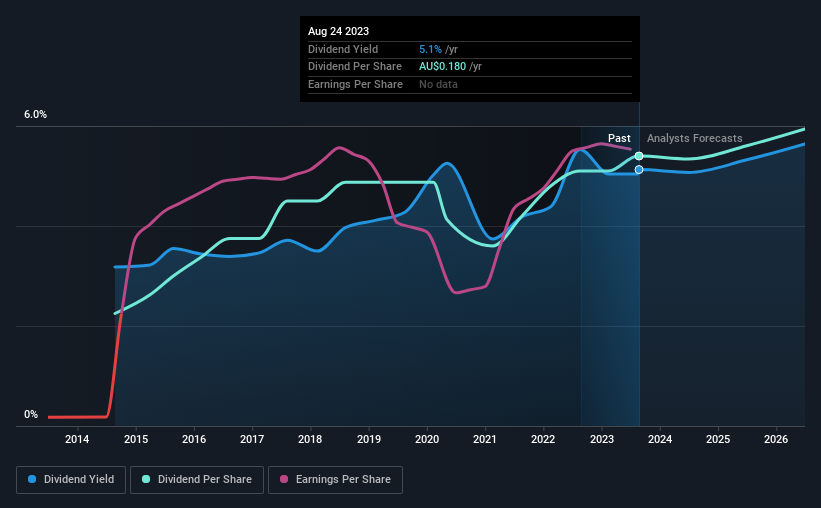

Orora Limited (ASX:ORA) will increase its dividend from last year's comparable payment on the 9th of October to A$0.09. This will take the annual payment to 5.1% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for Orora

Orora's Earnings Easily Cover The Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before making this announcement, Orora was paying out quite a large proportion of both earnings and cash flow, with the dividend being 249% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

Looking forward, earnings per share is forecast to rise by 17.7% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 71%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Orora's Dividend Has Lacked Consistency

It's comforting to see that Orora has been paying a dividend for a number of years now, however it has been cut at least once in that time. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. Since 2014, the dividend has gone from A$0.075 total annually to A$0.18. This means that it has been growing its distributions at 10% per annum over that time. Orora has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Although it's important to note that Orora's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

Orora's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Orora's payments are rock solid. The payments are bit high to be considered sustainable, and the track record isn't the best. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 2 warning signs for Orora that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ORA

Orora

Designs, manufactures, and supplies packaging products and services in Australia, New Zealand, the United States, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026