- Australia

- /

- Metals and Mining

- /

- ASX:OBM

Undiscovered Gems In Australia Three Promising Small Caps To Watch

Reviewed by Simply Wall St

Amidst a fluctuating Australian market, where recent gains have been tempered by setbacks in sectors like healthcare, small-cap stocks continue to capture the attention of investors seeking potential growth opportunities. In this dynamic environment, identifying promising small caps involves looking for companies with strong fundamentals and unique value propositions that can thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| MFF Capital Investments | NA | 40.81% | 44.64% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Fiducian Group (ASX:FID)

Simply Wall St Value Rating: ★★★★★★

Overview: Fiducian Group Ltd operates in the financial services sector in Australia through its subsidiaries, with a market capitalization of A$391.75 million.

Operations: Fiducian Group generates revenue through four primary segments: Funds Management (A$24.34 million), Corporate Services (A$16.38 million), Financial Planning (A$28.93 million), and Platform Administration (A$16.49 million).

Fiducian Group, a nimble player in the financial services sector, shines with its impressive earnings growth of 23.6% over the past year, outpacing the industry average of 12.7%. The company boasts high-quality earnings and has remained debt-free for five years, which speaks volumes about its financial prudence. Recently announcing an ordinary fully franked dividend of A$0.25 per share for the six months ending June 2025 further underscores its commitment to shareholder returns. With free cash flow consistently positive and no debt concerns, Fiducian seems well-positioned within its market niche for potential future gains.

- Navigate through the intricacies of Fiducian Group with our comprehensive health report here.

Explore historical data to track Fiducian Group's performance over time in our Past section.

Macmahon Holdings (ASX:MAH)

Simply Wall St Value Rating: ★★★★★☆

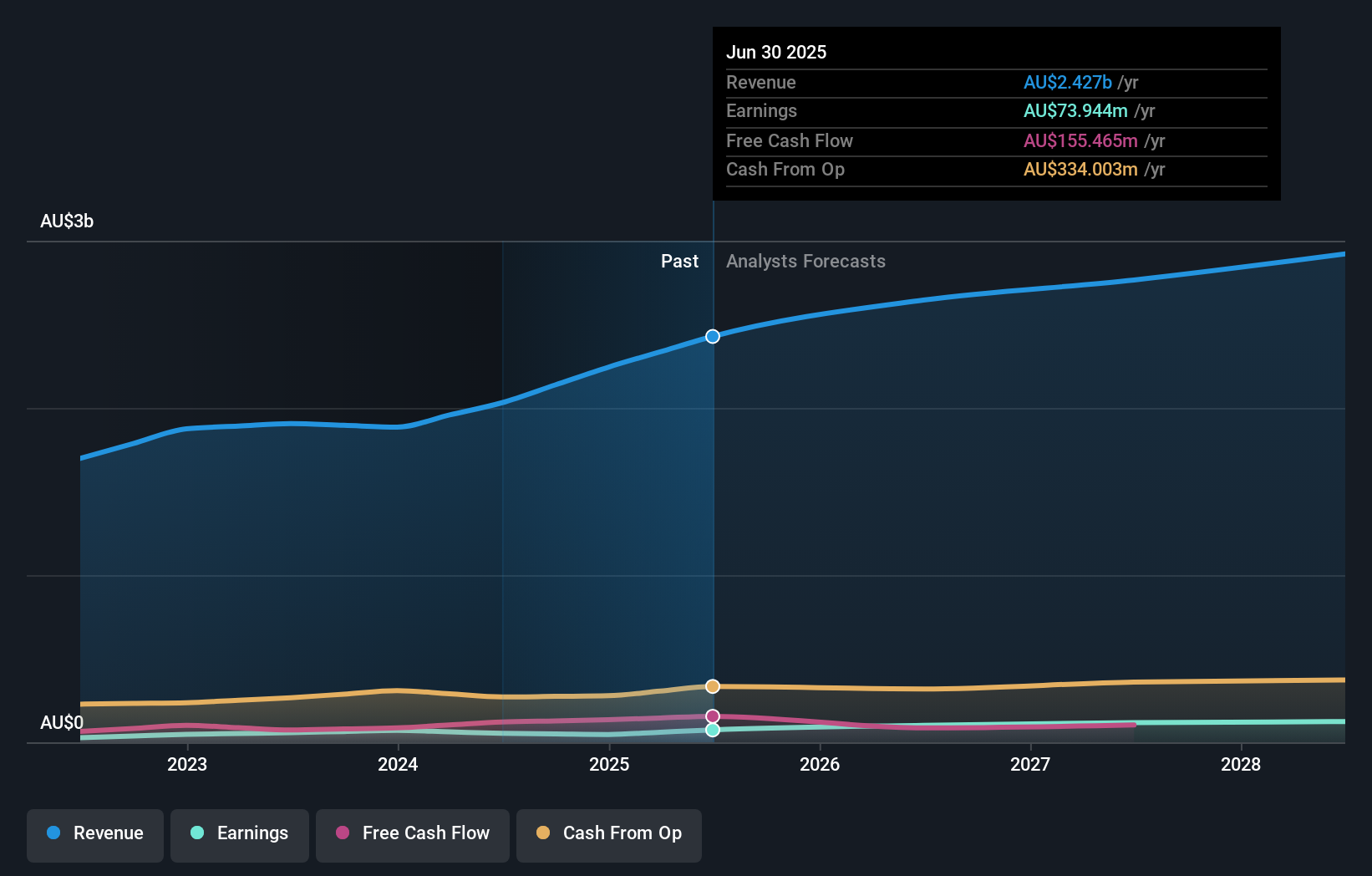

Overview: Macmahon Holdings Limited offers surface and underground mining, mining support, and civil infrastructure services to clients in Australia and Southeast Asia, with a market capitalization of A$834.04 million.

Operations: Macmahon Holdings generates revenue through its provision of surface and underground mining, mining support, and civil infrastructure services. The company's financial performance is characterized by its net profit margin trends over time.

Macmahon Holdings, a small player in the Australian market, has shown impressive growth with earnings up 38.9% last year, surpassing the industry average of 14.3%. The company reported net income of A$73.94 million for the fiscal year ending June 2025, compared to A$53.23 million previously, reflecting its strong performance. Trading at a significant discount to estimated fair value by 54.3%, it offers good relative value among peers and industry standards. With an order book worth A$24.8 billion and strategic moves like acquiring Decmil to diversify services in mining and infrastructure, Macmahon seems poised for continued expansion despite potential challenges such as labor shortages and reliance on gold prices impacting its operations.

Ora Banda Mining (ASX:OBM)

Simply Wall St Value Rating: ★★★★★☆

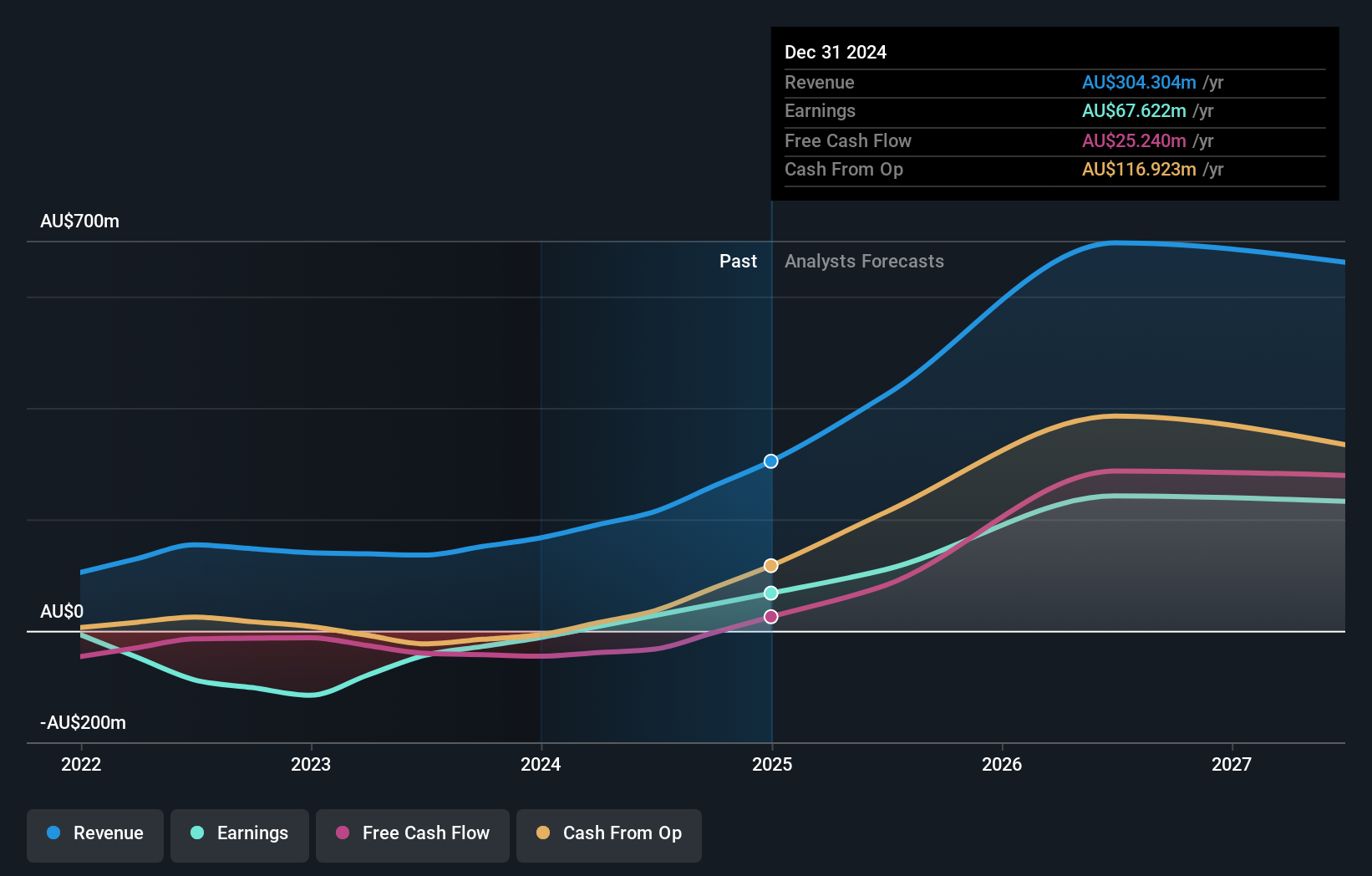

Overview: Ora Banda Mining Limited is involved in the exploration, operation, and development of mineral properties in Australia with a market capitalization of A$1.41 billion.

Operations: Ora Banda Mining Limited generates revenue primarily from its gold mining operations, amounting to A$304.30 million.

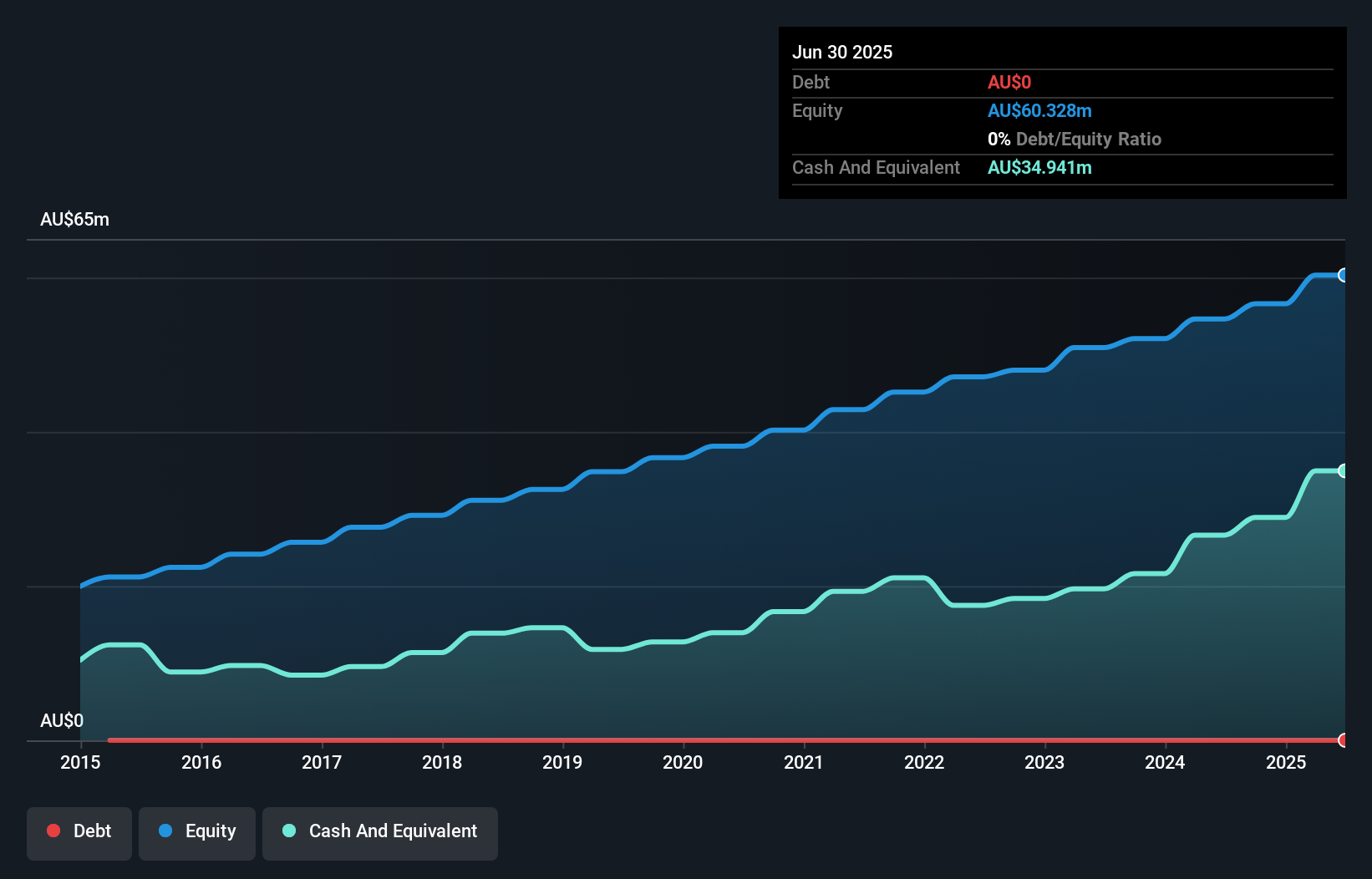

Ora Banda Mining, a promising player in the Australian mining sector, is trading at an impressive 71.2% below its estimated fair value. This company has recently turned profitable, making it hard to compare its earnings growth with the broader Metals and Mining industry which stands at 14.3%. With interest payments comfortably covered by EBIT at 29 times over, financial stability seems strong. The debt-to-equity ratio rose from zero to 2.6% in five years but remains manageable as cash exceeds total debt. Future prospects appear bright with earnings projected to grow by about 40% annually and gold production guidance set between 140,000oz and 155,000oz for fiscal year 2026.

Summing It All Up

- Access the full spectrum of 46 ASX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OBM

Ora Banda Mining

Engages in the exploration, operation, and development of mineral properties and mining in Australia.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives