- Australia

- /

- Diversified Financial

- /

- ASX:TYR

ASX Penny Stocks Under A$700M Market Cap: 3 Promising Picks

Reviewed by Simply Wall St

Following a Thursday that marked the best ASX trading day in six weeks, Australian shares are facing a slight dip as global investors remain cautious. For those interested in exploring beyond the established giants, penny stocks—often representing smaller or newer companies—can offer intriguing possibilities despite their somewhat outdated label. In this article, we examine three such stocks that could provide compelling opportunities with financial strength and potential for growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.64 | A$127.94M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$1.99 | A$146.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.795 | A$1.02B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.645 | A$77.6M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.38 | A$368.64M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$117.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.08 | A$146.15M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.87 | A$962.59M | ✅ 4 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.88 | A$1.32B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.375 | A$44M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 981 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian-listed investment company with a market capitalization of A$693.82 million, focusing on leveraging the expertise of leading fund managers to create a concentrated portfolio.

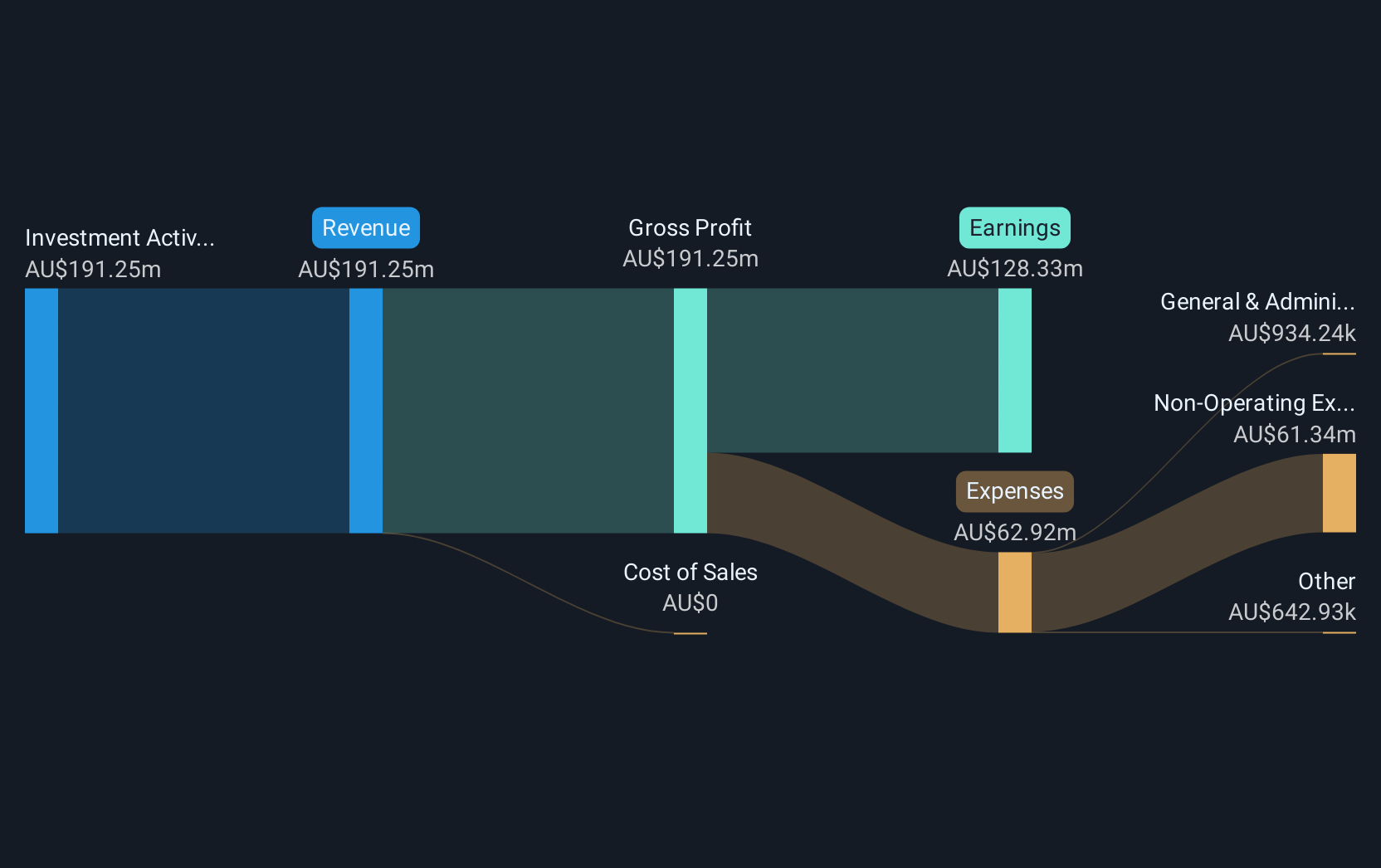

Operations: The company generates revenue of A$191.25 million from its investment activities.

Market Cap: A$693.82M

Hearts and Minds Investments has shown remarkable earnings growth, with a recent increase of 466.4% over the past year, significantly outpacing its five-year average. The company reported half-year revenue of A$137.51 million, up from A$25.99 million a year prior, with net income rising to A$91.95 million. Despite having no debt and strong asset coverage for liabilities, its management team is relatively inexperienced with an average tenure of 1.5 years. While the stock's price-to-earnings ratio is attractively low at 5.4x compared to the market average, its dividend yield of 5.28% isn't well covered by free cash flows.

- Navigate through the intricacies of Hearts and Minds Investments with our comprehensive balance sheet health report here.

- Learn about Hearts and Minds Investments' historical performance here.

Renascor Resources (ASX:RNU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Renascor Resources Limited focuses on the exploration, development, and evaluation of mineral properties in Australia, with a market capitalization of A$127.10 million.

Operations: The company generates revenue from its activities in the exploration of graphite, copper, gold, uranium, and other minerals in Australia.

Market Cap: A$127.1M

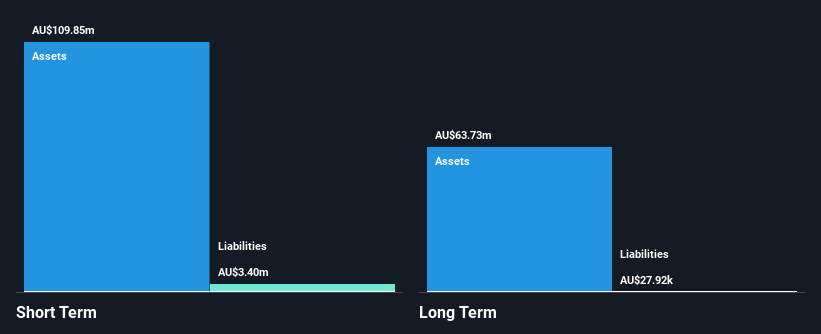

Renascor Resources has demonstrated substantial earnings growth, with a 302.1% increase over the past year, surpassing industry averages. The company reported half-year revenue of A$2.66 million and net income of A$1.02 million, indicating improved profit margins from the previous year. Despite its low return on equity at 1%, Renascor is debt-free with short-term assets of A$113.2 million covering both long-term liabilities and short-term obligations comfortably. The management team and board are experienced, contributing to stable weekly volatility levels at 7%. However, high non-cash earnings suggest caution in assessing quality profitability metrics.

- Unlock comprehensive insights into our analysis of Renascor Resources stock in this financial health report.

- Evaluate Renascor Resources' historical performance by accessing our past performance report.

Tyro Payments (ASX:TYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyro Payments Limited provides payment solutions to merchants in Australia and has a market capitalization of A$395.57 million.

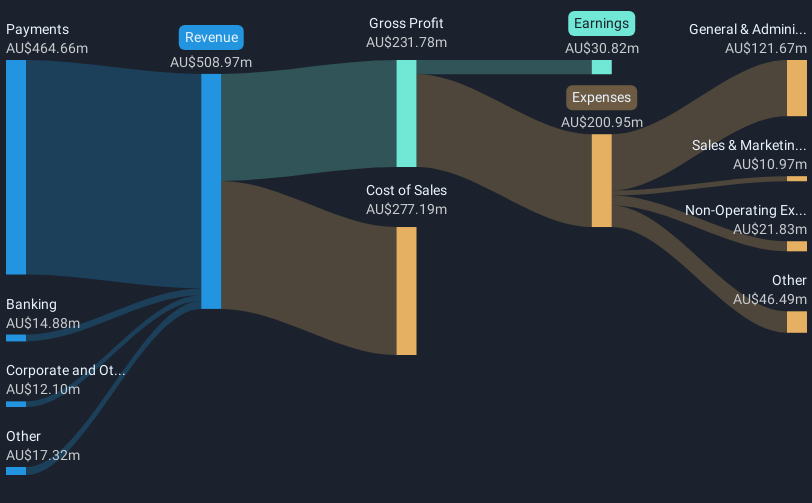

Operations: Tyro Payments generates revenue through its Payments segment, which accounts for A$464.66 million, and its Banking segment, contributing A$14.88 million.

Market Cap: A$395.57M

Tyro Payments has shown significant earnings growth, with a 206.7% increase over the past year, outpacing industry averages. The company reported half-year revenue of A$248.31 million and net income of A$10.26 million, reflecting improved profit margins from the previous year. Despite a low return on equity at 14.2%, Tyro is debt-free with short-term assets exceeding both long-term and short-term liabilities comfortably. Its management team and board are experienced, contributing to stable weekly volatility levels at 5%. The price-to-earnings ratio of 12.8x suggests it may be undervalued compared to the broader market average.

- Dive into the specifics of Tyro Payments here with our thorough balance sheet health report.

- Gain insights into Tyro Payments' outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Unlock our comprehensive list of 981 ASX Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyro Payments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TYR

Tyro Payments

Engages in the provision of payment solutions to merchants in Australia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives