- Australia

- /

- Metals and Mining

- /

- ASX:NVA

Nova Minerals (ASX:NVA) Is Down 47.7% After Securing US-Backed Land for Alaska Antimony Refinery – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Nova Minerals Limited recently secured a land use permit for 42.81 acres near Port MacKenzie, Alaska, paving the way for a proposed antimony refinery supported by a US$43.4 million award from the U.S. Department of War.

- This move positions Nova as a potential first-mover in developing a vertically integrated antimony supply chain strategically vital to U.S. military and industrial markets.

- We'll examine how securing government support and access to key infrastructure at Port MacKenzie shapes Nova Minerals' investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Nova Minerals' Investment Narrative?

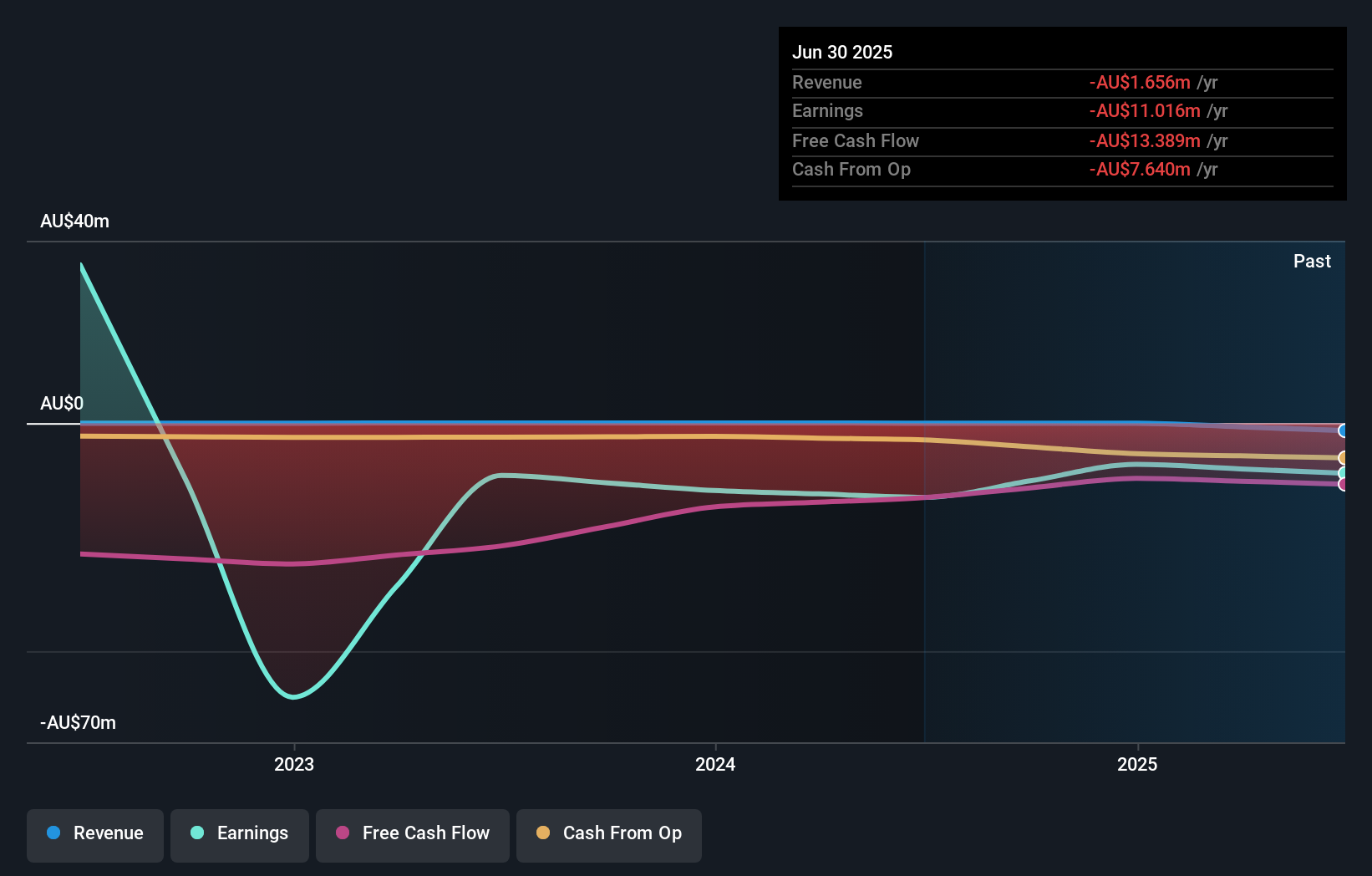

For anyone following Nova Minerals, the recent land use permit approval and US$43.4 million Department of War backing could mark a major turning point. Until now, Nova’s story was defined by ambitious Alaskan mineral plans but weighed down by persistent losses, limited revenue (A$3.6 million last year), and highly volatile shares. This permit, secured adjacent to key Port MacKenzie infrastructure, could accelerate Nova’s route to becoming a significant domestic antimony supplier, putting real government support and first-mover advantage at the center of its near-term narrative. Immediate catalysts now hinge on progress toward refinery construction, regulatory milestones, and any further federal support Nova can secure. At the same time, risks like ongoing losses, shareholder dilution and execution on its industrial build-out remain in sharp focus, especially as the market recalibrates after dramatic recent price swings. But despite the project momentum, execution risk around funding and delivery is something every investor should be aware of.

Our expertly prepared valuation report on Nova Minerals implies its share price may be too high.Exploring Other Perspectives

Explore 2 other fair value estimates on Nova Minerals - why the stock might be a potential multi-bagger!

Build Your Own Nova Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nova Minerals research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Nova Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nova Minerals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nova Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NVA

Nova Minerals

Engages in the exploration of mineral properties in Australia and the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)