- Australia

- /

- Oil and Gas

- /

- ASX:EPM

Spotlight On ASX Penny Stocks For December 2024

Reviewed by Simply Wall St

The Australian market has been experiencing some turbulence this December, with the ASX 200 facing a downturn and broader global markets showing signs of strain. Amidst these fluctuations, investors are increasingly looking towards alternative investment opportunities such as penny stocks. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still present unique growth opportunities, especially when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.915 | A$311.8M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.77 | A$97.91M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.59 | A$779.23M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.98M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.83 | A$102.64M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.92 | A$485.43M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Eclipse Metals (ASX:EPM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eclipse Metals Limited is a mineral exploration company focused on rare earth element deposits in Australia and Greenland, with a market cap of A$15.76 million.

Operations: The company's revenue segment is solely derived from Mineral Exploration, amounting to A$0.0088 million.

Market Cap: A$15.76M

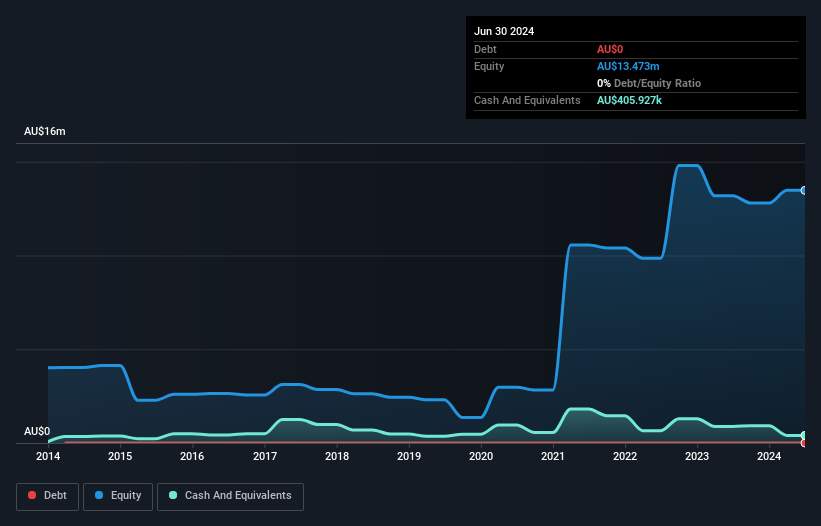

Eclipse Metals Limited operates as a pre-revenue mineral exploration company, primarily focused on rare earth elements in Australia and Greenland. With a market cap of A$15.76 million, the company recently filed a follow-on equity offering of A$1.14 million to bolster its financial position, although it faces challenges with short-term liabilities exceeding assets by A$199.2K. Despite being debt-free and having an experienced board with an average tenure of 11.2 years, Eclipse Metals has seen shareholder dilution over the past year and struggles with high share price volatility and increasing losses at 35.4% annually over five years.

- Click here to discover the nuances of Eclipse Metals with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Eclipse Metals' track record.

Perenti (ASX:PRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.23 billion.

Operations: Perenti's revenue is primarily derived from its Contract Mining Services segment, which generated A$2.54 billion, followed by Drilling Services at A$598.10 million and Mining Services and Idoba at A$239.06 million.

Market Cap: A$1.23B

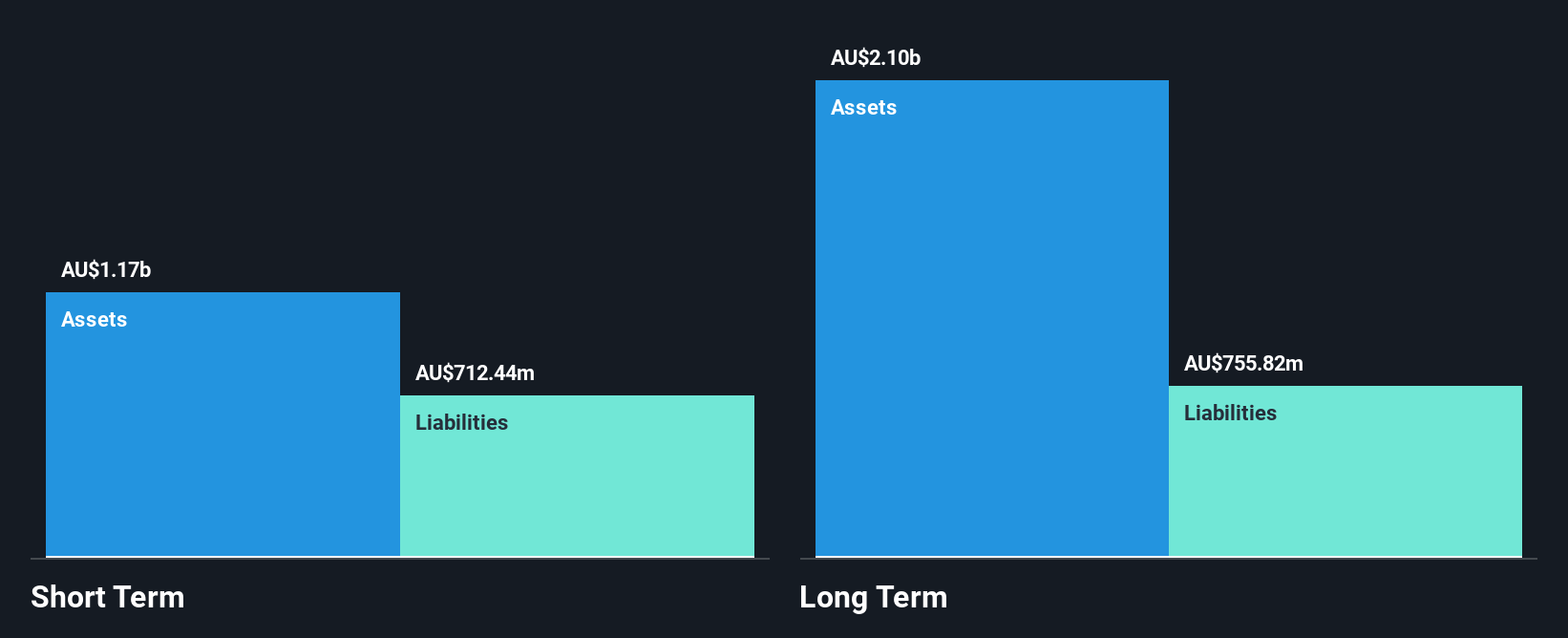

Perenti Limited, a global mining services company with a market cap of A$1.23 billion, demonstrates financial stability with its operating cash flow covering 55.4% of its debt and short-term assets exceeding both short and long-term liabilities. Despite experiencing negative earnings growth last year, the company has achieved significant profit growth over the past five years at 23.9% annually. The management team is experienced, and the board's tenure averages 3.3 years, suggesting strong governance. Recent strategic moves include a share buyback program to repurchase up to 9.9% of issued shares by June 2025, potentially enhancing shareholder value.

- Click to explore a detailed breakdown of our findings in Perenti's financial health report.

- Evaluate Perenti's prospects by accessing our earnings growth report.

Qube Holdings (ASX:QUB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qube Holdings Limited operates as a logistics solutions provider for import and export supply chains across Australia, New Zealand, and Southeast Asia, with a market cap of A$6.89 billion.

Operations: The company generates revenue primarily from its Operating Division, which accounts for A$3.51 billion.

Market Cap: A$6.89B

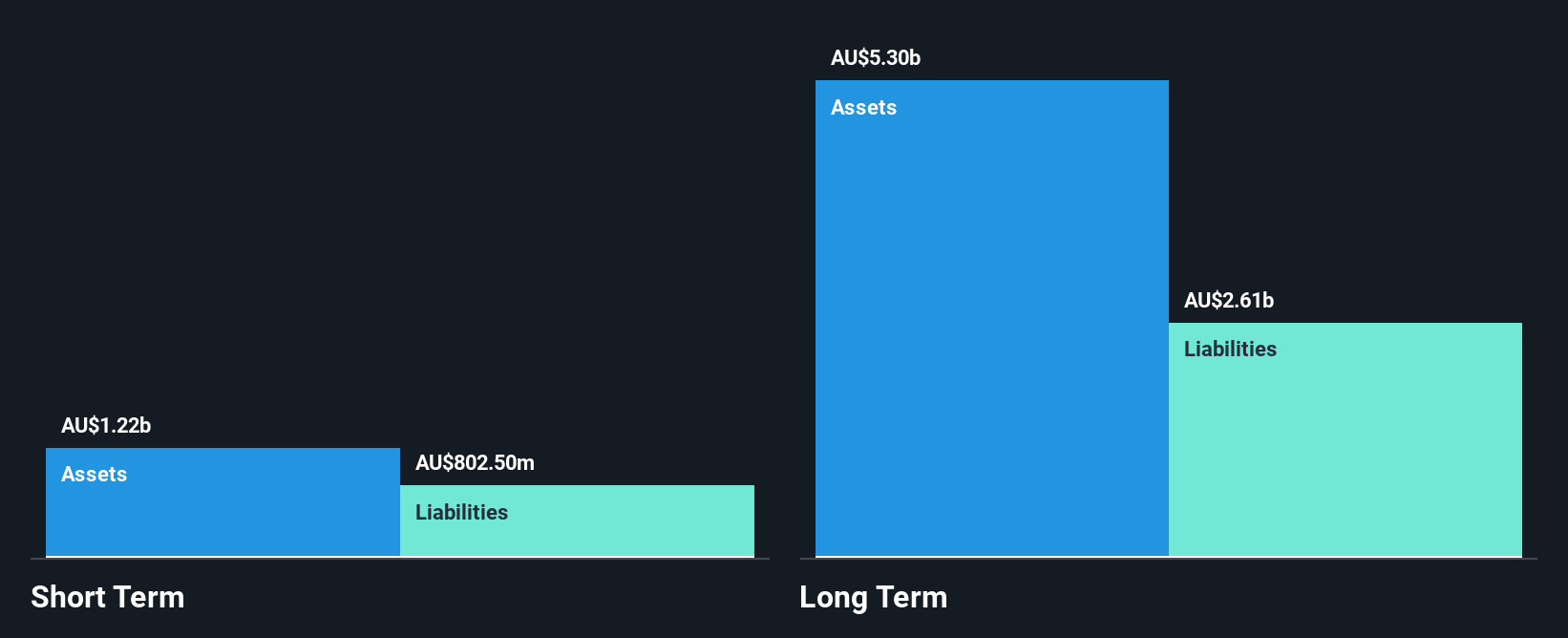

Qube Holdings Limited, with a market cap of A$6.89 billion, showcases robust financial health through satisfactory net debt levels and well-covered interest payments by EBIT. Its earnings have grown significantly over the past year, surpassing both its five-year average and industry benchmarks. The company maintains high-quality earnings and stable volatility while managing an experienced board and management team. However, short-term assets fall short of covering long-term liabilities, posing potential risks. Recent strategic actions include issuing A$600 million in fixed-income offerings to strengthen its financial position amidst leadership transitions following the Deputy Chairman's retirement.

- Jump into the full analysis health report here for a deeper understanding of Qube Holdings.

- Understand Qube Holdings' earnings outlook by examining our growth report.

Next Steps

- Click this link to deep-dive into the 1,051 companies within our ASX Penny Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eclipse Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EPM

Eclipse Metals

A mineral exploration company, engages in the exploration and development of a rare earth element deposits in Australia and Greenland.

Moderate with adequate balance sheet.

Market Insights

Community Narratives