- Australia

- /

- Medical Equipment

- /

- ASX:COV

December 2024 ASX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Australian market navigates a challenging December, with the ASX200 recently dipping below 8,300 points and materials taking a hit, investors are keenly watching for opportunities amidst fluctuating indices. In this climate, penny stocks—though an outdated term—remain relevant as they spotlight smaller or less-established companies that may offer value. By focusing on those with strong financials and growth potential, investors might discover promising opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.935 | A$320.75M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.505 | A$322.48M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.80 | A$232.15M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.75 | A$95.97M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.60 | A$774.33M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$220.22M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.84 | A$105.44M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.86 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cleo Diagnostics (ASX:COV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cleo Diagnostics Ltd is a medical diagnostics and devices company specializing in the development and commercialization of non-invasive blood tests for detecting ovarian cancer in Australia, with a market cap of A$46.90 million.

Operations: The company's revenue is derived entirely from its Medical Labs & Research segment, amounting to A$0.21 million.

Market Cap: A$46.9M

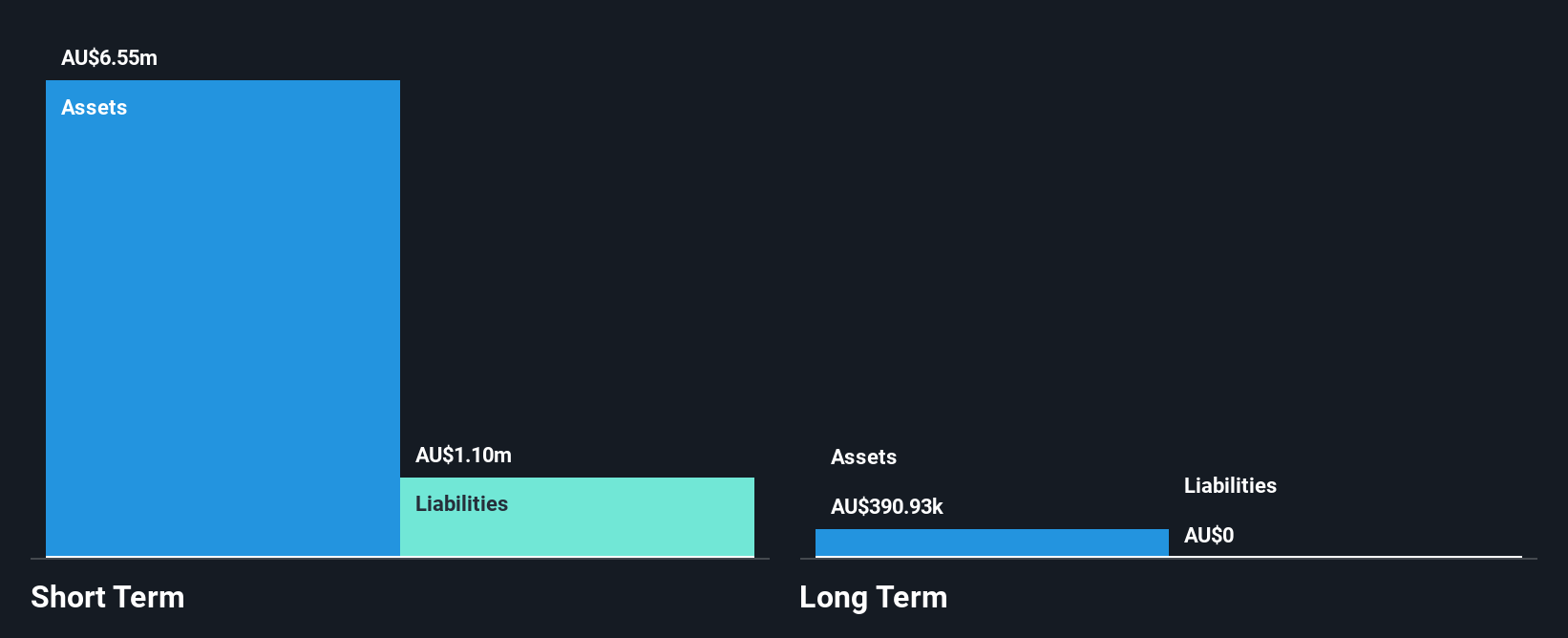

Cleo Diagnostics Ltd, with a market cap of A$46.90 million, is a pre-revenue company focused on non-invasive blood tests for ovarian cancer detection. Despite its unprofitability and limited financial history, it remains debt-free with no long-term liabilities. The company has a sufficient cash runway exceeding three years based on current free cash flow and has not experienced significant shareholder dilution recently. While the management team is relatively experienced, the board lacks seasoned tenure. Recent events include an upcoming AGM to consider auditor changes and director re-elections, reflecting ongoing corporate governance activities.

- Navigate through the intricacies of Cleo Diagnostics with our comprehensive balance sheet health report here.

- Gain insights into Cleo Diagnostics' historical outcomes by reviewing our past performance report.

InvestSMART Group (ASX:INV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: InvestSMART Group Limited offers financial services and products to retail investors in Australia, with a market capitalization of A$16.08 million.

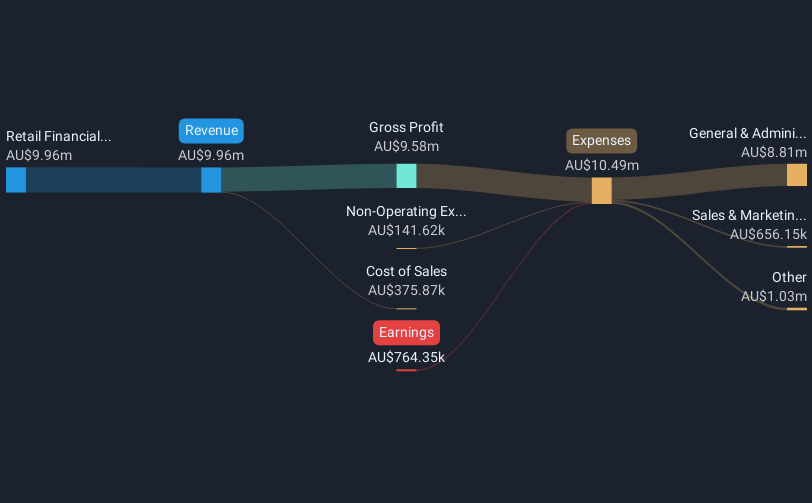

Operations: The company generates revenue of A$9.96 million from its retail financial services segment in Australia.

Market Cap: A$16.08M

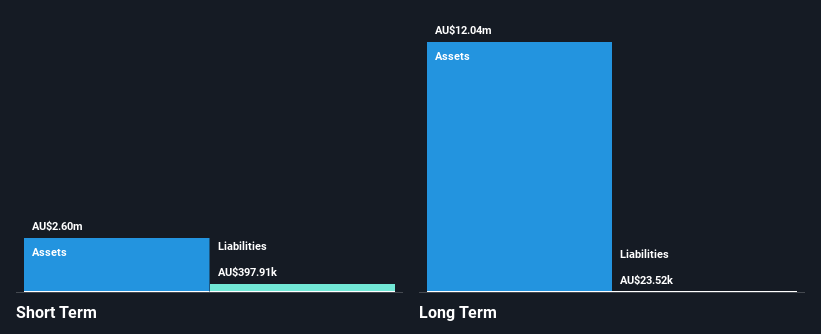

InvestSMART Group Limited, with a market cap of A$16.08 million, generates A$9.96 million in revenue from its retail financial services segment. The company is debt-free and maintains a stable financial position with short-term assets exceeding both short- and long-term liabilities. Despite being unprofitable, it has managed to reduce losses by 15.7% annually over the past five years and boasts a cash runway extending beyond three years due to positive free cash flow growth of 8.1% per year. Recent governance activities include appointing Effie Zahos as director and an upcoming AGM addressing key reports and director re-elections.

- Click here and access our complete financial health analysis report to understand the dynamics of InvestSMART Group.

- Explore historical data to track InvestSMART Group's performance over time in our past results report.

Marquee Resources (ASX:MQR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Marquee Resources Limited is involved in the exploration, evaluation, and development of mineral properties across the United States, Australia, and Canada with a market cap of A$7.08 million.

Operations: Marquee Resources Limited currently does not report any revenue segments.

Market Cap: A$7.08M

Marquee Resources Limited, with a market cap of A$7.08 million, is pre-revenue and debt-free, but faces financial challenges with less than a year of cash runway. The company's short-term assets exceed its liabilities, providing some liquidity cushion. Despite being unprofitable, it has reduced losses by 5.4% annually over the past five years and maintains stable weekly volatility higher than most Australian stocks. Recent board changes include the resignation of George Henderson and the appointment of Anna Mackintosh as an independent non-executive director, bringing extensive commercial experience to bolster governance amid ongoing strategic developments.

- Unlock comprehensive insights into our analysis of Marquee Resources stock in this financial health report.

- Assess Marquee Resources' previous results with our detailed historical performance reports.

Key Takeaways

- Jump into our full catalog of 1,047 ASX Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:COV

Cleo Diagnostics

A medical diagnostics and devices company, focuses on the development and commercializing of non-invasive blood tests to detect ovarian cancer in Australia.

Flawless balance sheet low.