- Australia

- /

- Metals and Mining

- /

- ASX:PDI

We Take A Look At Whether Predictive Discovery Limited's (ASX:PDI) CEO May Be Underpaid

Shareholders will be pleased by the impressive results for Predictive Discovery Limited (ASX:PDI) recently and CEO Paul Roberts has played a key role. This would be kept in mind at the upcoming AGM on 14 May 2021 which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

See our latest analysis for Predictive Discovery

How Does Total Compensation For Paul Roberts Compare With Other Companies In The Industry?

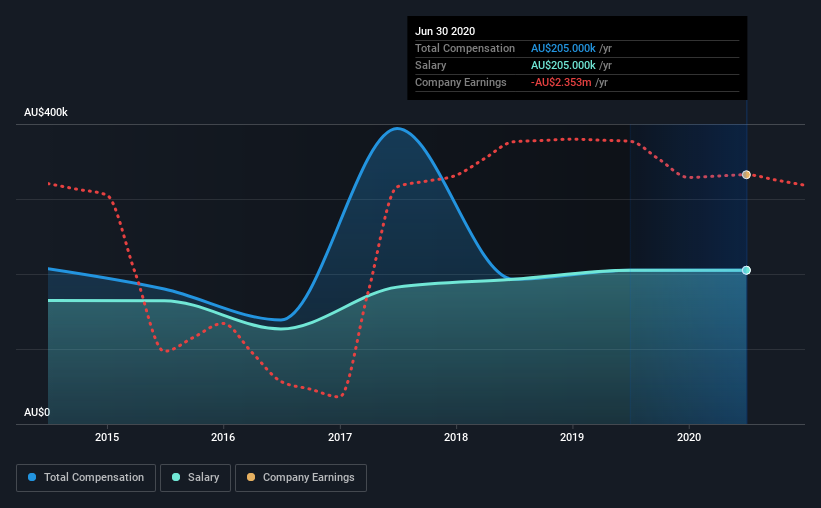

Our data indicates that Predictive Discovery Limited has a market capitalization of AU$84m, and total annual CEO compensation was reported as AU$205k for the year to June 2020. This was the same amount the CEO received in the prior year. It is worth noting that the CEO compensation consists entirely of the salary, worth AU$205k.

For comparison, other companies in the industry with market capitalizations below AU$257m, reported a median total CEO compensation of AU$303k. This suggests that Paul Roberts is paid below the industry median. What's more, Paul Roberts holds AU$508k worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$205k | AU$205k | 100% |

| Other | - | - | - |

| Total Compensation | AU$205k | AU$205k | 100% |

Talking in terms of the industry, salary represented approximately 69% of total compensation out of all the companies we analyzed, while other remuneration made up 31% of the pie. At the company level, Predictive Discovery pays Paul Roberts solely through a salary, preferring to go down a conventional route. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Predictive Discovery Limited's Growth

Predictive Discovery Limited has seen its earnings per share (EPS) increase by 29% a year over the past three years. Its revenue is down 46% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Predictive Discovery Limited Been A Good Investment?

Boasting a total shareholder return of 178% over three years, Predictive Discovery Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Predictive Discovery pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for Predictive Discovery (2 make us uncomfortable!) that you should be aware of before investing here.

Important note: Predictive Discovery is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Predictive Discovery or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:PDI

Predictive Discovery

Explores for, identifies, and develops economic reserves in West Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026