- Australia

- /

- Metals and Mining

- /

- ASX:PNR

ASX Stocks Including Aussie Broadband That May Be Trading Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the Australian market shows signs of diverging from Wall Street trends, with sectors like real estate leading and healthcare lagging, investors are keenly observing potential opportunities amid this shifting landscape. In such an environment, identifying stocks that may be trading below their intrinsic value can provide a strategic edge, especially when considering companies like Aussie Broadband alongside others that might offer untapped potential.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Reckon (ASX:RKN) | A$0.625 | A$1.19 | 47.3% |

| PointsBet Holdings (ASX:PBH) | A$1.25 | A$2.06 | 39.3% |

| Kinatico (ASX:KYP) | A$0.315 | A$0.53 | 41.1% |

| Fenix Resources (ASX:FEX) | A$0.385 | A$0.68 | 43.4% |

| Elders (ASX:ELD) | A$7.76 | A$14.04 | 44.7% |

| Credit Clear (ASX:CCR) | A$0.25 | A$0.47 | 46.5% |

| CleanSpace Holdings (ASX:CSX) | A$0.80 | A$1.41 | 43.2% |

| Betmakers Technology Group (ASX:BET) | A$0.18 | A$0.31 | 42.5% |

| Aussie Broadband (ASX:ABB) | A$5.40 | A$10.69 | 49.5% |

| Airtasker (ASX:ART) | A$0.41 | A$0.70 | 41.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Aussie Broadband (ASX:ABB)

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market cap of A$1.58 billion.

Operations: The company's revenue is derived from several segments, including Business (A$108.07 million), Wholesale (A$89.99 million), Residential (A$676.81 million), Symbio Group (A$214.48 million), and Enterprise and Government (A$97.79 million).

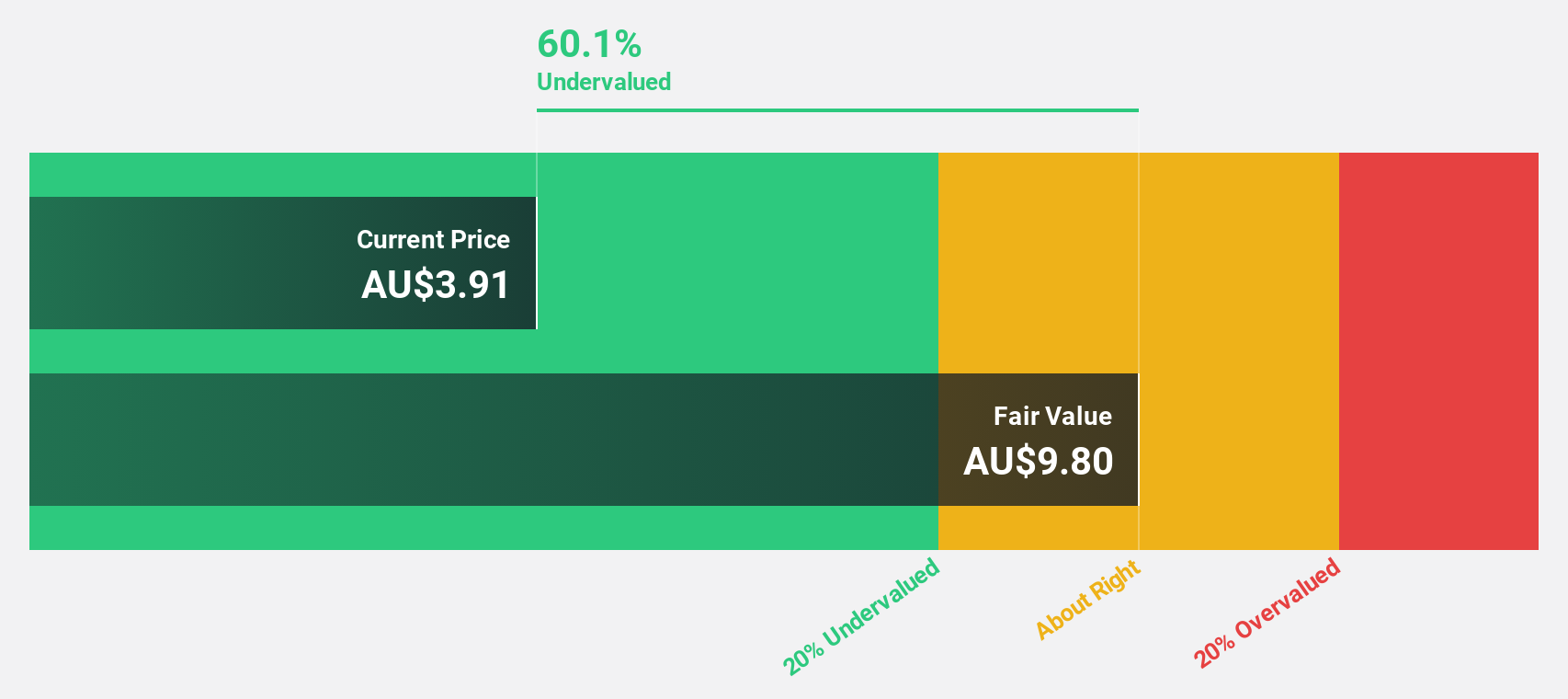

Estimated Discount To Fair Value: 49.5%

Aussie Broadband appears undervalued, trading at A$5.4 against an estimated fair value of A$10.69, suggesting a potential upside based on discounted cash flow analysis. Earnings grew 24.5% last year and are forecast to rise 21.9% annually, outpacing the Australian market's growth rate of 10.8%. Despite insider selling, strategic M&A pursuits may enhance value further as the company seeks acquisitions that align with its business strategy and capabilities in emerging sectors.

- The growth report we've compiled suggests that Aussie Broadband's future prospects could be on the up.

- Take a closer look at Aussie Broadband's balance sheet health here in our report.

Nick Scali (ASX:NCK)

Overview: Nick Scali Limited, with a market cap of A$2.04 billion, operates in the sourcing and retailing of household furniture and related accessories across Australia, New Zealand, and the United Kingdom.

Operations: The company's revenue primarily comes from the retailing of furniture, amounting to A$495.28 million.

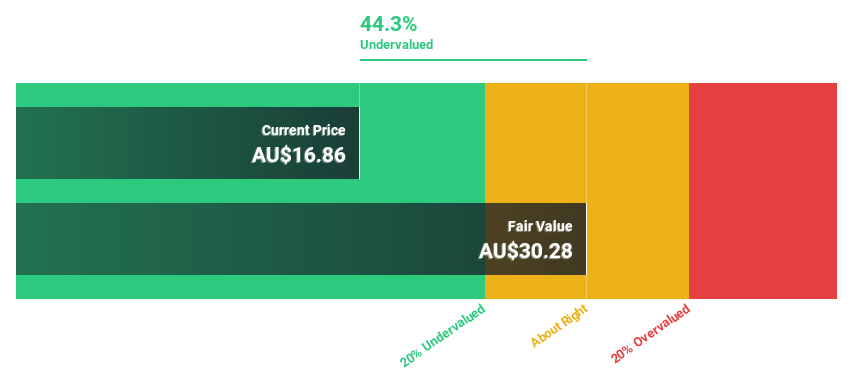

Estimated Discount To Fair Value: 30.1%

Nick Scali is trading at A$23.83, significantly below its estimated fair value of A$34.1, highlighting potential undervaluation based on cash flows. Despite a forecasted revenue growth of 8.8% annually and earnings growth of 14.9%, profit margins have declined to 11.6% from last year's 17.2%. The recent appointment of Niran Peiris as an independent Non-Executive Director may bolster governance and strategic oversight amid these financial dynamics and evolving market conditions.

- Our earnings growth report unveils the potential for significant increases in Nick Scali's future results.

- Click to explore a detailed breakdown of our findings in Nick Scali's balance sheet health report.

Pantoro Gold (ASX:PNR)

Overview: Pantoro Gold Limited, with a market cap of A$2.04 billion, is involved in gold mining, processing, and exploration activities in Western Australia through its subsidiaries.

Operations: The company's revenue is primarily derived from the Norseman Gold Project, contributing A$289.11 million.

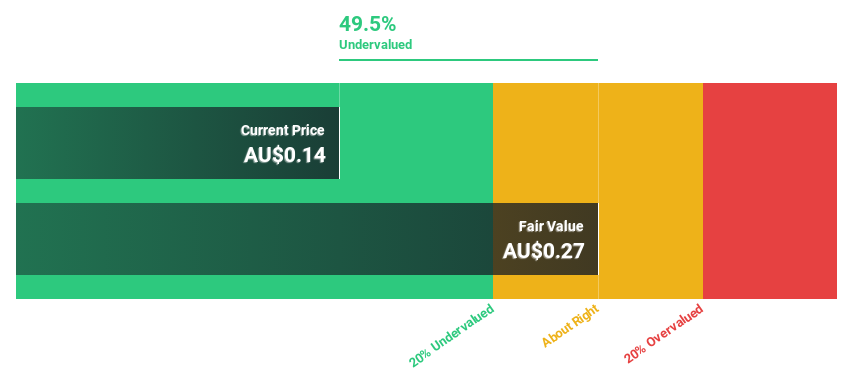

Estimated Discount To Fair Value: 16.1%

Pantoro Gold is trading at A$5.17, below its estimated fair value of A$6.16, suggesting it may be undervalued based on cash flows. The company is forecast to become profitable within three years, with earnings expected to grow 62.78% annually and revenue by 28.7%, outpacing the Australian market's growth rate of 5.4%. Recent presentations at key industry forums highlight ongoing engagement with investors and potential strategic developments in the precious metals sector.

- The analysis detailed in our Pantoro Gold growth report hints at robust future financial performance.

- Get an in-depth perspective on Pantoro Gold's balance sheet by reading our health report here.

Key Takeaways

- Investigate our full lineup of 30 Undervalued ASX Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNR

Pantoro Gold

Engages in the gold mining, processing, and exploration activities in Western Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives