- Australia

- /

- Metals and Mining

- /

- ASX:OMH

Spotlight On Dreadnought Resources And 2 Other ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market is showing signs of optimism, with the local bourse set to rise amid significant global political developments. In this context, penny stocks—though an old-fashioned term—remain a relevant investment area for those seeking opportunities in smaller or newer companies. By focusing on financial robustness and growth potential, investors can find value in these stocks, and this article will highlight three such promising candidates on the ASX.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.75M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.815 | A$295.51M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.645 | A$806.18M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.03 | A$134.6M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.51 | A$133.03M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$61M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.31 | A$111.83M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$5.00 | A$493.33M | ★★★★☆☆ |

Click here to see the full list of 1,036 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Dreadnought Resources (ASX:DRE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dreadnought Resources Limited is an Australian mineral exploration company with a market capitalization of A$60.04 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration company.

Market Cap: A$60.04M

Dreadnought Resources, with a market cap of A$60.04 million, is a pre-revenue mineral exploration company focused on the Mangaroon Critical Metals Project in Western Australia. Recent EIS co-funded grant awards underscore the potential of its Gifford Creek Carbonatite for critical metals discoveries. Despite being unprofitable and experiencing shareholder dilution, Dreadnought remains debt-free and has sufficient short-term assets to cover liabilities. The management team is experienced, but the company faces challenges such as limited cash runway and increased losses over five years. Its removal from key indices may impact investor sentiment despite promising project developments.

- Dive into the specifics of Dreadnought Resources here with our thorough balance sheet health report.

- Examine Dreadnought Resources' earnings growth report to understand how analysts expect it to perform.

OM Holdings (ASX:OMH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OM Holdings Limited is an investment holding company involved in the global mining, smelting, trading, and marketing of manganese ores and ferroalloys, with a market cap of A$286.62 million.

Operations: The company generates revenue primarily from its Smelting segment, which accounts for $441.70 million, and its Marketing and Trading activities, contributing $631.02 million.

Market Cap: A$286.62M

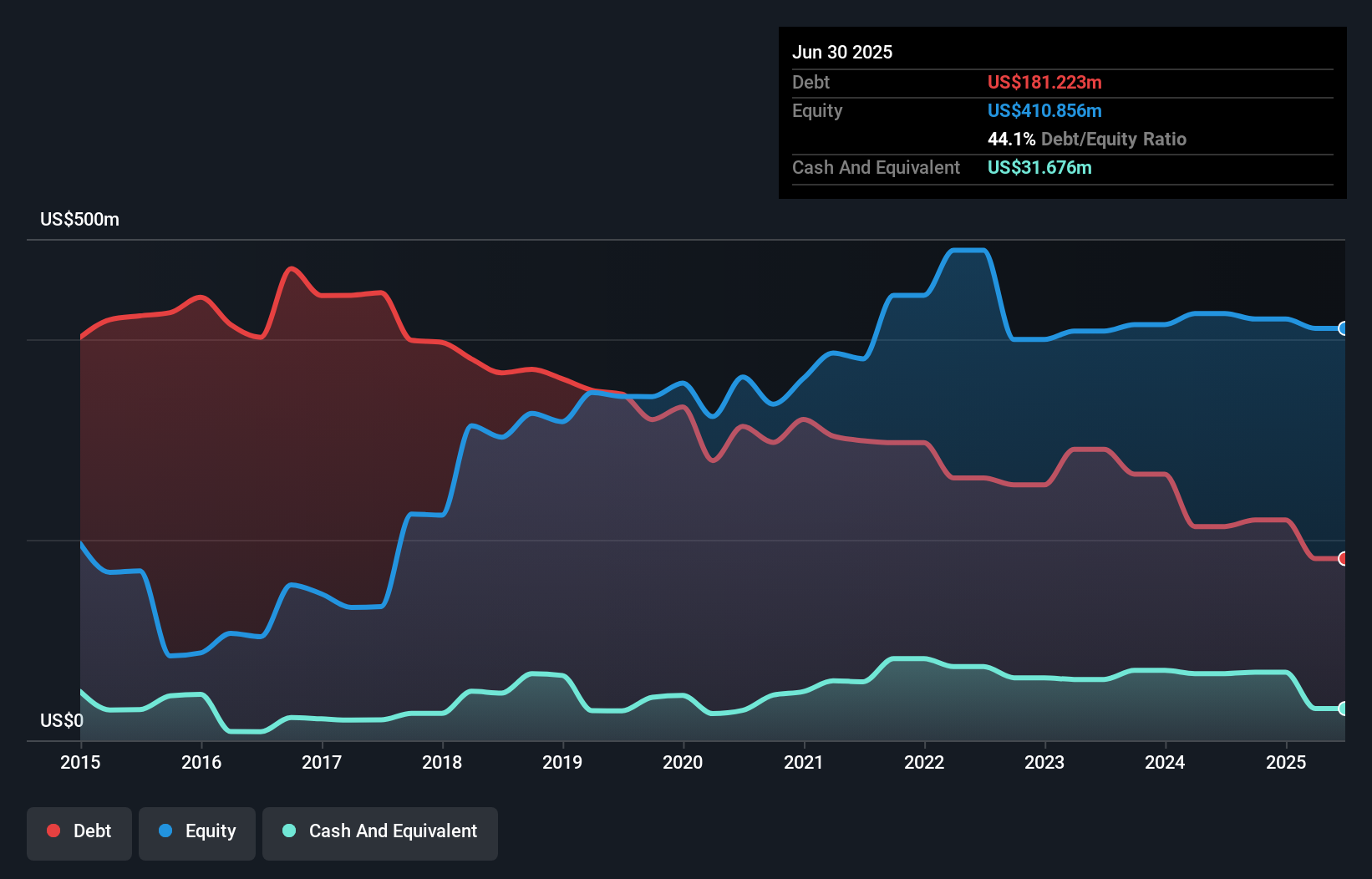

OM Holdings, with a market cap of A$286.62 million, faces challenges as its earnings have declined by 2.7% annually over the past five years and recent profit margins dropped to 2% from 5.3%. Despite these setbacks, the company is trading at a significant discount to estimated fair value and maintains satisfactory debt levels with operating cash flow covering 48.4% of its debt. Recent production data shows robust output in ferrosilicon and manganese alloys, though interest coverage remains weak at 0.9x EBIT. The seasoned board adds stability amid fluctuating financial performance and shareholder dilution concerns.

- Jump into the full analysis health report here for a deeper understanding of OM Holdings.

- Gain insights into OM Holdings' future direction by reviewing our growth report.

Peel Mining (ASX:PEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Peel Mining Limited is an Australian company focused on the exploration of mineral deposits, with a market cap of A$75.54 million.

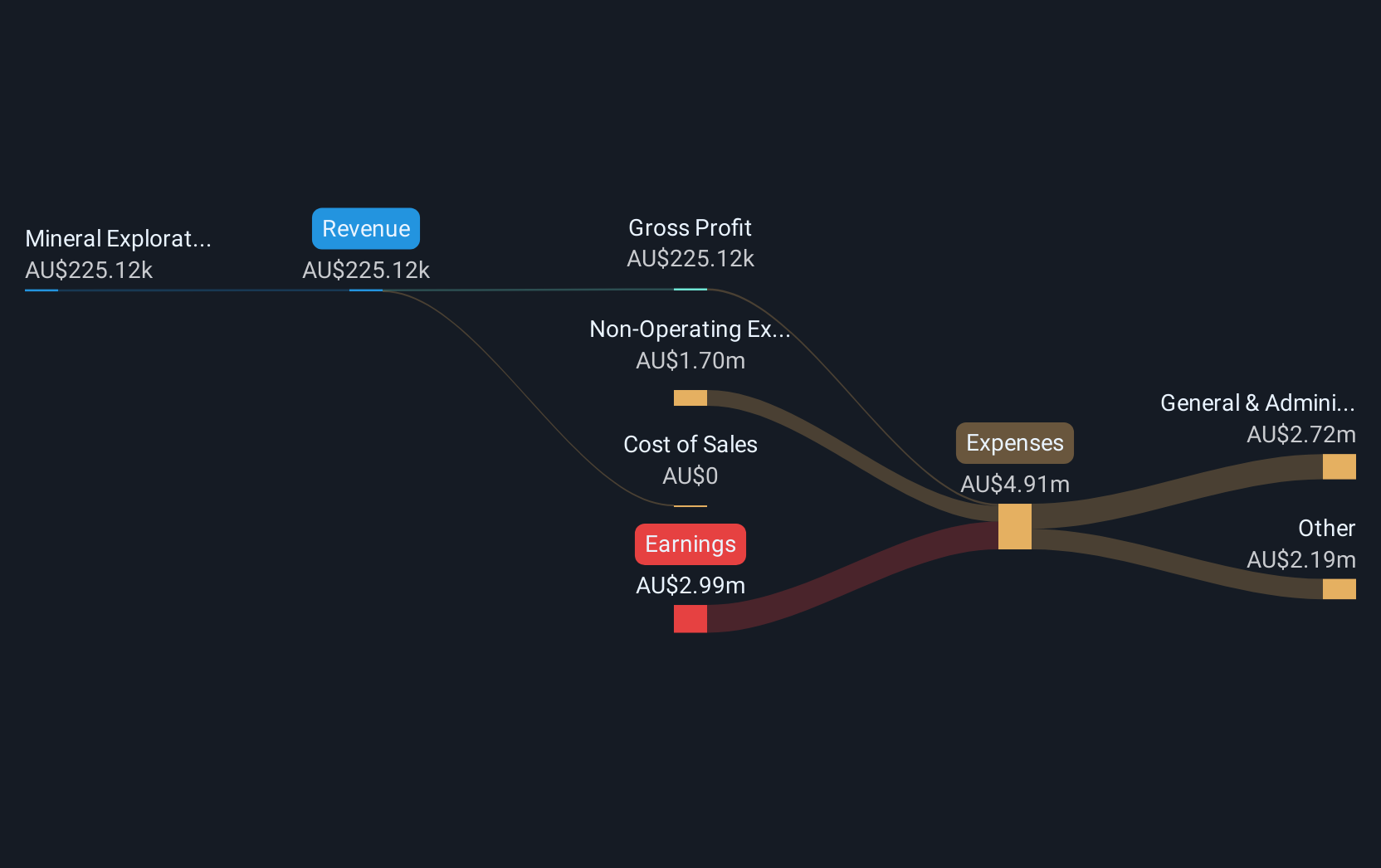

Operations: The company generates revenue from its Mineral Exploration and Development segment, amounting to A$0.000416 million.

Market Cap: A$75.54M

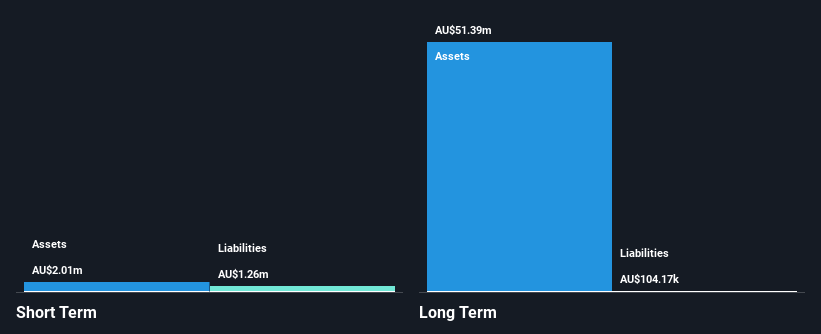

Peel Mining Limited, with a market cap of A$75.54 million, is pre-revenue, reporting minimal sales and a net loss of A$2.7 million for the year ended June 30, 2024. Despite its unprofitability and declining earnings over five years at 27.3% annually, Peel Mining maintains financial stability with no debt and short-term assets exceeding liabilities by a significant margin. The company benefits from an experienced management team and board of directors while having a sufficient cash runway for over two years based on current free cash flow trends without any shareholder dilution in the past year.

- Click here to discover the nuances of Peel Mining with our detailed analytical financial health report.

- Gain insights into Peel Mining's historical outcomes by reviewing our past performance report.

Where To Now?

- Click this link to deep-dive into the 1,036 companies within our ASX Penny Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OMH

OM Holdings

An investment holding company, engages in mining, smelting, trading, and marketing manganese ores and ferroalloys worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives