- Australia

- /

- Metals and Mining

- /

- ASX:OBM

Exploring Australia's Undiscovered Gems In May 2025

Reviewed by Simply Wall St

As of May 2025, the Australian market has shown mixed performance, with the ASX200 closing slightly down by 0.08% at 8,151 points. While sectors like Energy and Real Estate have seen modest gains, Health Care has lagged behind, highlighting the varied landscape that small-cap companies must navigate to thrive. In such an environment, identifying undiscovered gems requires a keen eye for potential growth in sectors that are gaining momentum or aligning with emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Metals X (ASX:MLX)

Simply Wall St Value Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on tin production, with a market capitalization of A$469.79 million.

Operations: Metals X Limited generates revenue primarily from its 50% stake in the Renison Tin Operation, contributing A$218.82 million. The company's financial performance is highlighted by a net profit margin trend worth noting.

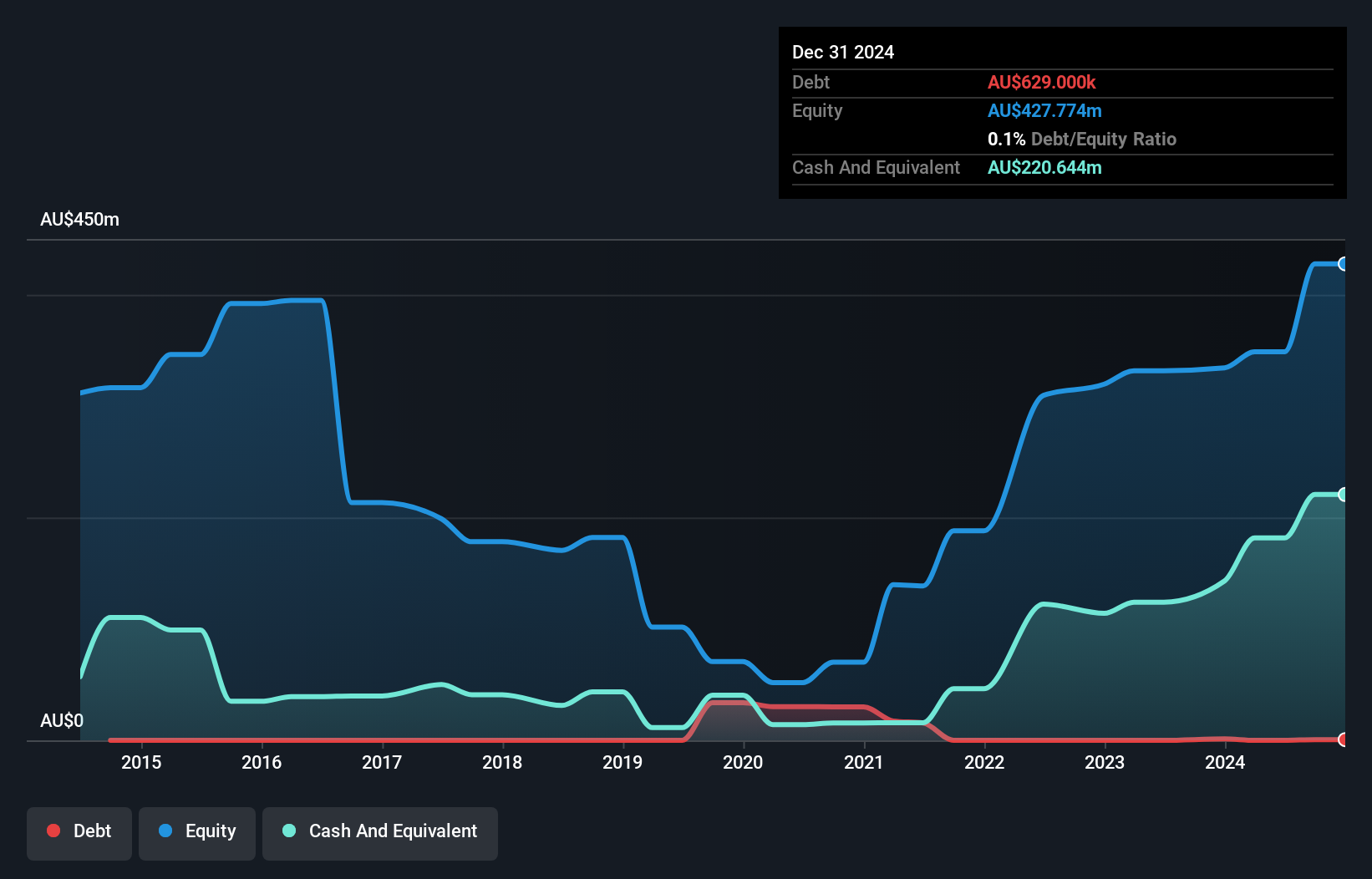

Metals X, a smaller player in the mining sector, has shown remarkable financial resilience. Over five years, its debt to equity ratio plummeted from 47.7% to 0.1%, reflecting robust balance sheet management. The company reported a net income of A$102.35 million for the year ending December 2024, up significantly from A$14.59 million previously, with earnings per share jumping to A$0.1134 from A$0.0161. While earnings surged by an impressive 601%, boosted partly by a one-off gain of A$20.2 million, Metals X trades at an attractive discount of 88% below estimated fair value despite outperforming industry growth rates.

- Get an in-depth perspective on Metals X's performance by reading our health report here.

Examine Metals X's past performance report to understand how it has performed in the past.

Ora Banda Mining (ASX:OBM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is involved in the exploration, operation, and development of mineral properties in Australia with a market capitalization of A$2.02 billion.

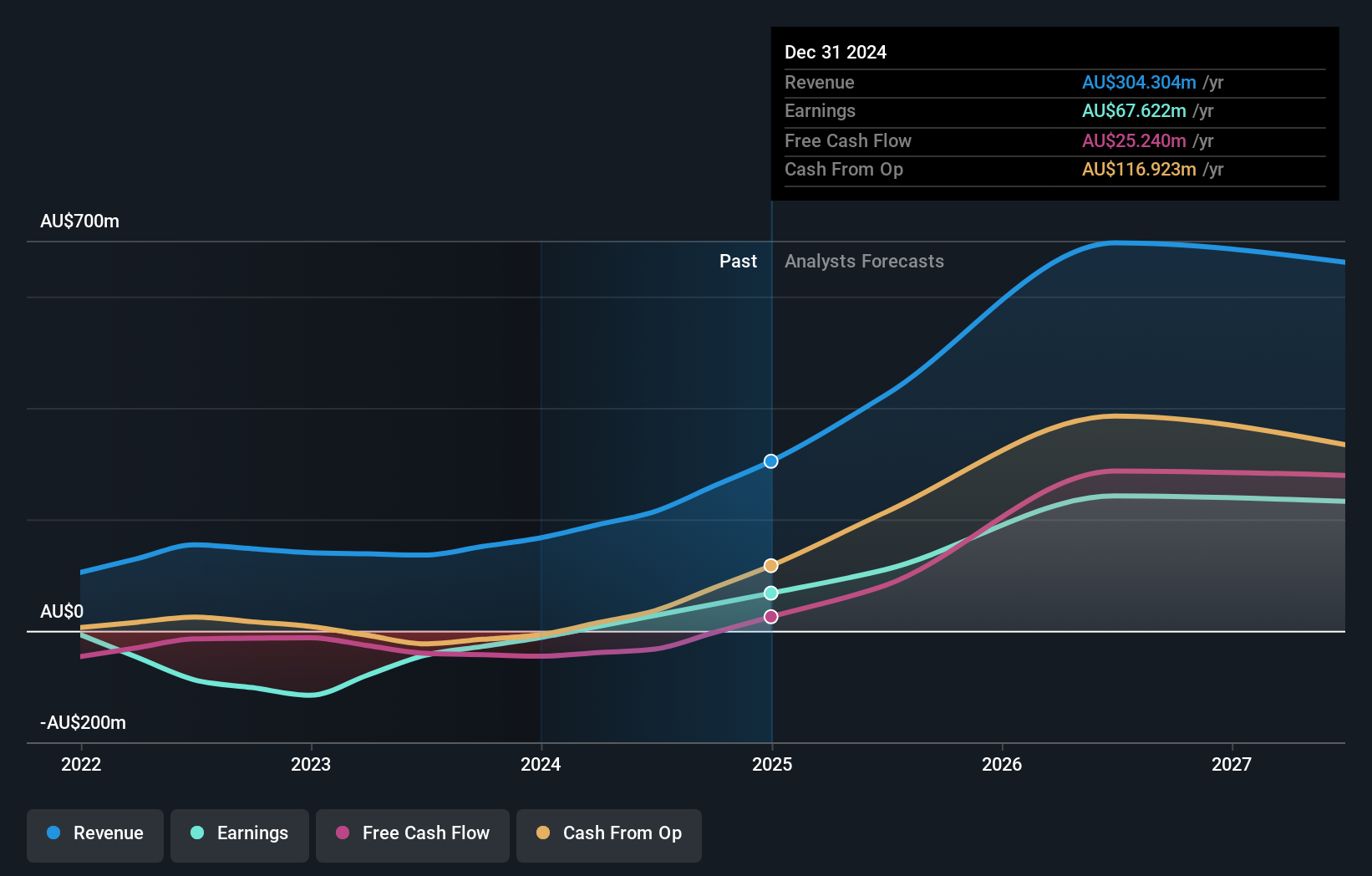

Operations: Ora Banda Mining Limited generates revenue primarily from its gold mining operations, amounting to A$304.30 million. The company's financial performance is significantly influenced by the profitability of these operations, with a focus on managing costs and optimizing production efficiency.

Ora Banda Mining, a player in the mining sector, has recently turned profitable, with net income jumping to A$50.84 million for the half-year ending December 31, 2024, up from A$10.79 million the previous year. This profitability is supported by strong sales growth to A$186.42 million and a robust EBIT coverage of interest payments at 29 times. The company trades significantly below its estimated fair value by about 66%, suggesting potential undervaluation in the market. With more cash than debt and inclusion in key indices like S&P/ASX 300, OBM appears well-positioned for future growth despite an increased debt-to-equity ratio of 2.6% over five years.

- Click here to discover the nuances of Ora Banda Mining with our detailed analytical health report.

Assess Ora Banda Mining's past performance with our detailed historical performance reports.

United Overseas Australia (ASX:UOS)

Simply Wall St Value Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, with a market cap of A$908.57 million, operates in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia.

Operations: United Overseas Australia's primary revenue stream is from land development and resale, contributing A$354.29 million, while its investment segment adds A$236.66 million. The company faces a net profit margin trend worth noting, which provides insight into its profitability relative to total revenue.

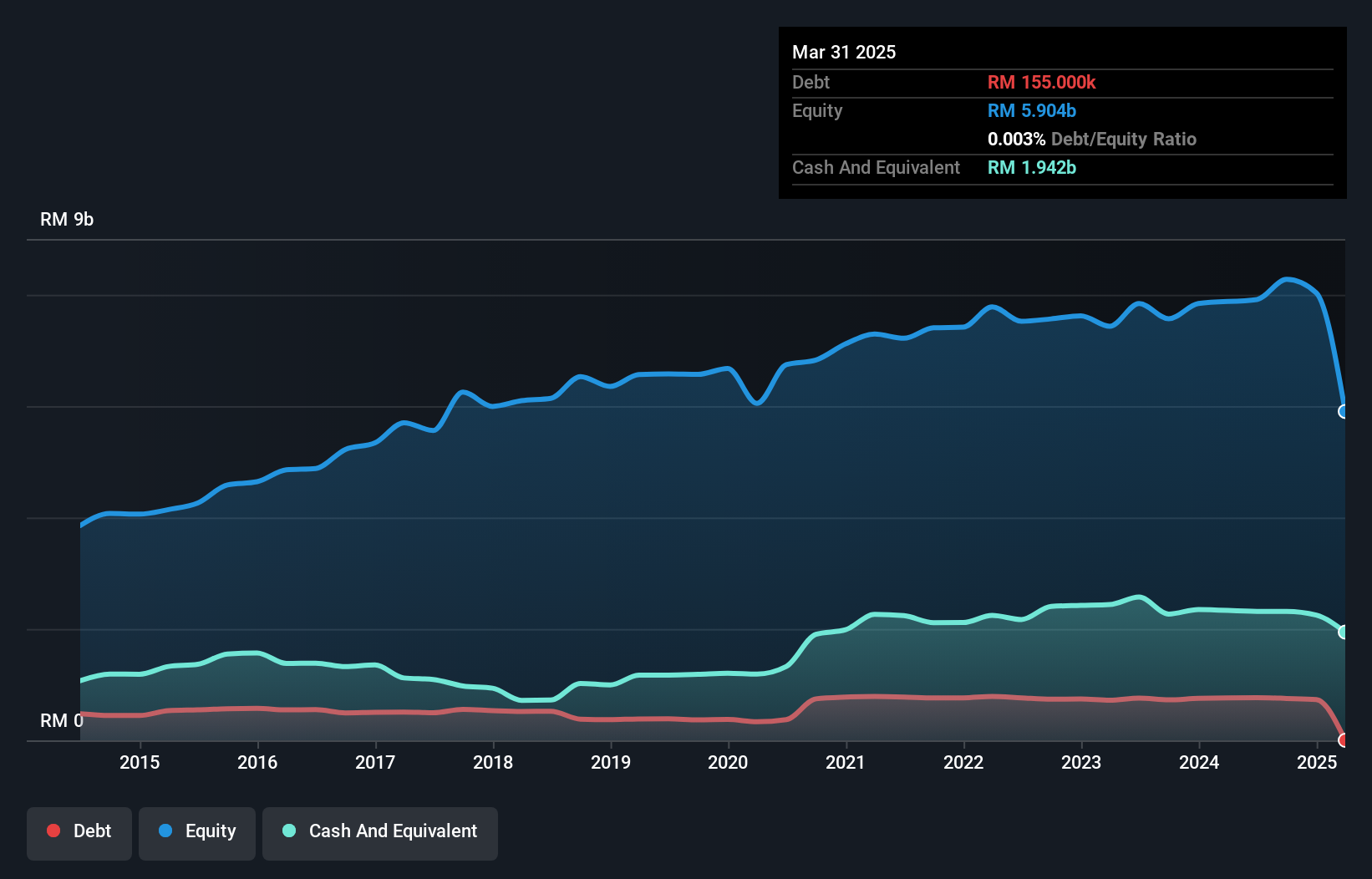

United Overseas Australia, a real estate player with a knack for growth, reported net income of A$91.57 million in 2024, up from A$79.22 million the previous year. Its earnings per share increased to A$0.0558 from A$0.05, showcasing solid performance amid industry challenges where it outpaced the sector's -14.5% earnings trend with a 15.6% rise over the past year. The price-to-earnings ratio of 9.9x suggests potential value against the broader Australian market's 17.6x benchmark, while its debt situation remains manageable as cash holdings surpass total debt levels—indicating financial stability and room for strategic maneuvers ahead.

Key Takeaways

- Discover the full array of 50 ASX Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OBM

Ora Banda Mining

Engages in the exploration, operation, and development of mineral properties in Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives