- Australia

- /

- Metals and Mining

- /

- ASX:S32

South32 (ASX:S32) Secures USD 166M DOE Grant for Hermosa Project, Announces USD 200M Share Buyback

Reviewed by Simply Wall St

Click here to discover the nuances of South32 with our detailed analytical report.

South32 Analysis

Strengths: Core Advantages Driving Sustained Success For South32

South32 has demonstrated robust financial health, with FY '24 underlying EBITDA of USD 1.8 billion and underlying earnings of USD 380 million. This financial strength is further underscored by the company's ability to lower net debt by USD 320 million in H2 FY '24. The strategic transformation towards commodities critical for a low-carbon future, as highlighted by CEO Graham Kerr, positions South32 advantageously in emerging markets. The company’s Price-To-Sales Ratio (1.8x) is notably favorable compared to the Australian Metals and Mining industry average (50.2x) and peer average (7x), indicating good relative value. Additionally, the decision to pay a USD 140 million fully franked ordinary dividend for H2 FY '24 reflects strong cash flow management and shareholder commitment.

Weaknesses: Critical Issues Affecting South32's Performance and Areas For Growth

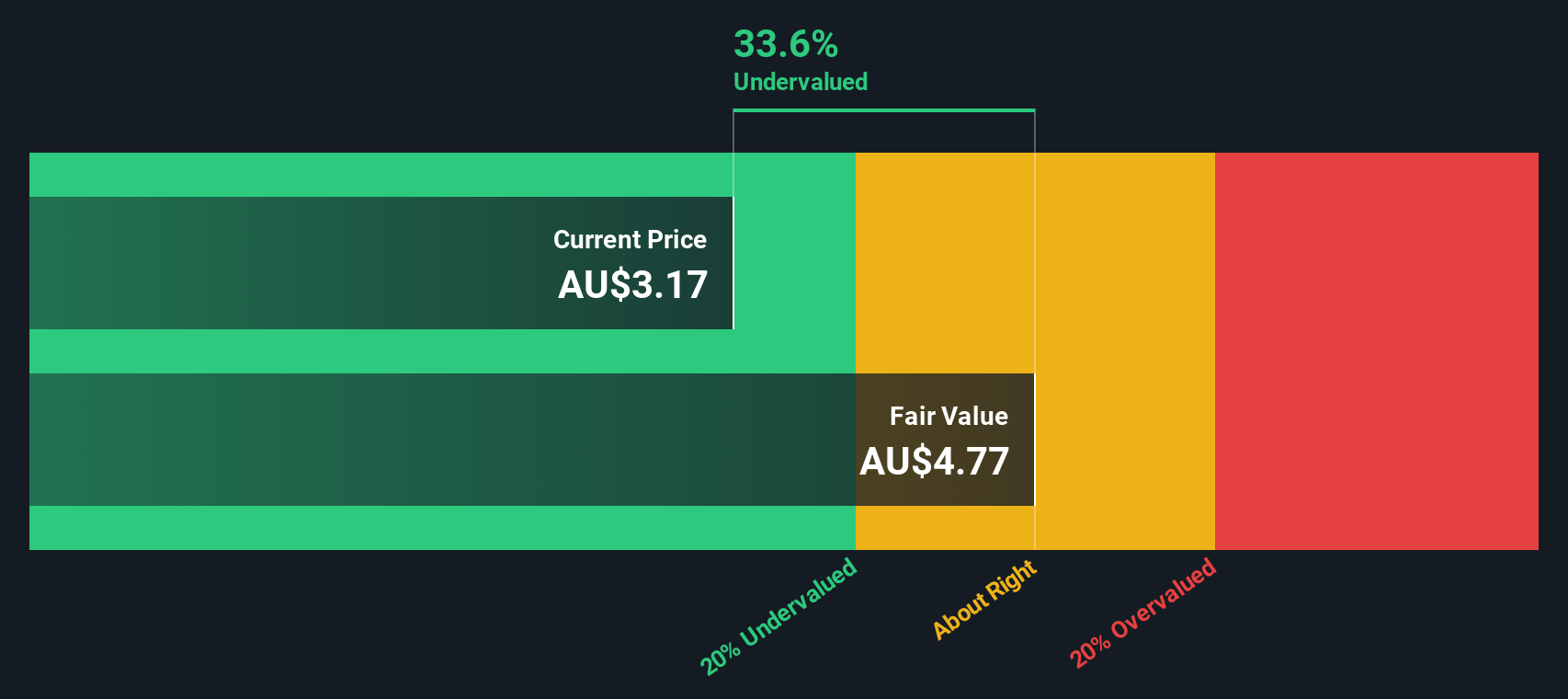

Despite its financial strengths, South32 faces several challenges. The company is currently unprofitable, with a negative Return on Equity (-7.13%). The valuation suggests that South32 (A$3.33) is trading above its estimated fair value (A$2.66), indicating potential overvaluation concerns. Operational disruptions, such as the suspension of GEMCO operations due to tropical cyclone Megan, highlight vulnerabilities in infrastructure resilience. Additionally, the increase in the lost time injury frequency rate by 19% underscores ongoing safety challenges. Environmental risks, particularly those related to greenhouse gas emissions targets, pose significant regulatory hurdles that could impact future operations.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

South32 has several strategic opportunities to enhance its market position. The sale of Illawarra Metallurgical Coal for up to USD 1.65 billion will streamline the portfolio towards base metals, zinc, cobalt, and aluminum, unlocking shareholder value. The company’s Hermosa project in Arizona, selected for a USD 166 million award negotiation from the US Department of Energy, represents a significant opportunity to establish a North American supply chain for battery-grade manganese. Additionally, the forecasted revenue growth of 8.6% per year, which is faster than the Australian market average of 5.4%, positions South32 for above-average market growth. The company’s efforts to secure environmental approvals and manage delays in mining approvals further highlight its proactive approach to leveraging growth opportunities.

Threats: Key Risks and Challenges That Could Impact South32's Success

South32 faces several external threats that could impact its long-term success. The ongoing appeal for environmental approvals with the WA government poses a significant risk, potentially affecting the next 15 years of bauxite mining. Regulatory pressures related to greenhouse gas emissions and offsets could impact not only South32 but also other resource and infrastructure projects in Australia. Competitive pressures and market volatility, particularly in the metals and mining industry, could affect profitability and market share. Additionally, any delays in securing necessary approvals or in the construction of new facilities, such as the Clark manganese production facility, could hinder growth prospects.

Conclusion

South32's strong financial health, highlighted by substantial EBITDA and earnings, coupled with effective debt reduction and shareholder-friendly dividend policies, underscores its solid foundation for future growth. However, the company's current unprofitability and higher trading price relative to its estimated fair value raise concerns about its immediate financial performance. Strategic initiatives, such as the sale of Illawarra Metallurgical Coal and the development of the Hermosa project, present significant growth opportunities, especially in the context of a low-carbon future. Nevertheless, regulatory and environmental challenges, along with operational disruptions, pose risks that could impact long-term success. Investors should weigh these factors carefully when considering South32's potential for sustained performance and market positioning.

Seize The Opportunity

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:S32

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives