- Australia

- /

- Metals and Mining

- /

- ASX:VAU

Exploring Three ASX Stocks With Intrinsic Discounts Ranging From 39.7% To 44.5%

Reviewed by Simply Wall St

Over the past year, the Australian market has seen an uplift of 8.4%, with earnings projected to grow by 13% annually. In such a thriving environment, identifying stocks that are trading below their intrinsic value can offer attractive opportunities for investors looking for potential growth at a discounted price.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MaxiPARTS (ASX:MXI) | A$1.995 | A$3.94 | 49.4% |

| Ansell (ASX:ANN) | A$27.43 | A$50.71 | 45.9% |

| Count (ASX:CUP) | A$0.61 | A$1.18 | 48.3% |

| VEEM (ASX:VEE) | A$1.78 | A$3.53 | 49.6% |

| IPH (ASX:IPH) | A$6.06 | A$11.79 | 48.6% |

| hipages Group Holdings (ASX:HPG) | A$1.06 | A$2.06 | 48.5% |

| ReadyTech Holdings (ASX:RDY) | A$3.29 | A$6.21 | 47% |

| Atturra (ASX:ATA) | A$0.81 | A$1.50 | 46.1% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Lotus Resources (ASX:LOT) | A$0.28 | A$0.56 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

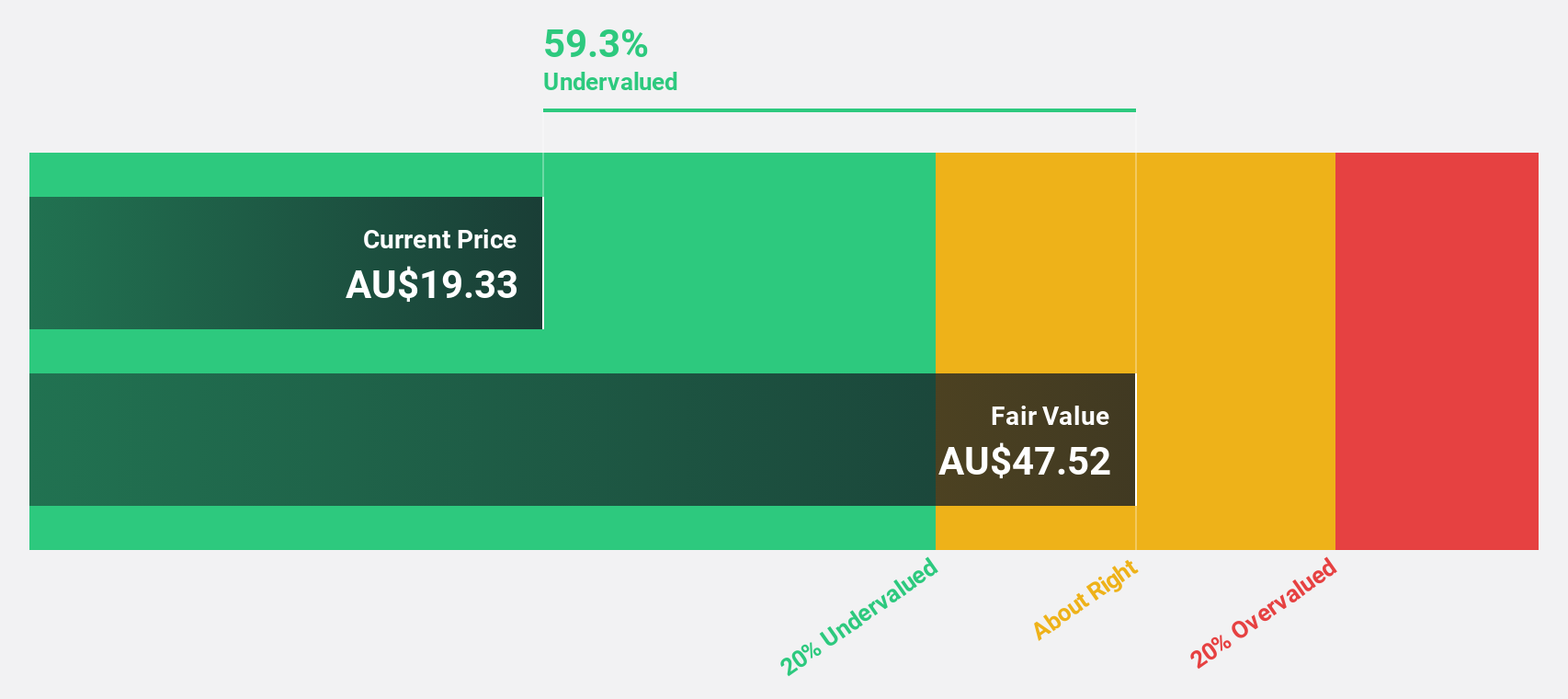

Domino's Pizza Enterprises (ASX:DMP)

Overview: Domino's Pizza Enterprises Limited is a company that operates retail food outlets, with a market capitalization of approximately A$3.06 billion.

Operations: The company generates its revenue primarily from restaurant operations, totaling A$2.48 billion.

Estimated Discount To Fair Value: 40.7%

Domino's Pizza Enterprises (DMP) is currently trading at A$33.61, which is 40.7% below the estimated fair value of A$56.69, highlighting its undervaluation based on discounted cash flow analysis. Despite this, DMP faces challenges such as a high debt level and lower profit margins year-over-year, now at 2.2%. However, it shows promising growth prospects with expected significant earnings growth over the next three years and a forecasted high return on equity of 27.7%.

- Our comprehensive growth report raises the possibility that Domino's Pizza Enterprises is poised for substantial financial growth.

- Dive into the specifics of Domino's Pizza Enterprises here with our thorough financial health report.

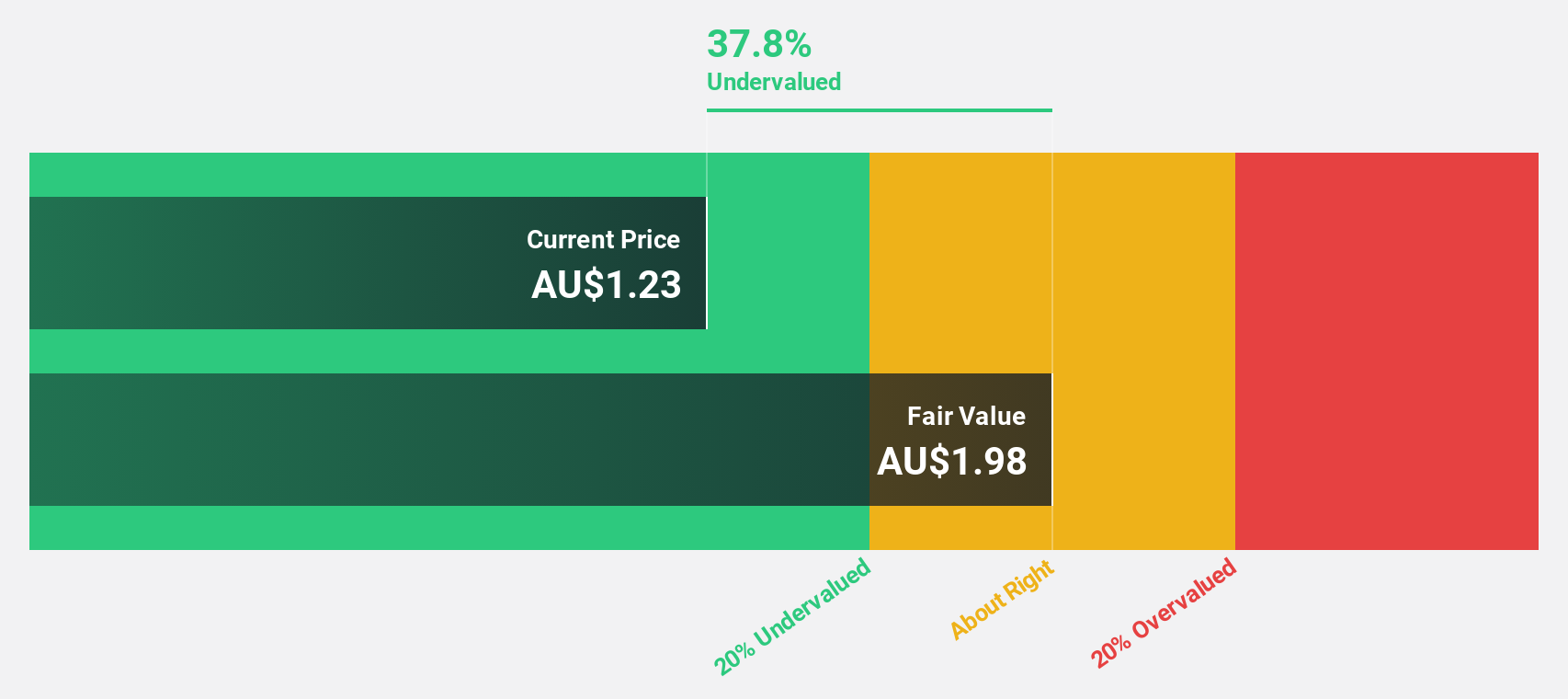

Infomedia (ASX:IFM)

Overview: Infomedia Ltd is a technology company that provides electronic parts catalogues, service quoting software, and e-commerce solutions to the automotive industry globally, with a market capitalization of A$620.87 million.

Operations: The company generates A$136.58 million in revenue from its publishing and periodicals segment.

Estimated Discount To Fair Value: 39.7%

Infomedia Ltd, priced at A$1.66, appears undervalued with a fair value estimate of A$2.75, reflecting a significant discount. The company's earnings are projected to grow by 27.83% annually, outpacing the Australian market forecast of 13.4%. Additionally, its revenue growth at 7.9% yearly also exceeds the national average of 5.6%. Despite these positives, it's essential to note the impact of substantial one-off items on its financial results and recent executive changes that could influence future performance.

- Our earnings growth report unveils the potential for significant increases in Infomedia's future results.

- Navigate through the intricacies of Infomedia with our comprehensive financial health report here.

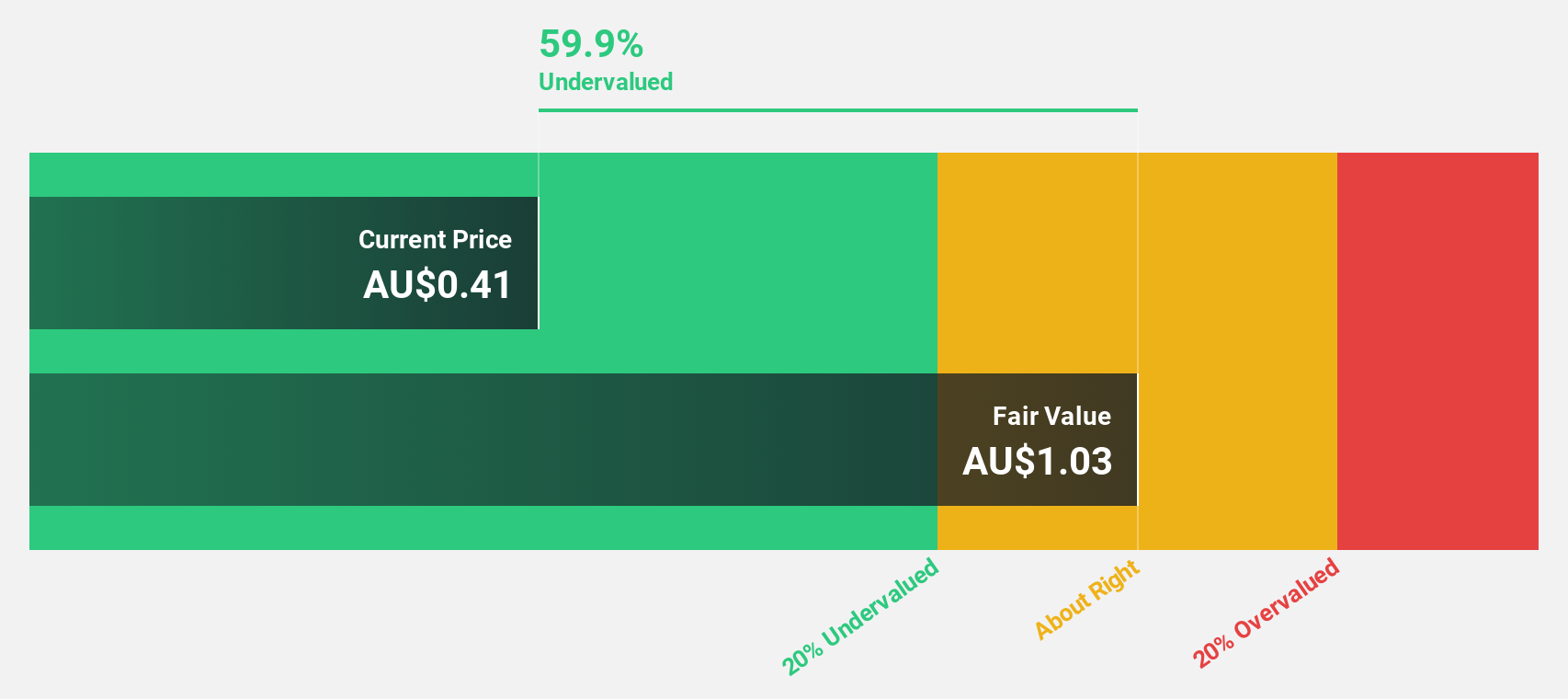

Red 5 (ASX:RED)

Overview: Red 5 Limited is a company focused on the exploration, production, and mining of gold deposits and mineral properties in the Philippines and Australia, with a market capitalization of approximately A$2.82 billion.

Operations: The company's revenue from production, development, and exploration assets totals A$546.40 million.

Estimated Discount To Fair Value: 44.5%

Red 5 Limited, currently trading at A$0.42, is valued below its estimated fair value of A$0.75, marking a significant undervaluation based on cash flows. The company's earnings and revenue are expected to grow at 47.5% and 34.6% per year respectively, outperforming the Australian market projections significantly. However, recent substantial insider selling and share dilution could pose risks to this growth trajectory despite promising forecasts and recent leadership restructuring following the merger with Silver Lake Resources.

- The growth report we've compiled suggests that Red 5's future prospects could be on the up.

- Click here to discover the nuances of Red 5 with our detailed financial health report.

Taking Advantage

- Navigate through the entire inventory of 41 Undervalued ASX Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VAU

Vault Minerals

Engages in the exploration, production, and mining of gold and gold/copper concentrates in Canada and Australia.

Flawless balance sheet and good value.