- Australia

- /

- Metals and Mining

- /

- ASX:CIA

3 Promising ASX Penny Stocks With Market Caps Below A$3B

Reviewed by Simply Wall St

The Australian market showed a mixed performance recently, with energy stocks leading the way due to geopolitical factors and materials remaining steady. In this context, penny stocks continue to attract attention for their potential to offer unique growth opportunities. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still be promising investments when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.475 | A$136.13M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.90 | A$56.04M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$424.49M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.42 | A$252.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.043 | A$50.3M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.505 | A$59.63M | ✅ 4 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$3.17 | A$292.7M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.48 | A$652.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Clover (ASX:CLV) | A$0.625 | A$104.37M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 419 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Champion Iron (ASX:CIA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Champion Iron Limited focuses on the acquisition, exploration, development, and production of iron ore properties in Canada and has a market cap of A$2.64 billion.

Operations: The company generates revenue primarily from its Iron Ore Concentrate segment, amounting to CA$1.53 billion.

Market Cap: A$2.64B

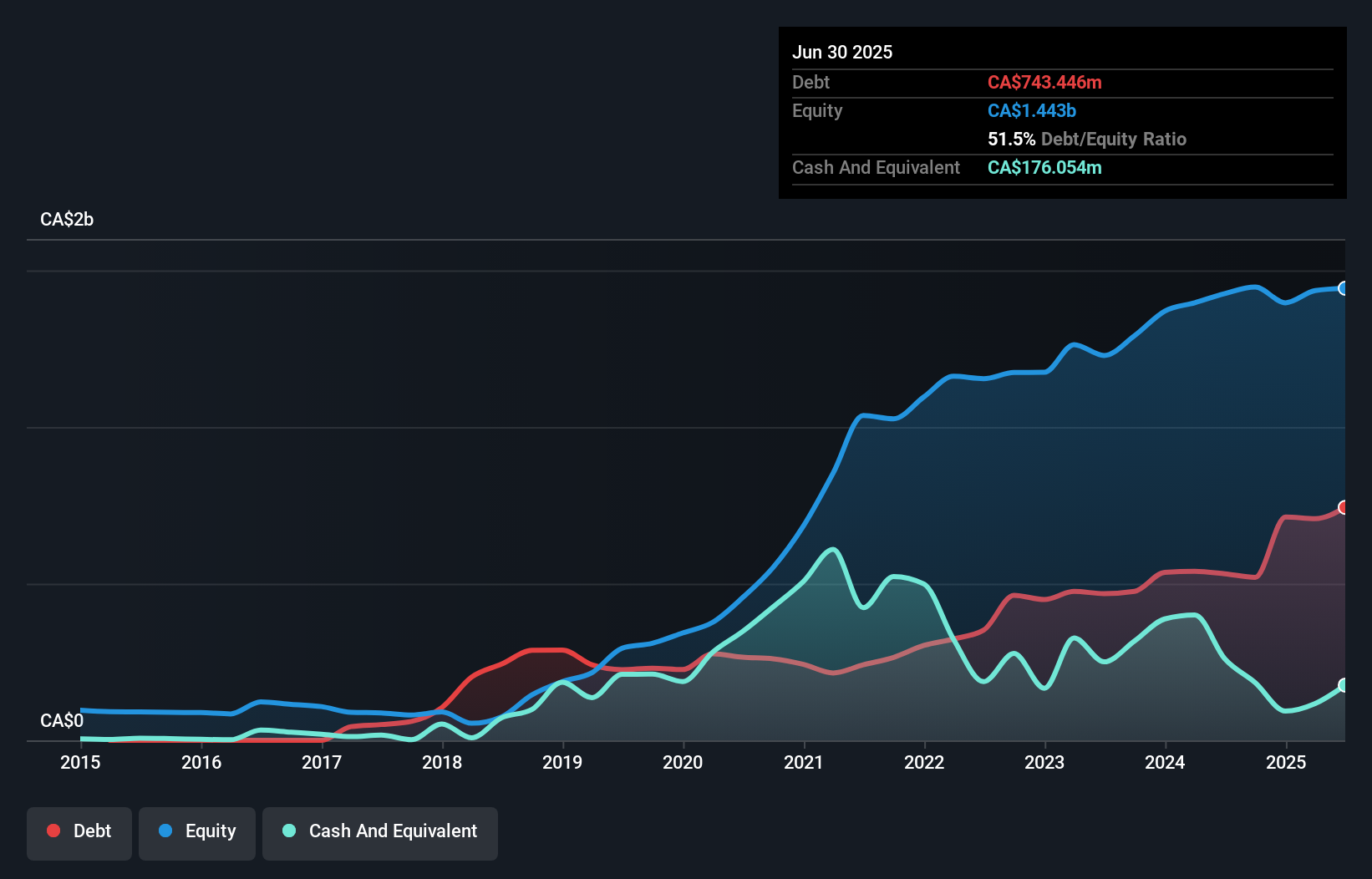

Champion Iron Limited, with a market cap of A$2.64 billion, has seen its earnings decline by 18.1% annually over the past five years, and recent net profit margins have decreased to 5.5% from 17.6% last year. Despite this, the company maintains high-quality earnings and its debt is well covered by operating cash flow at 47.6%. The recent partnership with Nippon Steel and Sojitz for the Kami Project could enhance future prospects, although significant capital expenditures are required for development. While trading below estimated fair value, Champion Iron's financial stability is supported by experienced management and board teams.

- Navigate through the intricacies of Champion Iron with our comprehensive balance sheet health report here.

- Examine Champion Iron's earnings growth report to understand how analysts expect it to perform.

Cleo Diagnostics (ASX:COV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cleo Diagnostics Ltd is a biotechnology company that develops and commercializes non-invasive blood tests for detecting ovarian cancer in Australia, with a market cap of A$57.83 million.

Operations: Cleo Diagnostics generates revenue from its Medical Labs & Research segment, amounting to A$0.85 million.

Market Cap: A$57.83M

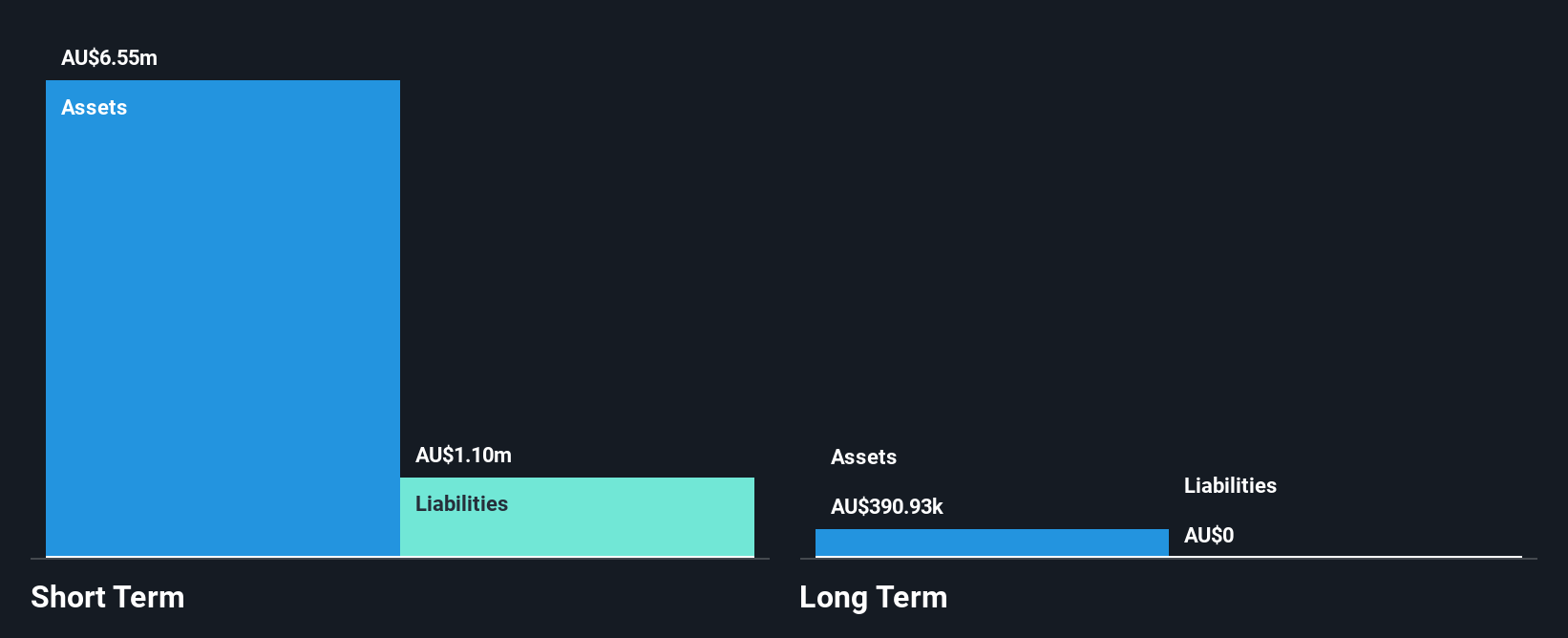

Cleo Diagnostics Ltd, a biotechnology firm with a market cap of A$57.83 million, remains pre-revenue with income from its Medical Labs & Research segment at A$0.85 million. The company reported a net loss of A$4 million for the year ending June 30, 2025, slightly higher than the previous year. Despite this, Cleo Diagnostics has no long-term liabilities and is debt-free, providing some financial stability. Its short-term assets significantly exceed short-term liabilities by A$5.4 million. Although unprofitable and unable to match industry growth rates, its cash runway extends beyond one year under current conditions without shareholder dilution over the past year.

- Unlock comprehensive insights into our analysis of Cleo Diagnostics stock in this financial health report.

- Explore historical data to track Cleo Diagnostics' performance over time in our past results report.

Pivotal Metals (ASX:PVT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pivotal Metals Limited is involved in the exploration and development of mineral resources in Canada, with a market capitalization of A$18.14 million.

Operations: The company's revenue is derived from the exploration for minerals, amounting to A$0.08 million.

Market Cap: A$18.14M

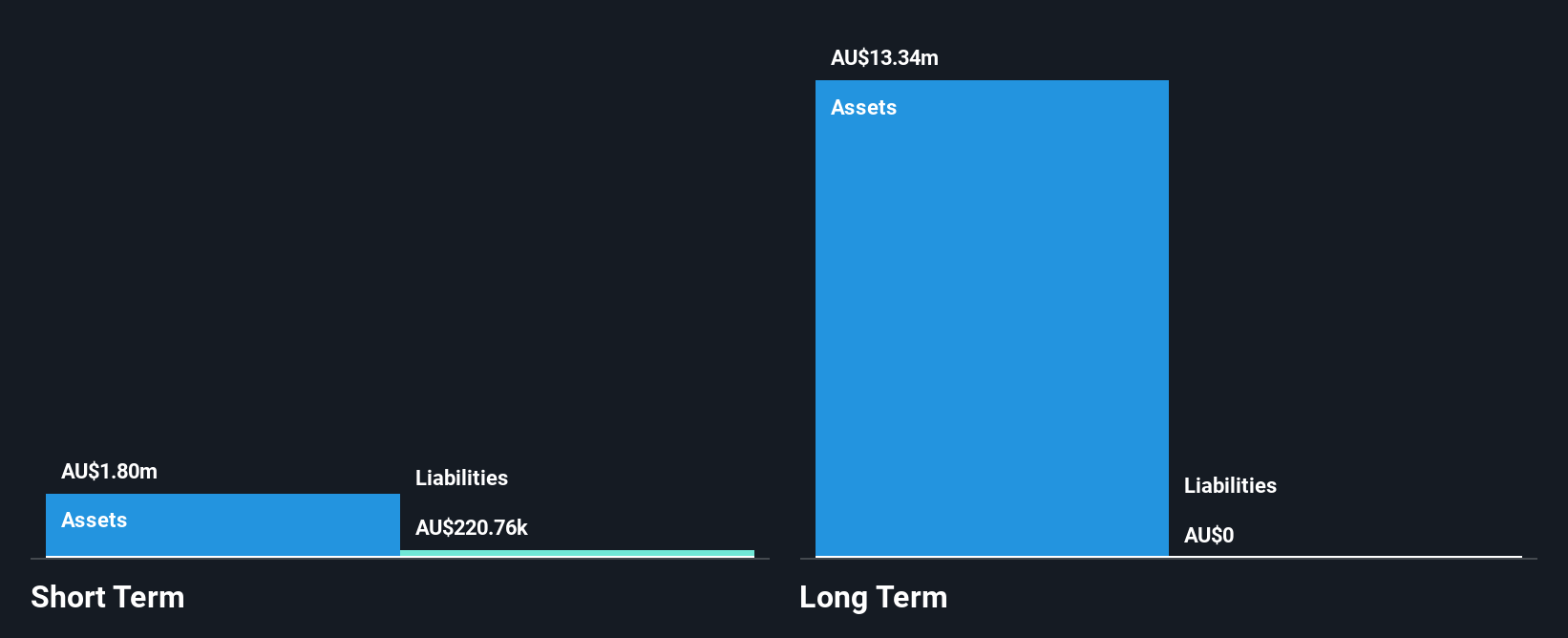

Pivotal Metals Limited, with a market cap of A$18.14 million, is pre-revenue, reporting sales of A$0.08 million for the year ending June 30, 2025. The company posted a net loss of A$1.55 million, an improvement from the previous year's loss. Despite being debt-free and having short-term assets (A$1.8M) exceeding liabilities (A$220.8K), Pivotal faces challenges with less than one year of cash runway and high share price volatility over recent months. While shareholder dilution has not been significant recently, its unprofitability and negative return on equity highlight ongoing financial hurdles in the exploration sector.

- Click here to discover the nuances of Pivotal Metals with our detailed analytical financial health report.

- Learn about Pivotal Metals' historical performance here.

Where To Now?

- Navigate through the entire inventory of 419 ASX Penny Stocks here.

- Interested In Other Possibilities? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CIA

Champion Iron

Engages in the acquisition, exploration, development, and production of iron ore properties in Canada.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives