- Australia

- /

- Metals and Mining

- /

- ASX:RRL

Regis Resources (ASX:RRL): Assessing Valuation After Strong Gold Production and Record Profits

Reviewed by Kshitija Bhandaru

Regis Resources (ASX:RRL) has caught investor attention after reporting strong September quarter gold production, record gold sales and net profits for FY 2025, as well as a healthy cash position with no debt.

See our latest analysis for Regis Resources.

The impressive September quarter results and robust financials have clearly struck a chord with investors. This is reflected in Regis Resources’ 1-month share price return of 22.6% and an outstanding 1-year total shareholder return of 217%. Momentum has accelerated sharply this year, signaling a renewed sense of optimism around the company’s long-term growth potential and risk profile.

If Regis’s strong run has you interested in what else is riding a wave of recent success, now’s the perfect time to discover fast growing stocks with high insider ownership

But with shares surging more than 200% over the past year and the company now trading above analyst price targets, the key question is whether there is real value left for new buyers or if the market has already accounted for future growth.

Most Popular Narrative: 22% Overvalued

With Regis Resources closing at A$6.25 and the narrative’s fair value at A$5.12, the market price is well above what consensus forecasts support. The latest surge has taken shares further beyond the targets that guide analyst thinking, creating a clear disconnect between excitement and the consensus scenario.

The company's commitment to operational efficiency, cost control, and disciplined capital allocation has resulted in record net profit after tax and strong operating cash flow, indicating likely improvements in net margins and ongoing financial resilience. Regis's significant financial flexibility, demonstrated by the repayment of all corporate debt and a robust cash and bullion balance of $517 million, enables strategic investment in organic and inorganic growth projects, underpinning long-term earnings growth.

Curious how such a high valuation could hold up? The entire blueprint depends on squeezed margins, disciplined leadership, and crucial production milestones that have not been reached yet. Want to see which bold assumptions fuel this price, and what is really projected behind closed doors? Only the full narrative reveals the details.

Result: Fair Value of $5.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty surrounding project approvals and future gold price movements could still challenge Regis Resources’ bullish outlook and reshape analyst expectations.

Find out about the key risks to this Regis Resources narrative.

Another View: What Do the Numbers Say?

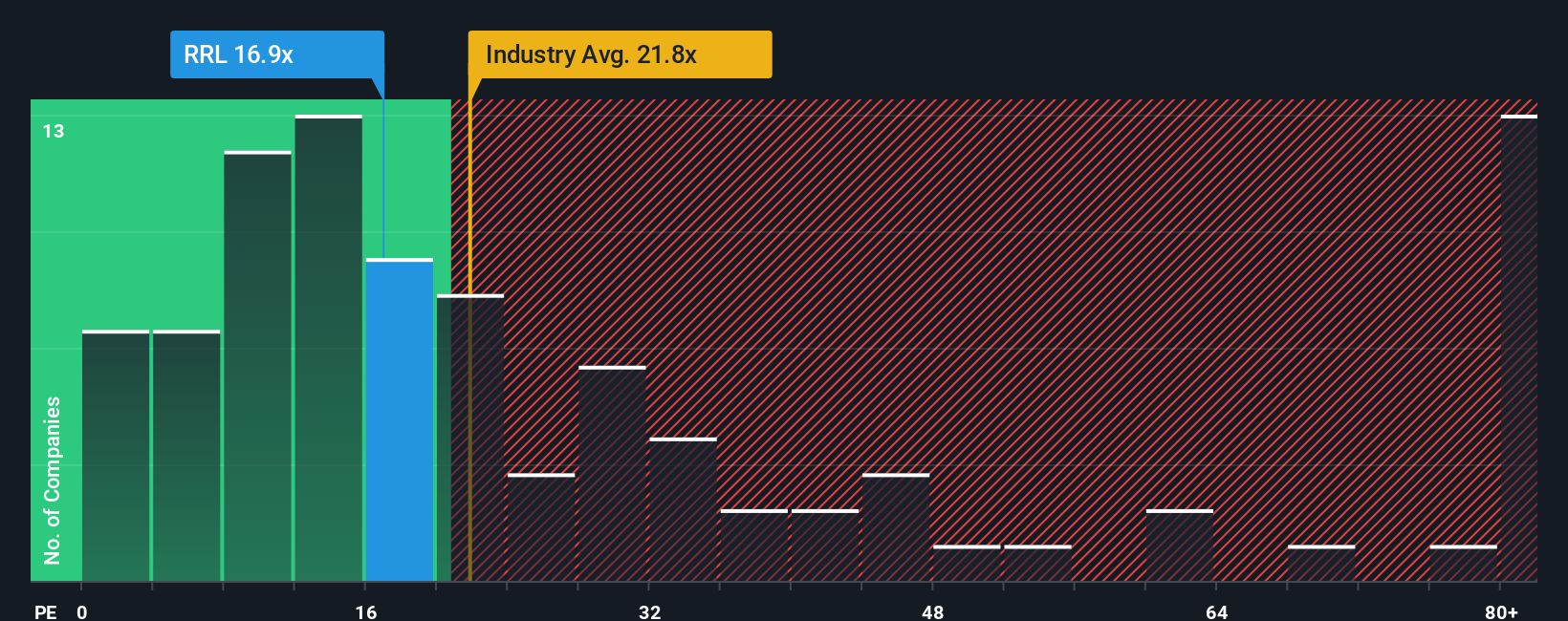

Looking at Regis Resources through price-to-earnings, the company trades at a 18.6x ratio, which is notably lower than both the industry average of 22.6x and the peer average of 54.8x. This also sits below our fair ratio of 20.9x, suggesting current pricing could offer investors a margin of safety. However, does this disconnect between market excitement and metrics point to an overlooked opportunity, or simply reflect different risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regis Resources Narrative

Whether you want to challenge these numbers or build a story of your own, it only takes a few minutes to dive in and craft your personal view. Do it your way

A great starting point for your Regis Resources research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stand still, so don’t limit your research to just one opportunity. Expand your horizons—exciting growth stories and hidden gems await you.

- Tap into the future of medicine by checking out these 32 healthcare AI stocks shaping patient care with groundbreaking artificial intelligence innovations.

- Uncover unbeatable income streams with these 19 dividend stocks with yields > 3% offering yields above 3% if steady cash flow tops your wish list.

- Supercharge your portfolio by spotting opportunities among these 895 undervalued stocks based on cash flows before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RRL

Regis Resources

Engages in the exploration, evaluation, and development of gold projects in Australia.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives