- Australia

- /

- Metals and Mining

- /

- ASX:PNR

ASX April 2025: Highlighting Three Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

The Australian market has experienced a relatively stable day, with the ASX200 closing at 7,760 points and sectors such as Health Care showing positive movement while others like Staples lagged. In this context of fluctuating sector performances and strategic shifts among companies, identifying stocks that may be trading below their estimated value can present potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Acrow (ASX:ACF) | A$1.05 | A$2.04 | 48.5% |

| GenusPlus Group (ASX:GNP) | A$2.63 | A$5.15 | 48.9% |

| Medical Developments International (ASX:MVP) | A$0.485 | A$0.89 | 45.5% |

| Amaero (ASX:3DA) | A$0.23 | A$0.45 | 48.9% |

| Genetic Signatures (ASX:GSS) | A$0.44 | A$0.84 | 47.6% |

| Pantoro (ASX:PNR) | A$2.72 | A$5.36 | 49.2% |

| Nuix (ASX:NXL) | A$2.37 | A$4.30 | 44.9% |

| Integral Diagnostics (ASX:IDX) | A$2.25 | A$4.03 | 44.2% |

| Electro Optic Systems Holdings (ASX:EOS) | A$1.20 | A$2.38 | 49.6% |

| Select Harvests (ASX:SHV) | A$5.41 | A$9.62 | 43.8% |

Here we highlight a subset of our preferred stocks from the screener.

Corporate Travel Management (ASX:CTD)

Overview: Corporate Travel Management Limited is a travel management solutions company that oversees the procurement and delivery of travel services across Australia and New Zealand, North America, Asia, and Europe, with a market cap of A$1.77 billion.

Operations: The company generates revenue through its travel services across various regions, with A$60.96 million from Asia, A$126.20 million from Europe, A$319.90 million from North America, and A$181.43 million from Australia and New Zealand.

Estimated Discount To Fair Value: 23.6%

Corporate Travel Management is trading at A$12.57, 23.6% below its estimated fair value of A$16.46, making it potentially undervalued based on cash flows. Despite a drop in profit margins from 15.3% to 9.2%, earnings are projected to grow significantly at 21.3% annually, outpacing the Australian market's growth rate of 11.7%. Recent leadership changes aim to enhance operational efficiency and client growth as Jo Sully succeeds Greg McCarthy as CEO for Australia & New Zealand by June 2025.

- Our expertly prepared growth report on Corporate Travel Management implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Corporate Travel Management stock in this financial health report.

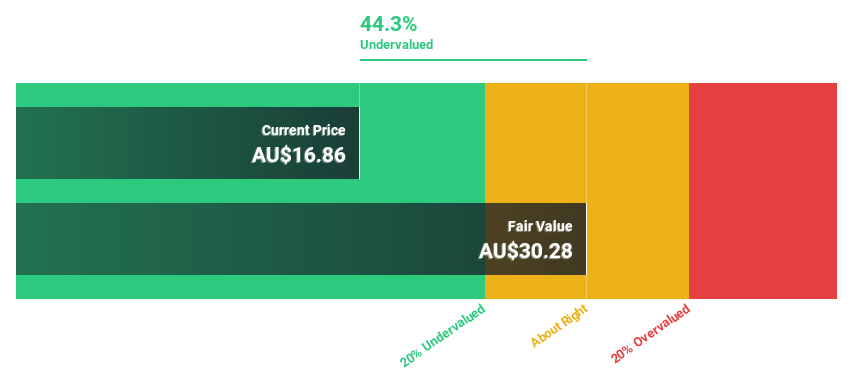

Nick Scali (ASX:NCK)

Overview: Nick Scali Limited, with a market cap of A$1.44 billion, is involved in the sourcing and retailing of household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: The company's revenue is primarily derived from the retailing of furniture, amounting to A$492.63 million.

Estimated Discount To Fair Value: 41%

Nick Scali is trading at A$16.80, 41% below its estimated fair value of A$28.48, suggesting it may be undervalued based on cash flows. Despite a decline in net income to A$30.04 million for the half-year ending December 2024, forecasts indicate earnings growth of 12.3% annually, surpassing the Australian market average of 11.7%. The company maintains a reliable dividend yield of 3.57%, although dividends were reduced from previous levels due to decreased earnings per share.

- The growth report we've compiled suggests that Nick Scali's future prospects could be on the up.

- Click here to discover the nuances of Nick Scali with our detailed financial health report.

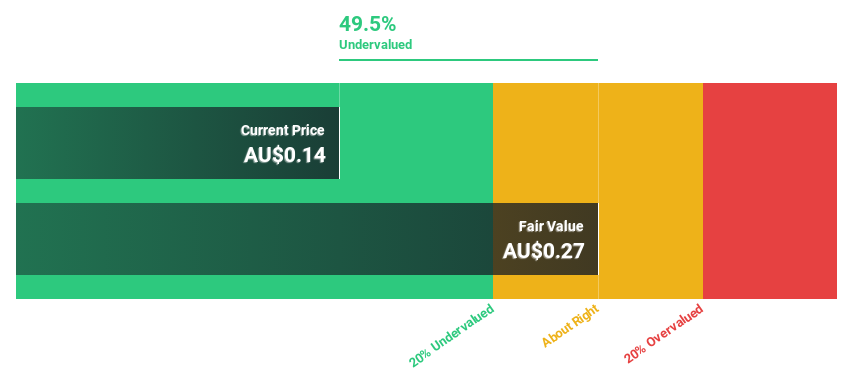

Pantoro (ASX:PNR)

Overview: Pantoro Limited, along with its subsidiaries, is involved in gold mining, processing, and exploration in Western Australia and has a market cap of A$1.05 billion.

Operations: The company's revenue is primarily derived from the Norseman Gold Project, amounting to A$289.11 million.

Estimated Discount To Fair Value: 49.2%

Pantoro is trading at A$2.72, significantly below its estimated fair value of A$5.36, highlighting potential undervaluation based on cash flows. Recent production results show a 30% increase in gold output to 40,812 ounces with improved sales of A$153.43 million for the half-year ending December 2024. The company has turned profitable with net income of A$6.62 million and forecasts suggest robust earnings growth ahead, supported by ongoing drilling programs at the OK Underground Mine.

- Our comprehensive growth report raises the possibility that Pantoro is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Pantoro.

Make It Happen

- Unlock our comprehensive list of 36 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pantoro, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNR

Pantoro

Engages in the gold mining, processing, and exploration activities in Western Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives