Over the last 7 days, the Australian market has risen by 1.1%, contributing to an impressive 17% climb over the past year, with earnings forecasted to grow by 12% annually. In this thriving environment, discovering stocks that combine strong fundamentals with growth potential can be key to capitalizing on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of A$2.73 billion.

Operations: Emerald Resources generates revenue primarily from its mine operations, amounting to A$366.04 million. The company's financial structure does not include "Other" segments in its primary revenue stream analysis.

Emerald Resources, a promising player in the mining sector, has seen its debt-to-equity ratio rise to 8.5% over five years, yet it remains financially robust with EBIT covering interest payments 18.6 times. Trading at a significant discount of 70.1% below estimated fair value, the company reported A$371 million in sales for the year ending June 2024, up from A$299 million previously. Despite shareholder dilution last year, earnings surged by 41.9%, outpacing industry growth significantly.

Generation Development Group (ASX:GDG)

Simply Wall St Value Rating: ★★★★★★

Overview: Generation Development Group Limited focuses on the marketing and management of life insurance and life investment products and services in Australia, with a market capitalization of A$921.74 million.

Operations: Generation Development Group generates revenue primarily from Benefit Funds and Benefit Funds Management & Funds Administration, amounting to A$316.26 million and A$37.26 million, respectively. The company experiences a deduction of A$27.48 million in its financial reporting due to eliminations.

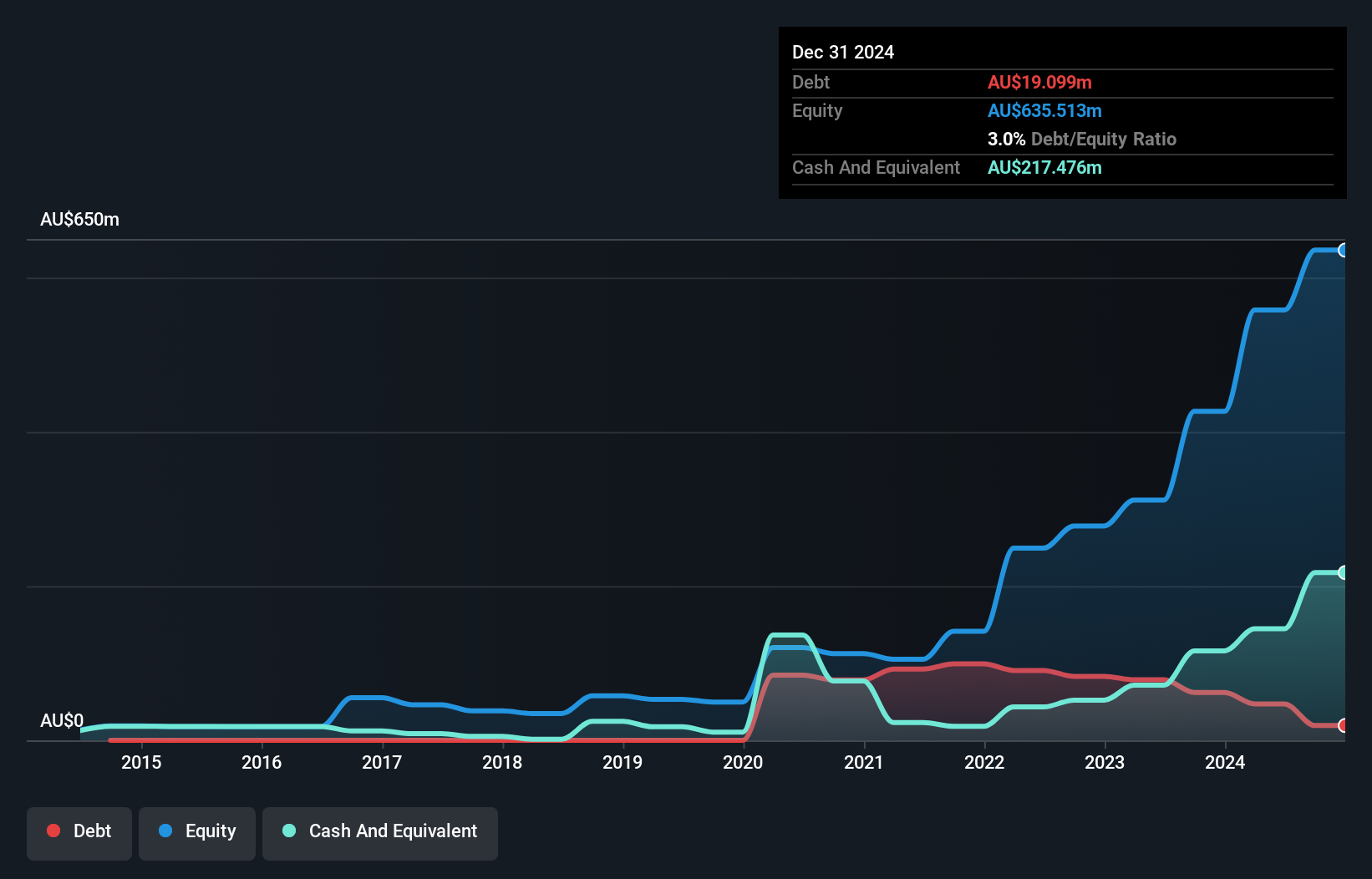

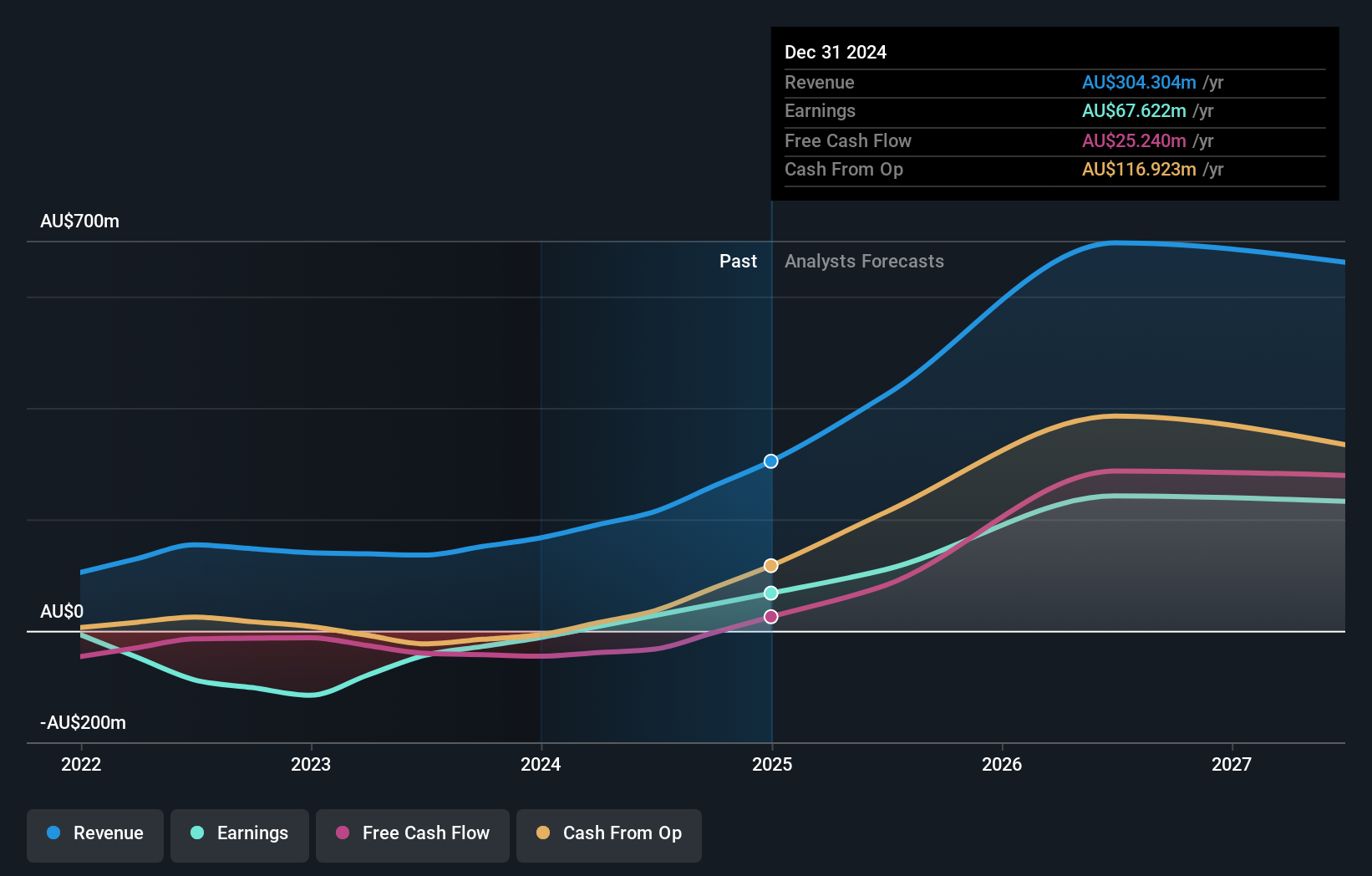

Generation Development Group, an intriguing player in the Australian market, has demonstrated robust earnings growth of 30.3% over the past year, outpacing its industry peers. With a debt-free balance sheet and positive free cash flow, GDG is positioned well financially. However, substantial shareholder dilution occurred recently. The appointment of Christine Christian AO as an independent director adds significant expertise to the board. Earnings per share rose from A$0.0238 to A$0.0301 in 2024, reflecting strong performance despite insider selling activity in recent months.

Ora Banda Mining (ASX:OBM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ora Banda Mining Limited is involved in the exploration, operation, and development of mineral properties in Australia with a market capitalization of approximately A$1.25 billion.

Operations: Ora Banda Mining generates revenue primarily through gold mining, with reported earnings of A$214.24 million from this segment.

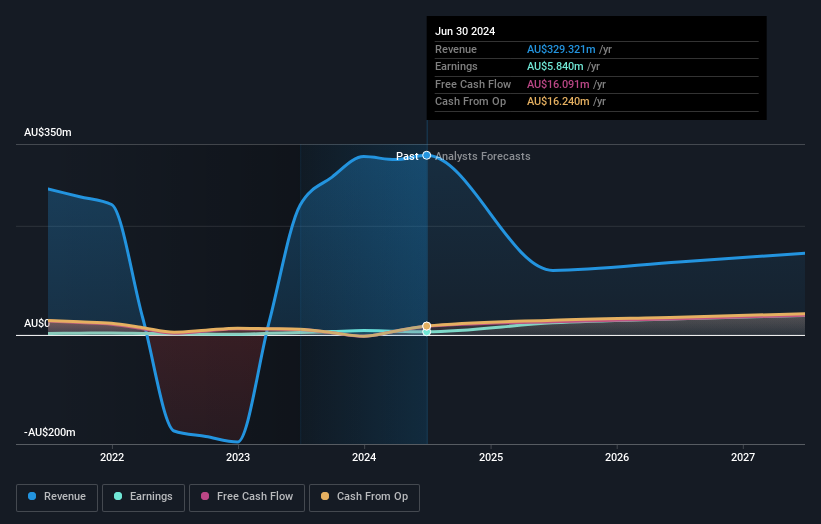

Ora Banda Mining, an intriguing player in the mining sector, has seen its sales jump to A$214.24 million from A$135.89 million over the past year, marking a significant turnaround with a net income of A$27.57 million compared to last year's loss of A$44.13 million. Despite recent shareholder dilution and negative free cash flow, the company is trading at 70% below its estimated fair value and has more cash than total debt, suggesting potential undervaluation and financial stability. With earnings forecasted to grow by 50% annually and interest payments well-covered at 7.8 times EBIT, Ora Banda seems poised for growth despite challenges in free cash flow generation.

- Delve into the full analysis health report here for a deeper understanding of Ora Banda Mining.

Assess Ora Banda Mining's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Delve into our full catalog of 53 ASX Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Generation Development Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GDG

Generation Development Group

Engages in the marketing and management of life insurance and life investment products and services in Australia.

Outstanding track record with mediocre balance sheet.