- Australia

- /

- Metals and Mining

- /

- ASX:NST

Northern Star Resources (ASX:NST) Declares 61% Dividend Increase Amid Strong Financial Performance

Reviewed by Simply Wall St

Delve into the full analysis report here for a deeper understanding of Northern Star Resources.

Strengths: Core Advantages Driving Sustained Success For Northern Star Resources

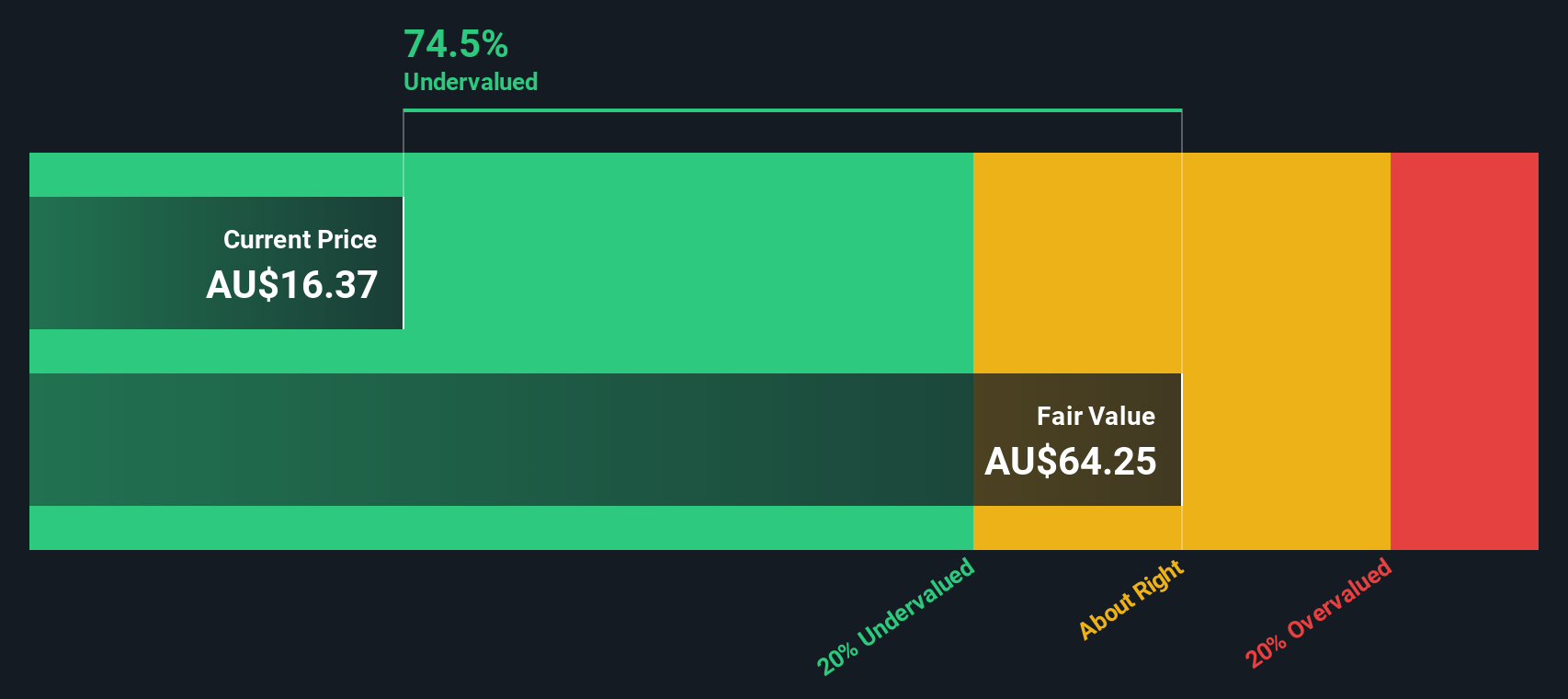

Northern Star Resources has demonstrated robust financial performance, with an underlying EBITDA of AUD 2.2 billion, resulting in record cash earnings of AUD 1.8 billion. CFO Ryan Gurner highlighted the company's strong cash generation, with AUD 462 million in underlying free cash flow. Additionally, the company declared a final unfranked dividend of AUD 0.25 per share, marking a 61% increase from the final FY '23 dividend. The company's strong balance sheet, with a net cash position of AUD 358 million as of June, positions it well for future growth. Notably, Northern Star has doubled its return on capital employed year-on-year to 8.6%. Operational excellence is evident, with gold sales of 1.62 million ounces and an all-in sustaining cost of AUD 1,853 per ounce. Trading at AUD 16.02, significantly below its estimated fair value of AUD 66.44, Northern Star may be undervalued despite its high Price-To-Earnings Ratio of 28.8x compared to industry peers.

Weaknesses: Critical Issues Affecting Northern Star Resources' Performance and Areas For Growth

Despite its strengths, Northern Star faces challenges in cost management, as noted by CEO Stuart Tonkin, who mentioned labor pressure and rising gold prices. The company's Price-To-Earnings Ratio of 28.8x is significantly higher than the Australian Metals and Mining industry average of 12.5x and the peer average of 13.4x, indicating it may be expensive relative to its peers. Additionally, the company's net profit margins have declined from 14.2% to 13% over the past year. Earnings growth over the past year (9.1%) is below its 5-year average of 16.3% per year, suggesting a slowdown in profit growth. Furthermore, Northern Star's Return on Equity (ROE) is considered low at 7.3%, below the 20% threshold typically deemed satisfactory.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Northern Star is well-positioned to capitalize on several growth opportunities. The company has completed the first year of a 3-year build for the KCGM mill expansion project, which could significantly boost production capacity. CEO Stuart Tonkin emphasized the company's attractive exploration program, with nearly 21 million ounces of ore reserves, underscoring its potential for value creation. The current high gold prices present a favorable backdrop for Northern Star, offering significant leverage to the gold price. The company's revenue is forecast to grow at 7.6% per year, outpacing the Australian market's 5.4% growth rate. These initiatives, coupled with strategic investments, could enhance Northern Star's market position and drive long-term growth.

Threats: Key Risks and Challenges That Could Impact Northern Star Resources' Success

Northern Star faces several external threats that could impact its performance. Economic factors, such as rising costs across the gold sector, pose a significant challenge. CEO Stuart Tonkin noted that costs tend to trend upwards due to industry-wide behaviors. Regulatory risks also loom large, with potential changes in legislation that could affect operations. Additionally, operational risks remain, with planned work at TBO expected to be second-half weighted, potentially impacting production timelines. The company's earnings growth forecast of 10.2% per year is slower than the Australian market's 12.3%, indicating potential market share erosion. These factors underscore the need for strategic risk management to safeguard Northern Star's future growth.

Northern Star Resources' strong financial performance, marked by significant cash generation and a solid balance sheet, positions it well for future growth. However, challenges such as high operational costs and a Price-To-Earnings Ratio of 28.8x, which is higher than industry peers, indicate potential cost management issues. The company's strategic initiatives, including the KCGM mill expansion and exploration programs, offer promising growth prospects, particularly given the favorable gold price environment. Despite trading at AUD 16.02, well below its estimated fair value of AUD 66.44, Northern Star's future performance will hinge on effectively managing external threats and leveraging its growth opportunities to enhance profitability and market share.

Taking Advantage

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Northern Star Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:NST

Northern Star Resources

Engages in the exploration, development, mining, and processing of gold deposits.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives