- Australia

- /

- Metals and Mining

- /

- ASX:OBM

Investors Still Aren't Entirely Convinced By Ora Banda Mining Limited's (ASX:OBM) Revenues Despite 27% Price Jump

Ora Banda Mining Limited (ASX:OBM) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last month tops off a massive increase of 254% in the last year.

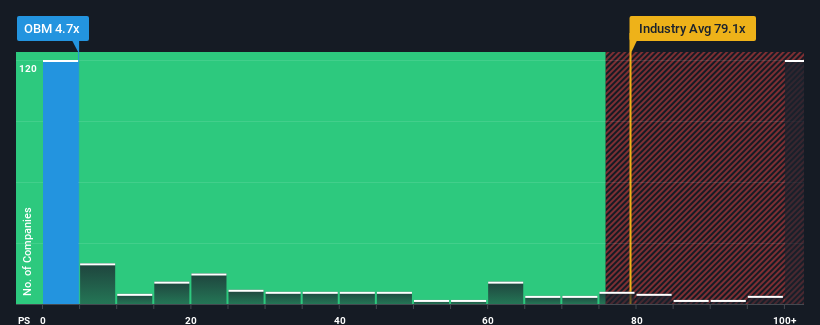

Even after such a large jump in price, Ora Banda Mining may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.7x, since almost half of all companies in the Metals and Mining industry in Australia have P/S ratios greater than 79.1x and even P/S higher than 486x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Ora Banda Mining

How Has Ora Banda Mining Performed Recently?

Recent times haven't been great for Ora Banda Mining as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Ora Banda Mining's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Ora Banda Mining?

The only time you'd be truly comfortable seeing a P/S as depressed as Ora Banda Mining's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 77% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 28%, which is noticeably less attractive.

In light of this, it's peculiar that Ora Banda Mining's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Shares in Ora Banda Mining have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Ora Banda Mining currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you settle on your opinion, we've discovered 1 warning sign for Ora Banda Mining that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OBM

Ora Banda Mining

Engages in the exploration, operation, and development of mineral properties and mining in Australia.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026