- Australia

- /

- Oil and Gas

- /

- ASX:HZN

ASX Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

As Australian traders anxiously await the Reserve Bank's rate decision, market sentiment is leaning towards a potential rate cut in August, which could provide relief to borrowers and investors. Amidst these broader economic discussions, penny stocks continue to present intriguing opportunities for those interested in smaller or newer companies. While the term 'penny stock' may seem outdated, it still signifies investment areas where solid financials can lead to significant returns. In this article, we explore three penny stocks that combine balance sheet strength with potential for growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$111.77M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.12 | A$100.01M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.40 | A$76.27M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.96 | A$456.38M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.71 | A$3.09B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.85 | A$489.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.01 | A$1.01B | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$363.6M | ✅ 2 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.81 | A$145.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Reckon (ASX:RKN) | A$0.655 | A$74.21M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 456 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Horizon Oil (ASX:HZN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Horizon Oil Limited, with a market cap of A$341.31 million, is involved in the exploration, development, and production of oil and gas properties across China, New Zealand, and Australia.

Operations: The company's revenue is primarily derived from its operations in China, contributing $60.53 million, and New Zealand, adding $34.26 million.

Market Cap: A$341.31M

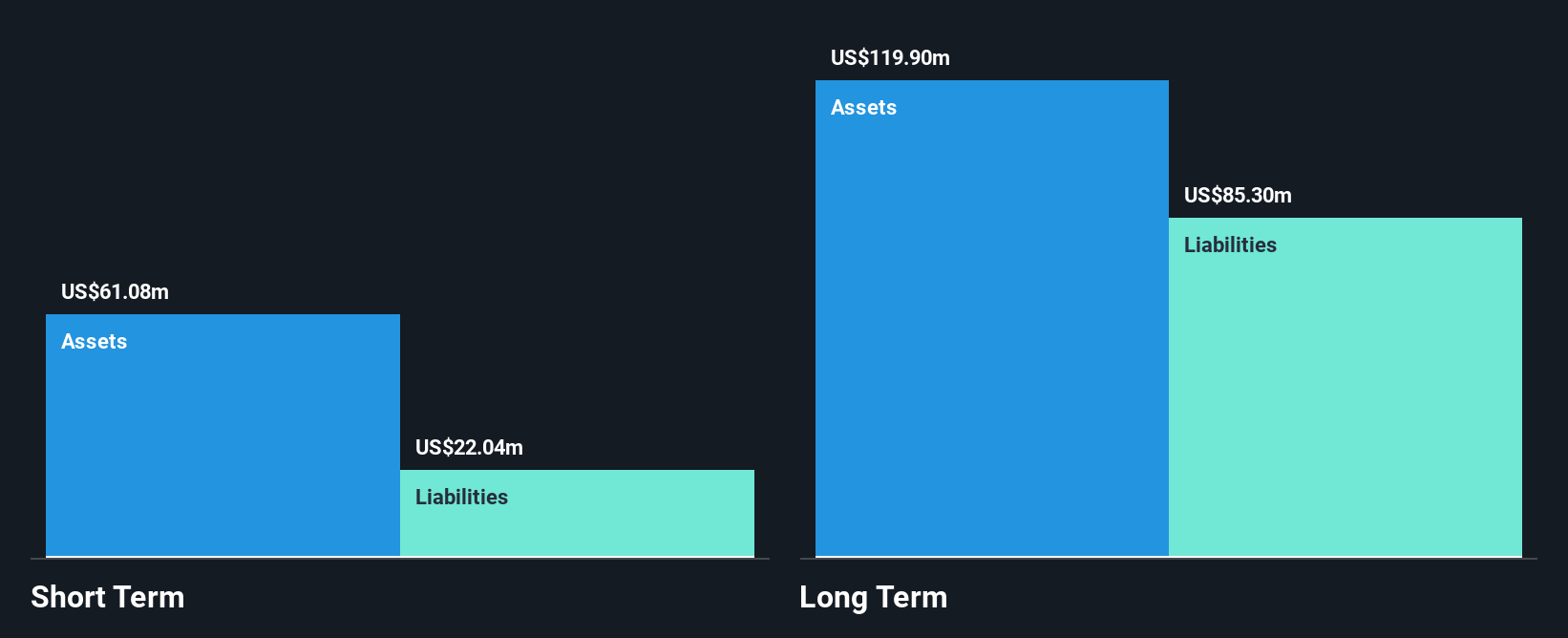

Horizon Oil Limited's market cap stands at A$341.31 million, with significant revenue streams from China (A$60.53 million) and New Zealand (A$34.26 million). Despite a decline in net profit margins to 14.1% from 30.3% last year, the company maintains high-quality earnings and has reduced its debt-to-equity ratio over five years to 33%. Its management and board are experienced, although recent negative earnings growth contrasts with a five-year average increase of 16.3%. The dividend yield of 13.06% is not well covered by earnings or cash flows, highlighting potential sustainability concerns.

- Navigate through the intricacies of Horizon Oil with our comprehensive balance sheet health report here.

- Evaluate Horizon Oil's historical performance by accessing our past performance report.

Kinatico (ASX:KYP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kinatico Ltd offers screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand with a market cap of A$123.15 million.

Operations: The company generates revenue of A$30.35 million from providing screening and verification checks.

Market Cap: A$123.15M

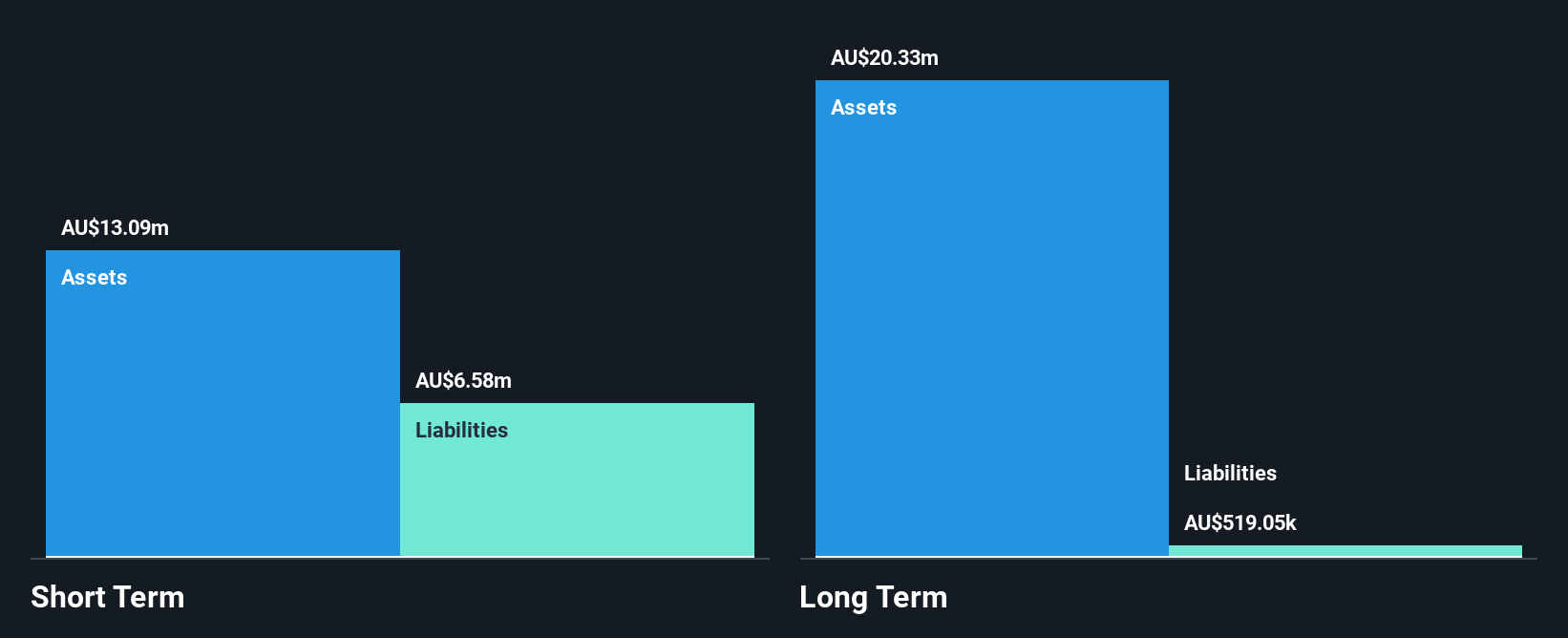

Kinatico Ltd, with a market cap of A$123.15 million, operates debt-free and generates A$30.35 million in revenue from its screening and verification services. Despite recent negative earnings growth, the company has achieved profitability over the past five years with an average annual earnings increase of 44.4%. Its management and board are experienced, boasting tenures over four years on average. Although current net profit margins have decreased to 2.8% from 5.5% last year, Kinatico's short-term assets comfortably cover both short- and long-term liabilities, indicating sound financial health amidst stable weekly volatility at 8%.

- Unlock comprehensive insights into our analysis of Kinatico stock in this financial health report.

- Examine Kinatico's earnings growth report to understand how analysts expect it to perform.

Ora Banda Mining (ASX:OBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is involved in the exploration, operation, and development of mineral properties in Australia with a market cap of A$1.27 billion.

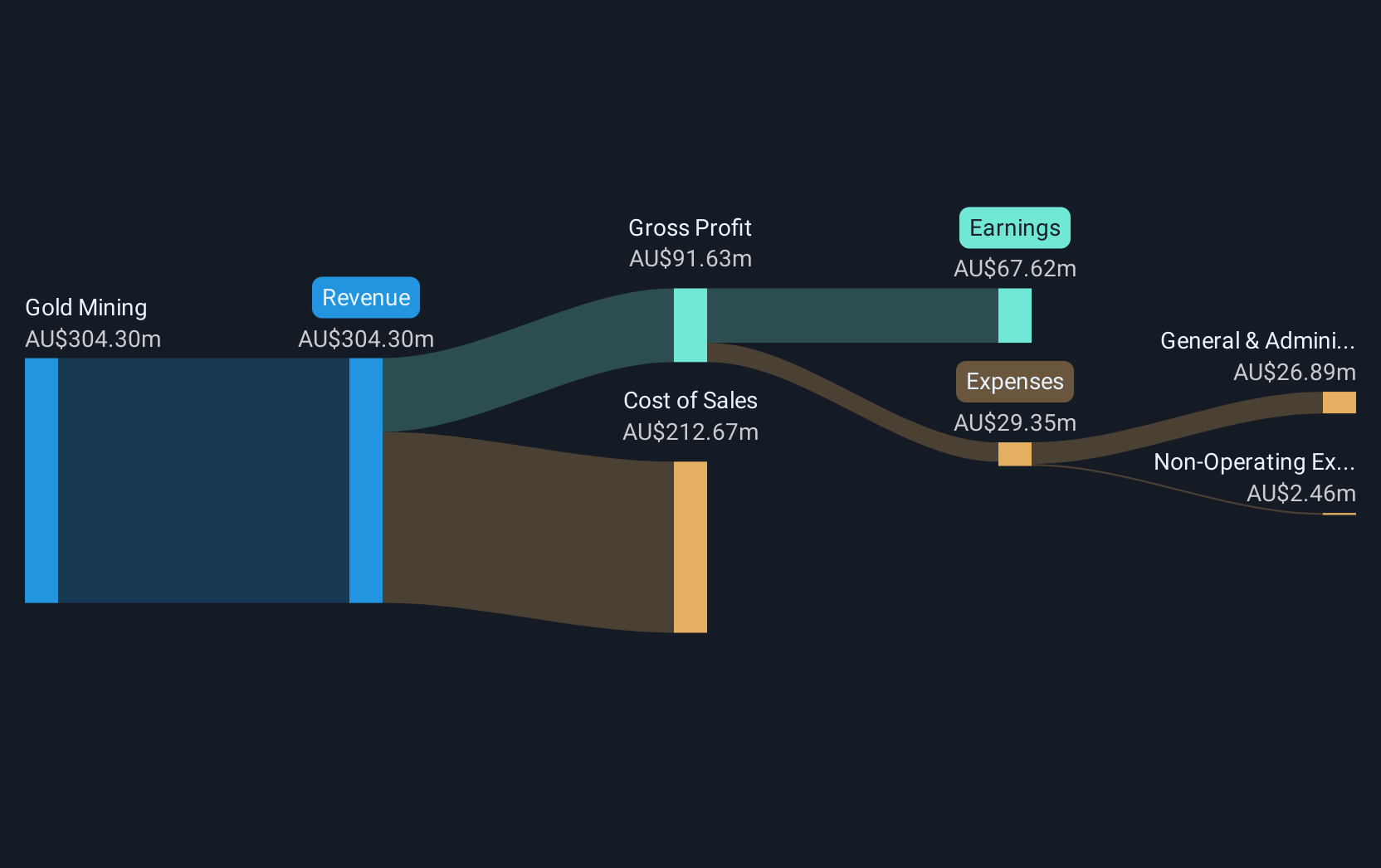

Operations: The company generates revenue from its gold mining operations, amounting to A$304.30 million.

Market Cap: A$1.27B

Ora Banda Mining Limited, with a market cap of A$1.27 billion, has recently become profitable and is trading at 74.1% below its estimated fair value, indicating potential upside. The company’s earnings are forecast to grow by over 40% annually, supported by well-covered debt and outstanding return on equity at 44.3%. Despite the management team's short tenure averaging 1.8 years, the company's financial position remains robust with short-term assets exceeding liabilities and strong operating cash flow covering debt significantly. Recent production guidance anticipates gold output between 140,000oz to 155,000oz for fiscal year 2026.

- Click here and access our complete financial health analysis report to understand the dynamics of Ora Banda Mining.

- Understand Ora Banda Mining's earnings outlook by examining our growth report.

Summing It All Up

- Access the full spectrum of 456 ASX Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Horizon Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HZN

Horizon Oil

Engages in the exploration, development, and production of oil and gas properties in China, New Zealand, Australia, and Thailand.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)