Andrew Elf has been the CEO of Mitchell Services Limited (ASX:MSV) since 2014, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Mitchell Services pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Mitchell Services

Comparing Mitchell Services Limited's CEO Compensation With the industry

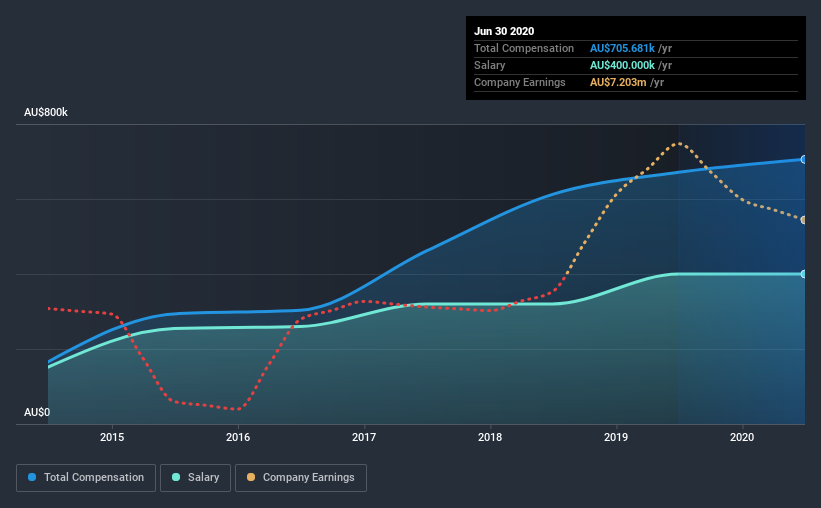

At the time of writing, our data shows that Mitchell Services Limited has a market capitalization of AU$112m, and reported total annual CEO compensation of AU$706k for the year to June 2020. That's a modest increase of 5.1% on the prior year. In particular, the salary of AU$400.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$264m, we found that the median total CEO compensation was AU$309k. Accordingly, our analysis reveals that Mitchell Services Limited pays Andrew Elf north of the industry median. Furthermore, Andrew Elf directly owns AU$440k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$400k | AU$400k | 57% |

| Other | AU$306k | AU$271k | 43% |

| Total Compensation | AU$706k | AU$671k | 100% |

Speaking on an industry level, nearly 70% of total compensation represents salary, while the remainder of 30% is other remuneration. In Mitchell Services' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Mitchell Services Limited's Growth Numbers

Over the past three years, Mitchell Services Limited has seen its earnings per share (EPS) grow by 81% per year. Its revenue is up 46% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Mitchell Services Limited Been A Good Investment?

With a total shareholder return of 32% over three years, Mitchell Services Limited shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

As we noted earlier, Mitchell Services pays its CEO higher than the norm for similar-sized companies belonging to the same industry. However, we must not forget that the EPS growth has been very strong over three years. Looking at the same time period, we think that the shareholder returns are respectable. So, considering the EPS growth we do not wish to criticize CEO compensation, though we'd recommend further research on management.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for Mitchell Services that investors should think about before committing capital to this stock.

Switching gears from Mitchell Services, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Mitchell Services or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MSV

Mitchell Services

Provides exploration, and mine site and geotechnical drilling services to the exploration, mining, and energy industries in Australia.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)