- Australia

- /

- Metals and Mining

- /

- ASX:S32

Will South32’s (ASX:S32) New ESG Voice Quietly Recast Its Long-Term Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- South32 Limited has appointed Geoff Healy as an independent Non-Executive Director, with his Board tenure beginning on 2 December 2025 and formal election to be sought at the 2026 Annual General Meeting.

- His background in climate, sustainability, legal and external affairs across BCG, BHP and Herbert Smith Freehills suggests a stronger emphasis on risk, ESG and energy-transition governance within South32’s boardroom.

- We’ll now examine how Healy’s ESG-focused appointment could reshape South32’s existing investment narrative around portfolio refocus and growth projects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

South32 Investment Narrative Recap

To own South32, you need to believe in its shift toward metals tied to the energy transition, while managing exposure to alumina pricing, aging assets and large capex programs. The Healy appointment does not materially change the key near term catalyst, which remains the delivery and de risk of copper and base metals growth projects, nor the biggest risk, which is cost and execution pressure across those developments and major sustaining investments.

The recent completion of the Cerro Matoso divestment is most relevant here, because it reinforces South32’s move away from lower margin, non core assets and concentrates management attention and capital on aluminium, alumina, manganese and copper growth options. That same focus, however, also increases the importance of successfully advancing projects like Hermosa and Sierra Gorda within budget and on schedule to support the company’s refocused investment case.

Yet investors should also be aware that cost inflation and project overruns could...

Read the full narrative on South32 (it's free!)

South32’s narrative projects $6.8 billion revenue and $1.1 billion earnings by 2028. This requires 4.5% yearly revenue growth and an earnings increase of about $0.8 billion from $318.0 million today.

Uncover how South32's forecasts yield a A$3.38 fair value, in line with its current price.

Exploring Other Perspectives

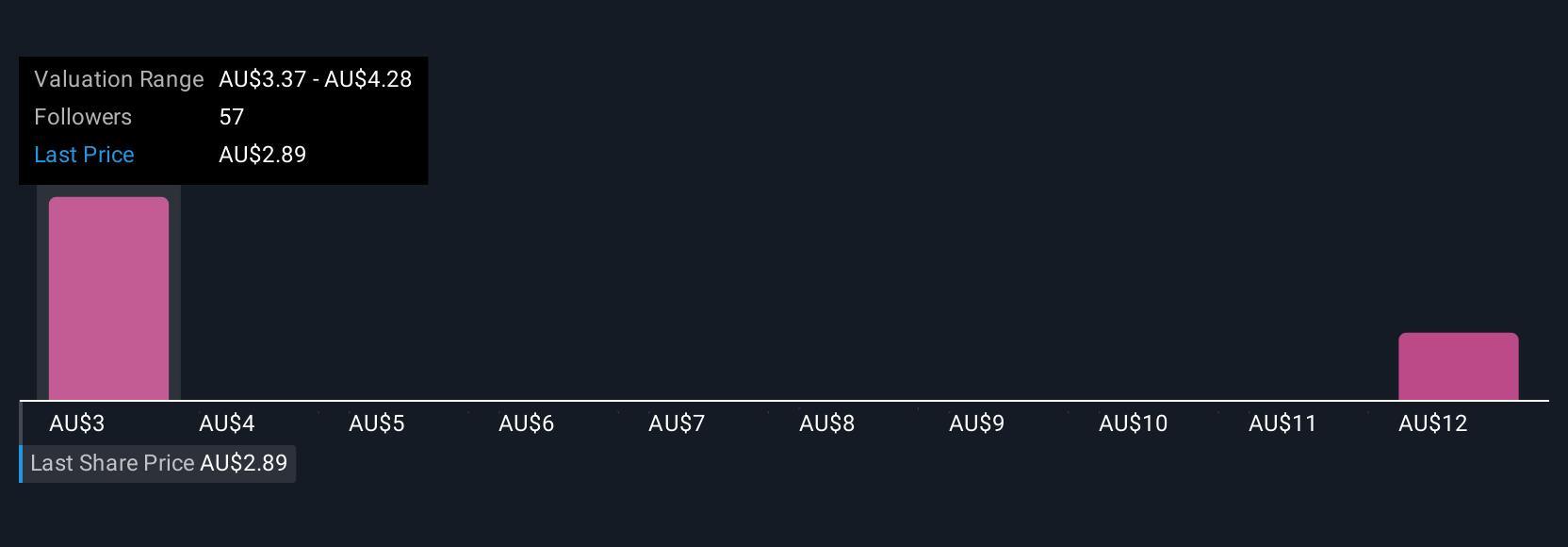

Six fair value estimates from the Simply Wall St Community span roughly A$3.37 to A$10.49 per share, showing a very wide range of expectations. Set those views against the company’s heavy future capex and execution risk on projects such as Hermosa and Sierra Gorda, and you can see why it helps to weigh several different opinions on South32’s long term performance potential.

Explore 6 other fair value estimates on South32 - why the stock might be worth over 3x more than the current price!

Build Your Own South32 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your South32 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free South32 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate South32's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:S32

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026