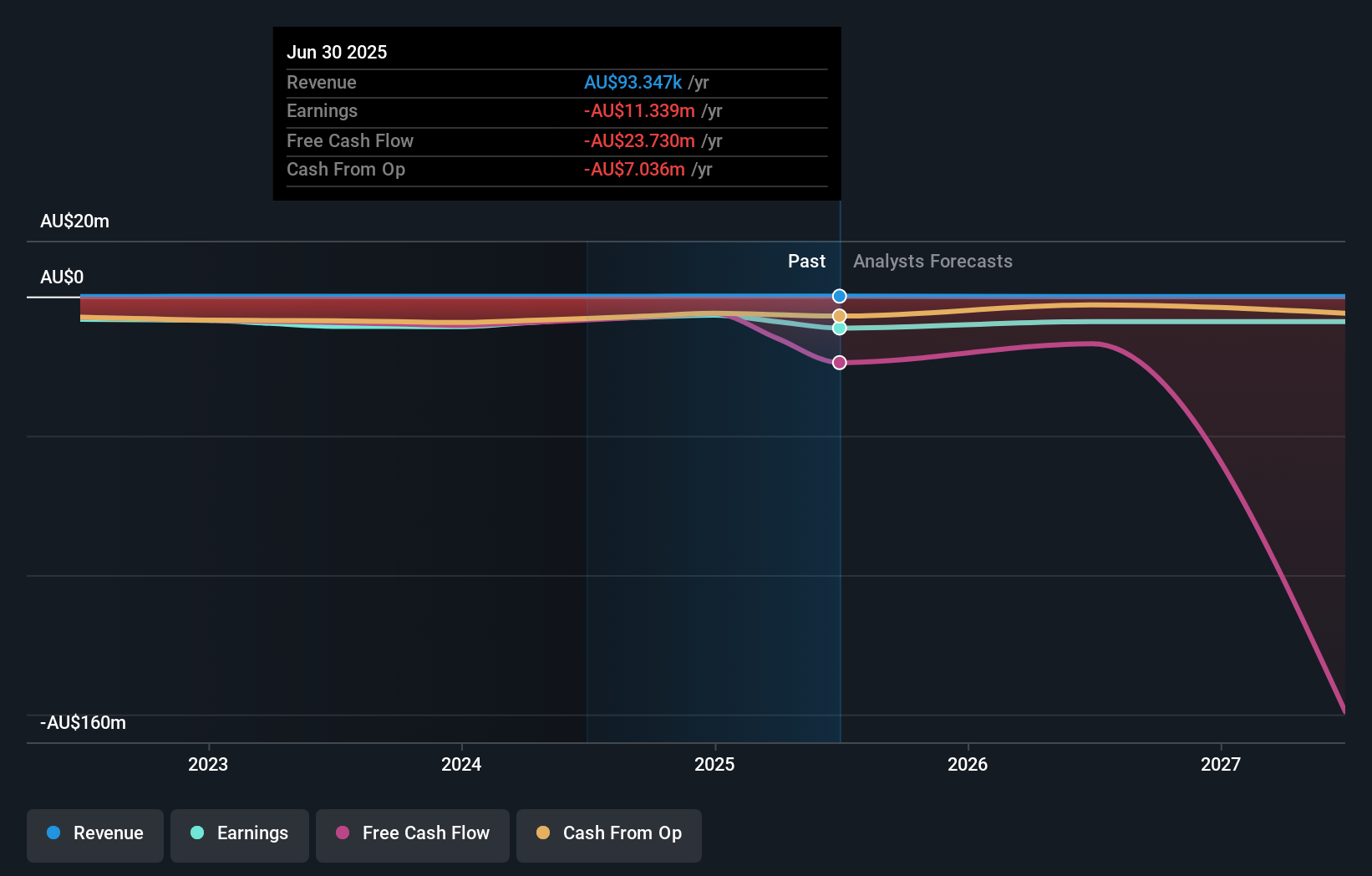

For anyone considering St George Mining, the story rests on whether the Araxá project's promise as a high-grade rare earths and niobium asset can be translated into commercial progress. The recent alliance and offtake agreement with REAlloys could change the immediate picture. Before this news, investor focus had been squarely on resource definition, managing ongoing losses, and persistent share dilution, with few firm catalysts on the horizon. Now, this US partnership not only lends industrial credibility, but it may accelerate access to non-Chinese supply chains, potentially boosting hopes for eventual offtake and revenue. That said, near-term revenue generation still relies on successfully completing resource development and advancing feasibility work, the milestones that matter most right now. Financing and dilution risk remain front of mind as recurring equity raises have been the primary source of capital and could continue unless project economics start to shift.

But there is one potential headwind on the board independence front that investors should be watching. Our expertly prepared valuation report on St George Mining implies its share price may be too high.Exploring Other Perspectives

Explore another fair value estimate on St George Mining - why the stock might be worth just A$0.12!

Build Your Own St George Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your St George Mining research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free St George Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate St George Mining's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGQ

St George Mining

Engages in the exploration for mineral properties in Australia.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives