- Australia

- /

- Metals and Mining

- /

- ASX:PRU

Is It Too Late to Consider Perseus Mining After Its 113% 2025 Share Price Surge?

Reviewed by Bailey Pemberton

- Wondering if Perseus Mining is still a smart buy after such a huge run, or if the real value has already been priced in? Let us unpack what the current share price is really saying about the business.

- The stock has climbed 1.1% over the last week, 16.1% in the last month, and an impressive 113.0% year to date, with a 115.7% gain over the past year and 418.0% over five years. This naturally raises questions about how much upside is left versus the risk of a pullback.

- Recent moves have been driven by a mix of sector sentiment toward gold producers and ongoing updates around Perseus Mining's production profile and project pipeline, which keep investors focused on its long term growth runway. At the same time, shifting expectations for interest rates and gold prices have sharpened the market's focus on which miners can still generate strong cash flows if conditions get tougher.

- On our framework, Perseus Mining currently scores a 3 out of 6 on undervaluation checks. This suggests the market may not be fully rewarding some aspects of its fundamentals, but also hints at pockets of froth. Next we will walk through the main valuation methods investors are using today, then circle back at the end with a more holistic way to judge whether the stock still offers compelling value.

Approach 1: Perseus Mining Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return. For Perseus Mining, the 2 Stage Free Cash Flow to Equity model starts from its last twelve months Free Cash Flow of about $358.2 Million and then applies a mix of analyst forecasts and longer term extrapolations.

Analysts see Free Cash Flow rising to around $139.0 Million by 2030, with interim years swinging from roughly $18.7 Million in 2026 to over $800 Million in 2028 before normalising. Beyond the five year analyst window, Simply Wall St extrapolates these figures to smooth out the cycle and capture a more sustainable long term profile.

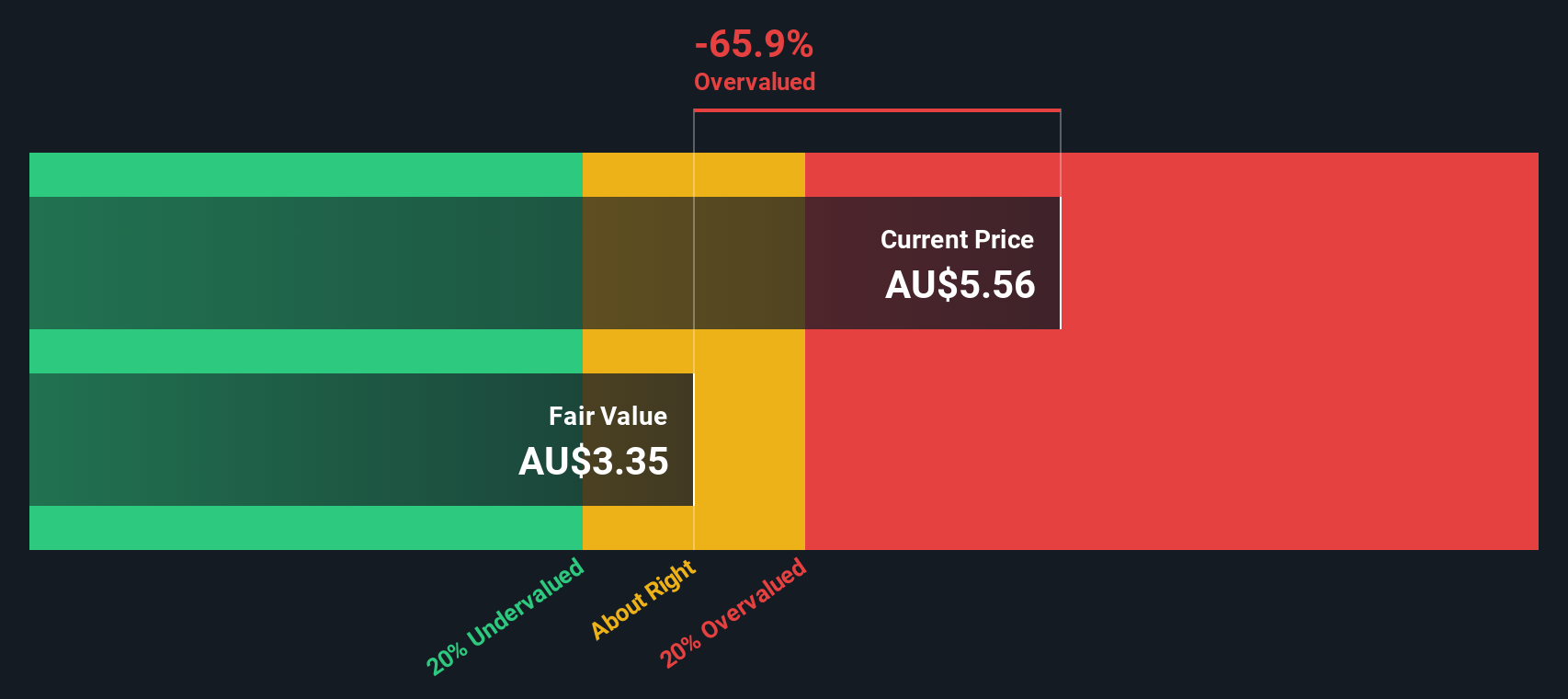

When all those projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $3.36 per share. That implies the stock is roughly 65.3% above its DCF based fair value, pointing to a market price that is well ahead of what current cash flow assumptions support.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Perseus Mining may be overvalued by 65.3%. Discover 925 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Perseus Mining Price vs Earnings

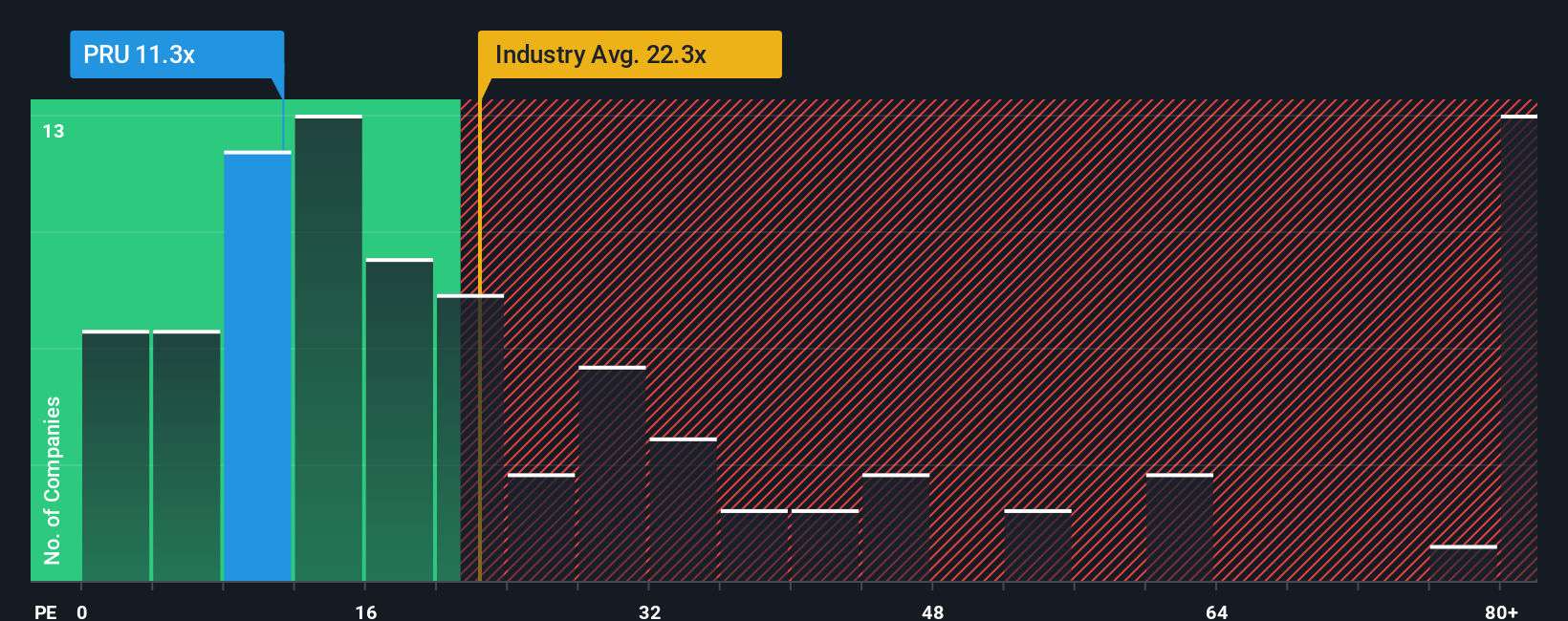

For profitable companies like Perseus Mining, the Price to Earnings (PE) ratio is a useful way to gauge value because it directly links what investors pay today to the profits the business is already generating. A higher PE can be justified when a company has strong, durable growth prospects and lower perceived risk. In contrast, slower growth or higher uncertainty typically calls for a more modest, or even discounted, PE multiple.

Perseus Mining currently trades on a PE of about 13.3x, which is well below both the Metals and Mining industry average of roughly 22.6x and the peer group average of around 59.8x. On the surface, that might suggest the stock is cheap, but these simple comparisons miss important context about the company’s specific growth outlook, margins and risk profile.

Simply Wall St addresses this with its Fair Ratio, an estimate of what PE multiple a stock should command after accounting for factors like earnings growth, profitability, industry, market cap and company specific risks. For Perseus Mining, the Fair Ratio is 21.5x, materially higher than its current 13.3x. This gap points to the market pricing Perseus at a discount relative to what its fundamentals would typically warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Perseus Mining Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives.

A Narrative is your story about a company, where you link your view of its future revenue, earnings and margins to a set of numbers and an assumed fair value, rather than just relying on one static metric like the PE ratio.

On Simply Wall St’s Community page, Narratives make this process easy and accessible, guiding you from the company’s story, to a forecast, and then to a fair value that you can compare with today’s share price to decide whether to buy, hold or sell.

Because Narratives are updated dynamically as new information comes in, like news on Perseus Mining’s mine life extensions or quarterly results, your fair value view evolves in real time instead of going stale.

For example, one investor might build a bullish Perseus Mining Narrative that assumes stronger revenue growth, higher profit margins and a fair value closer to A$5.8 per share, while another more cautious investor might focus on cost and geopolitical risks and land on a far lower fair value closer to A$2.6 per share, yet both are using the same framework to reach clearly defined, comparable decisions.

Do you think there's more to the story for Perseus Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PRU

Perseus Mining

Explores, evaluates, develops, and mines for gold properties in Ghana, Côte d’Ivoire, Tanzania, and Sudan.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026