Is Vik Bansal’s Upcoming Chair Appointment Reshaping the Investment Case for Orica (ASX:ORI)?

Reviewed by Simply Wall St

- On July 8, 2025, Orica Limited Chair Malcolm Broomhead announced that Vik Bansal, a seasoned executive and current non-executive director of Brambles Ltd., will join Orica's Board as a Non-Executive Director in August and become Chair after the 2025 Annual General Meeting.

- Bansal brings over 30 years of international industrial leadership, with a proven record in strategic growth and operational transformation across multiple sectors, including clean energy and manufacturing.

- As Bansal’s upcoming transition to Chair brings fresh board-level expertise, we’ll now examine how this new leadership could influence Orica’s investment narrative.

Orica Investment Narrative Recap

To be a shareholder in Orica, one needs to believe in both the company's ability to capture growth from recent acquisitions and digital solutions, as well as its ongoing efforts in sustainability and operational resilience. Vik Bansal’s appointment as Chair Elect brings substantial board-level experience but does not materially change the most important short-term catalyst, successful integration of recent acquisitions, or the primary risk of supply constraints and margin pressure in its sodium cyanide segment.

Among recent announcements, Orica’s acquisition of Cyanco stands out, directly tying into the company’s focus on Specialty Mining Chemicals and underlining the importance of operational integration. As Orica continues to target earnings growth through cross-selling and product expansion, the smooth integration of these businesses will remain closely watched in light of new board leadership.

However, investors should be aware that with the company still facing supply constraints and maintenance requirements on key assets, the risk of a margin squeeze is far from resolved...

Read the full narrative on Orica (it's free!)

Orica's narrative projects A$8.7 billion revenue and A$625.1 million earnings by 2028. This requires 4.4% yearly revenue growth and a A$100.5 million earnings increase from A$524.6 million today.

Uncover how Orica's forecasts yield a A$21.41 fair value, in line with its current price.

Exploring Other Perspectives

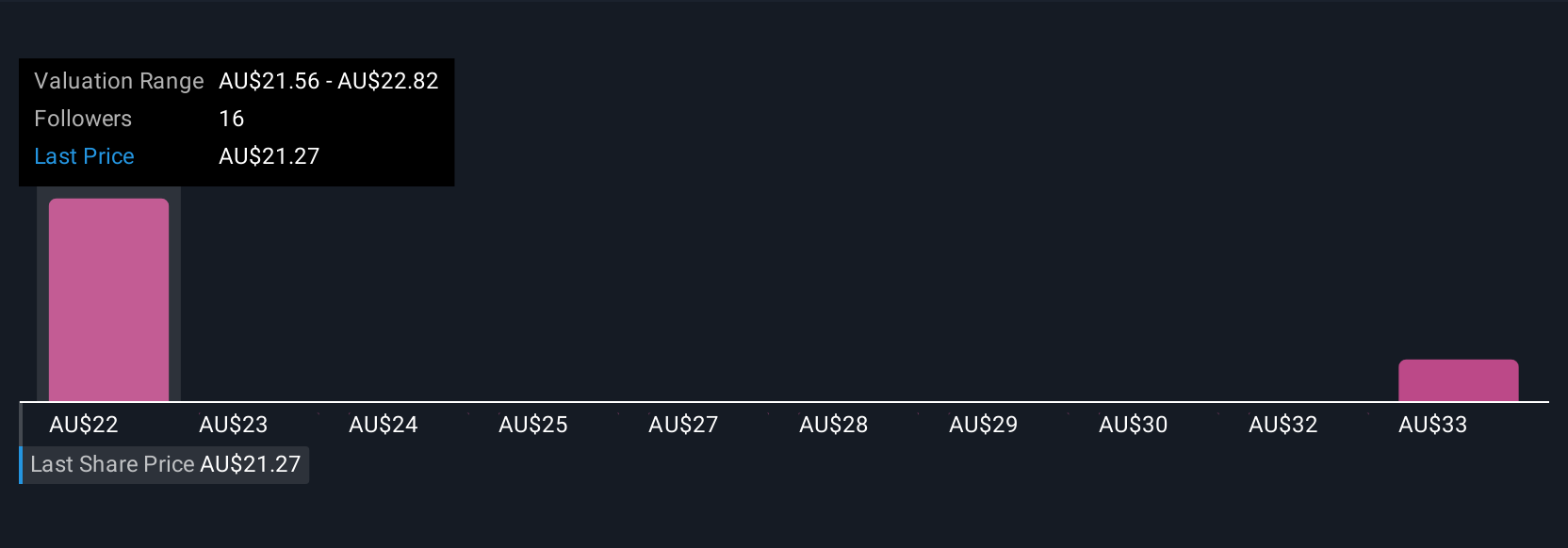

Simply Wall St Community members estimate Orica’s fair value between A$21.41 and A$34.21, offering two distinct views. While integration progress is a catalyst, opinions sharply differ, so weigh several perspectives before making decisions.

Explore 2 other fair value estimates on Orica - why the stock might be worth just A$21.41!

Build Your Own Orica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Orica research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Orica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Orica's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ORI

Orica

Manufactures, distributes, and sells commercial blasting systems, explosives, mining and tunnelling support systems, and various chemical products and services in Australia, Peru, Canada, the United States, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives