- Australia

- /

- Metals and Mining

- /

- ASX:PNR

Exploring 3 Undervalued Small Caps In Global With Insider Buying

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience with U.S. stocks climbing on easing trade concerns and better-than-expected earnings, while small- and mid-cap indexes have advanced for the fourth consecutive week. This positive sentiment comes amid mixed economic signals such as strong job growth in the U.S. despite a contraction in GDP, presenting an intriguing backdrop for investors exploring opportunities in smaller companies that may be positioned to capitalize on these shifting dynamics. When assessing potential investments in undervalued small caps with insider buying, it's crucial to consider factors such as market conditions that favor nimble companies capable of adapting quickly to economic changes and those demonstrating strong internal confidence through insider transactions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.0x | 0.5x | 41.04% | ★★★★★☆ |

| Nexus Industrial REIT | 5.4x | 2.8x | 20.32% | ★★★★★☆ |

| Eastnine | 17.4x | 8.4x | 40.44% | ★★★★★☆ |

| Westshore Terminals Investment | 12.3x | 3.5x | 41.85% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.5x | 44.57% | ★★★★☆☆ |

| Italmobiliare | 10.8x | 1.4x | -265.39% | ★★★☆☆☆ |

| Speedy Hire | NA | 0.2x | -3.53% | ★★★☆☆☆ |

| Calfrac Well Services | 33.1x | 0.2x | 33.70% | ★★★☆☆☆ |

| Saturn Oil & Gas | 5.5x | 0.4x | -12.42% | ★★★☆☆☆ |

| Arendals Fossekompani | NA | 1.6x | 42.35% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Bapcor (ASX:BAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bapcor operates as a leading provider of automotive aftermarket parts, accessories, equipment, and services across Australia and New Zealand with a market capitalization of A$2.3 billion.

Operations: Bapcor derives its revenue from segments including Trade, Retail, Specialist Wholesale, and NZ operations. The company has experienced fluctuations in its net income margin, which reached a high of 7.48% in June 2019 but turned negative by December 2024 at -8.09%. Operating expenses are a significant cost component, with General & Administrative Expenses accounting for the largest portion among operating costs.

PE: -10.7x

Bapcor, a small company in the automotive sector, has seen insider confidence with recent share purchases. Despite a slight dip in net income to A$40.83 million for the half-year ending December 2024, earnings are projected to grow annually by 55.91%. The company's reliance on external borrowing adds risk but presents potential growth opportunities as they unveil new strategies and visions at their Queensland Distribution Centre. Future prospects hinge on strategic execution amidst industry challenges and leadership transitions.

- Delve into the full analysis valuation report here for a deeper understanding of Bapcor.

Review our historical performance report to gain insights into Bapcor's's past performance.

Pantoro Gold (ASX:PNR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pantoro Gold focuses on gold exploration and production, primarily through its Norseman Gold Project, with a market cap of A$289.11 million.

Operations: Pantoro Gold's revenue primarily stems from the Norseman Gold Project, with recent figures indicating A$289.11 million. The company's cost of goods sold (COGS) reached A$287.05 million, resulting in a gross profit of A$2.05 million and a gross profit margin of 0.71%. Operating expenses were recorded at A$15.88 million, impacting net income, which stood at -A$26.89 million with a net income margin of -9.30%.

PE: -45.2x

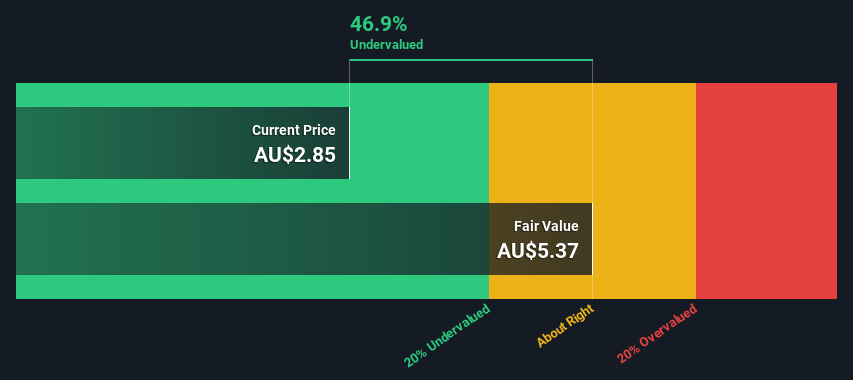

Pantoro Gold, a player in the gold mining sector, shows potential as an undervalued stock. Despite facing dilution over the past year, insider confidence is evident with recent share purchases. The company reported a significant turnaround with A$6.62 million net income for H2 2024 against a previous loss. Its ongoing drilling program at OK Underground Mine aims to boost reserves and production capacity, while being added to S&P/ASX indices underscores market recognition of its growth trajectory.

Jupiter Fund Management (LSE:JUP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Jupiter Fund Management is a UK-based asset management company that specializes in investment management services and has a market capitalization of approximately £1.06 billion.

Operations: The company generates revenue primarily from its Investment Management Business, with a recent figure of £364.1 million. Over the observed periods, the gross profit margin consistently stands at 100%, while net income margin has shown variability, recently reporting a negative -3.50% before recovering to 17.91%. Operating expenses and non-operating expenses are significant cost components impacting overall profitability.

PE: 6.0x

Jupiter Fund Management, a smaller player in the investment management industry, recently announced a share repurchase program worth £13.9 million, reflecting insider confidence. Despite reporting improved net income of £65.2 million for 2024 compared to a loss the previous year, they face challenges with earnings projected to decline by an average of 21.4% annually over the next three years. The upcoming retirement of their Chair and recent dividend reduction add layers of complexity to their strategic direction moving forward.

Where To Now?

- Gain an insight into the universe of 155 Undervalued Global Small Caps With Insider Buying by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNR

Pantoro Gold

Engages in the gold mining, processing, and exploration activities in Western Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives