- Australia

- /

- Metals and Mining

- /

- ASX:PSC

Prospect Resources (ASX:PSC) pulls back 13% this week, but still delivers shareholders splendid 54% CAGR over 3 years

No-one enjoys it when they lose money on a stock. But it can difficult to make money in a declining market. While the Prospect Resources Limited (ASX:PSC) share price is down 82% in the last three years, the total return to shareholders (which includes dividends) was 266%. That's better than the market which returned 22% over the last three years. Furthermore, it's down 38% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Since Prospect Resources has shed AU$7.4m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Prospect Resources

Prospect Resources hasn't yet reported any revenue, so it's as much a business idea as an actual business. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Prospect Resources will find or develop a valuable new mine before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. We can see that they needed to raise more capital, and took that step recently despite the fact that it would have been dilutive to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Prospect Resources has already given some investors a taste of the bitter losses that high risk investing can cause.

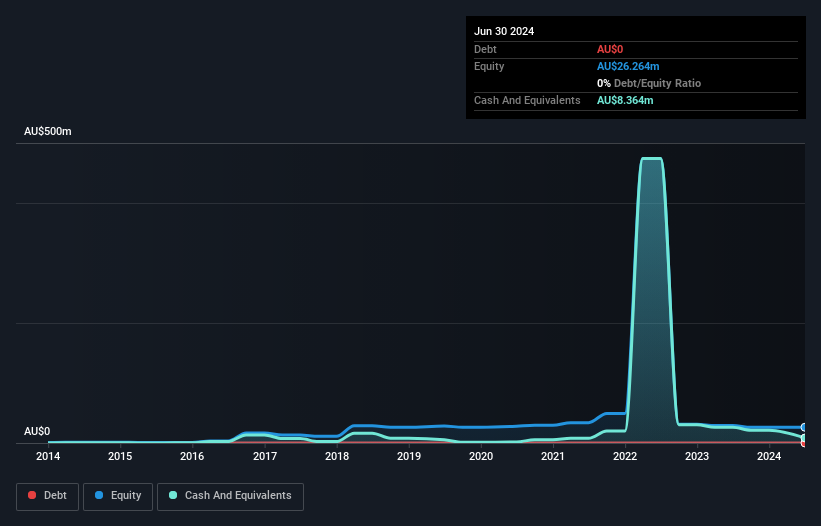

Prospect Resources only just had cash in excess of all liabilities when it last reported. So it's prudent that the management team has already moved to replenish reserves through the recent capital raising event. With that in mind, you can imagine there may be other factors that caused the share price to drop 22% per year, over 3 years. You can click on the image below to see (in greater detail) how Prospect Resources' cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. You can click here to see if there are insiders selling.

What About The Total Shareholder Return (TSR)?

We've already covered Prospect Resources' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Prospect Resources hasn't been paying dividends, but its TSR of 266% exceeds its share price return of -82%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Prospect Resources provided a TSR of 13% over the last twelve months. But that was short of the market average. On the bright side, the longer term returns (running at about 68% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand Prospect Resources better, we need to consider many other factors. Even so, be aware that Prospect Resources is showing 4 warning signs in our investment analysis , and 2 of those make us uncomfortable...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PSC

Prospect Resources

Through its subsidiaries, engages in the exploration, evaluation, and development of mineral resources in Africa.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion