- Australia

- /

- Metals and Mining

- /

- ASX:MIN

Mineral Resources (ASX:MIN): Assessing Valuation After Strong Uptrend and Rising Investor Attention

Reviewed by Simply Wall St

Mineral Resources (ASX:MIN) has just popped up in a fresh ASX uptrend roundup, with its share price strength and technical signals putting it in the same conversation as the larger mining names.

See our latest analysis for Mineral Resources.

That recent breakout to A$51.63 caps a powerful run, with the 30 day share price return of 16.6 percent and 90 day share price return of 43.8 percent signalling momentum is building, even though the 3 year total shareholder return is still negative.

If this kind of strong move has you curious about what else the market is rewarding, it could be a good time to explore fast growing stocks with high insider ownership.

Yet with Mineral Resources now trading above analyst targets and recent gains outpacing its longer term record, investors have to ask whether the rally still leaves upside on the table or whether future growth is already priced in.

Most Popular Narrative: 11% Overvalued

With Mineral Resources closing at A$51.63 against a narrative fair value near the mid A$40s, the current rally sits above that long term anchor.

The fair value estimate has risen slightly to A$46.58 per share from A$45.43 per share, implying a modest uplift in the intrinsic valuation.

The net profit margin forecast has increased significantly to about 10.21 percent from 7.45 percent, driving a substantial portion of the higher fair value estimate.

Want to see what is powering that margin jump and higher growth runway, and why the valuation multiple actually falls despite it? The full narrative unpacks the revenue build, profitability shift, and future earnings lens that all have to line up for this price to make sense.

Result: Fair Value of $46.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy capital spending and volatile lithium and iron ore prices could still derail margin improvements and undermine the optimistic growth assumptions behind this rally.

Find out about the key risks to this Mineral Resources narrative.

Another Angle on Valuation

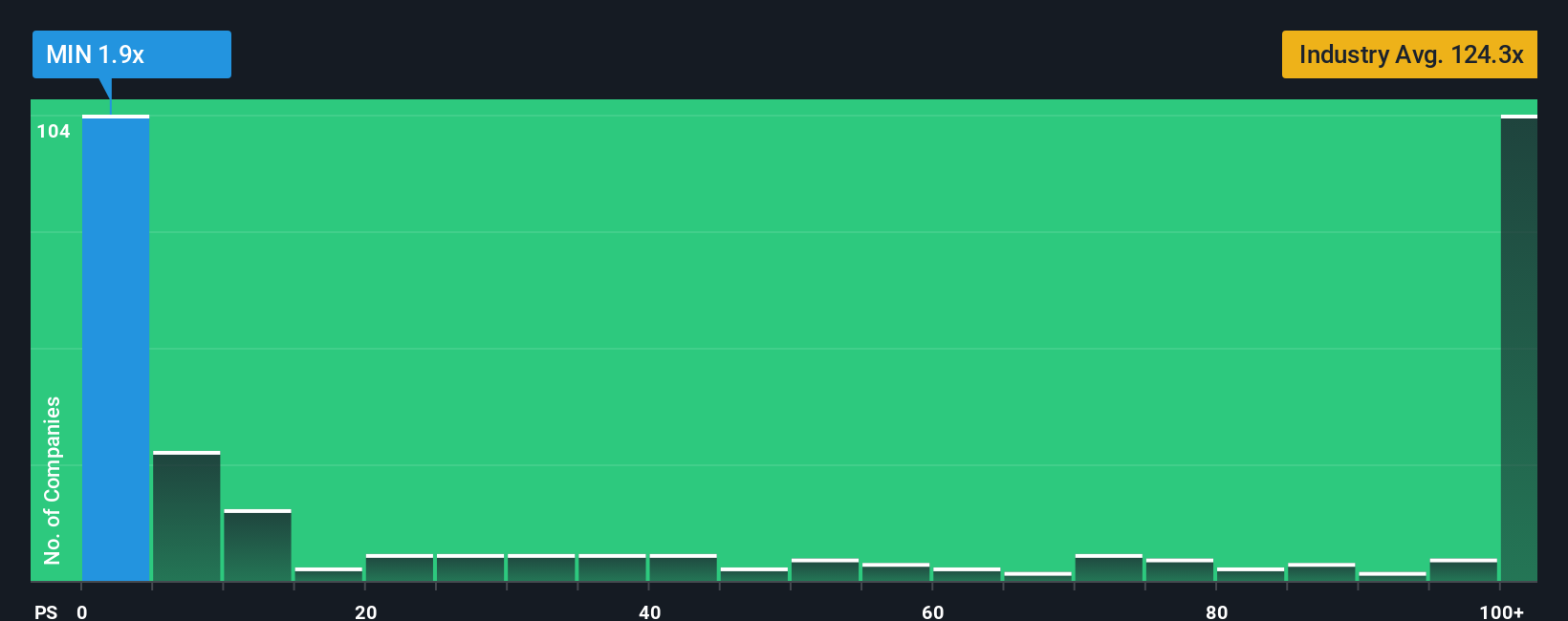

While the narrative fair value suggests Mineral Resources is about 11 percent overvalued, its price to sales ratio near 2.3 times looks strikingly cheap versus peers at 13.1 times and a fair ratio of 12.3 times, hinting at upside if sentiment fully normalises. Which signal would you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mineral Resources Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a customised view in just a few minutes: Do it your way.

A great starting point for your Mineral Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more actionable investment ideas?

Do not stop at a single opportunity when the market is full of potential. Use the Simply Wall Street Screener now to uncover your next edge.

- Capture powerful turnaround potential by reviewing these 905 undervalued stocks based on cash flows that the market has not fully priced for their cash flow strength.

- Position yourself for the next wave of innovation by scanning these 26 AI penny stocks shaping breakthroughs in automation and intelligent software.

- Lock in reliable portfolio income by targeting these 12 dividend stocks with yields > 3% that combine attractive yields with solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, provides mining services in Australia, Asia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026