- Australia

- /

- Metals and Mining

- /

- ASX:MIN

3 Top ASX Growth Stocks With 16% Insider Ownership

Reviewed by Simply Wall St

The ASX200 has experienced a slight dip, closing down 0.62% at 8,218 points, despite the September quarter marking its best performance since 2013. In this mixed market environment where sectors like Health Care and IT are showing resilience while Materials and Financials face sell-offs, identifying growth companies with significant insider ownership can provide valuable insights into potential long-term opportunities.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 55.8% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's dive into some prime choices out of the screener.

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Liontown Resources Limited (ASX:LTR) is an Australian company focused on the exploration, evaluation, and development of mineral properties, with a market cap of approximately A$1.95 billion.

Operations: Liontown Resources Limited generates its revenue from the exploration, evaluation, and development of mineral properties in Australia.

Insider Ownership: 16.4%

Liontown Resources is trading at 75.3% below its estimated fair value and is expected to become profitable within three years, with earnings forecasted to grow 55.77% annually. Despite a net loss of A$64.92 million for the fiscal year ended June 2024, insider buying has been more prevalent than selling recently. A strategic partnership with LG Energy Solution includes a US$250 million investment and extends their lithium spodumene supply agreement by ten years, highlighting strong growth potential in the global lithium sector.

- Click here to discover the nuances of Liontown Resources with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Liontown Resources is priced lower than what may be justified by its financials.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$10.15 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

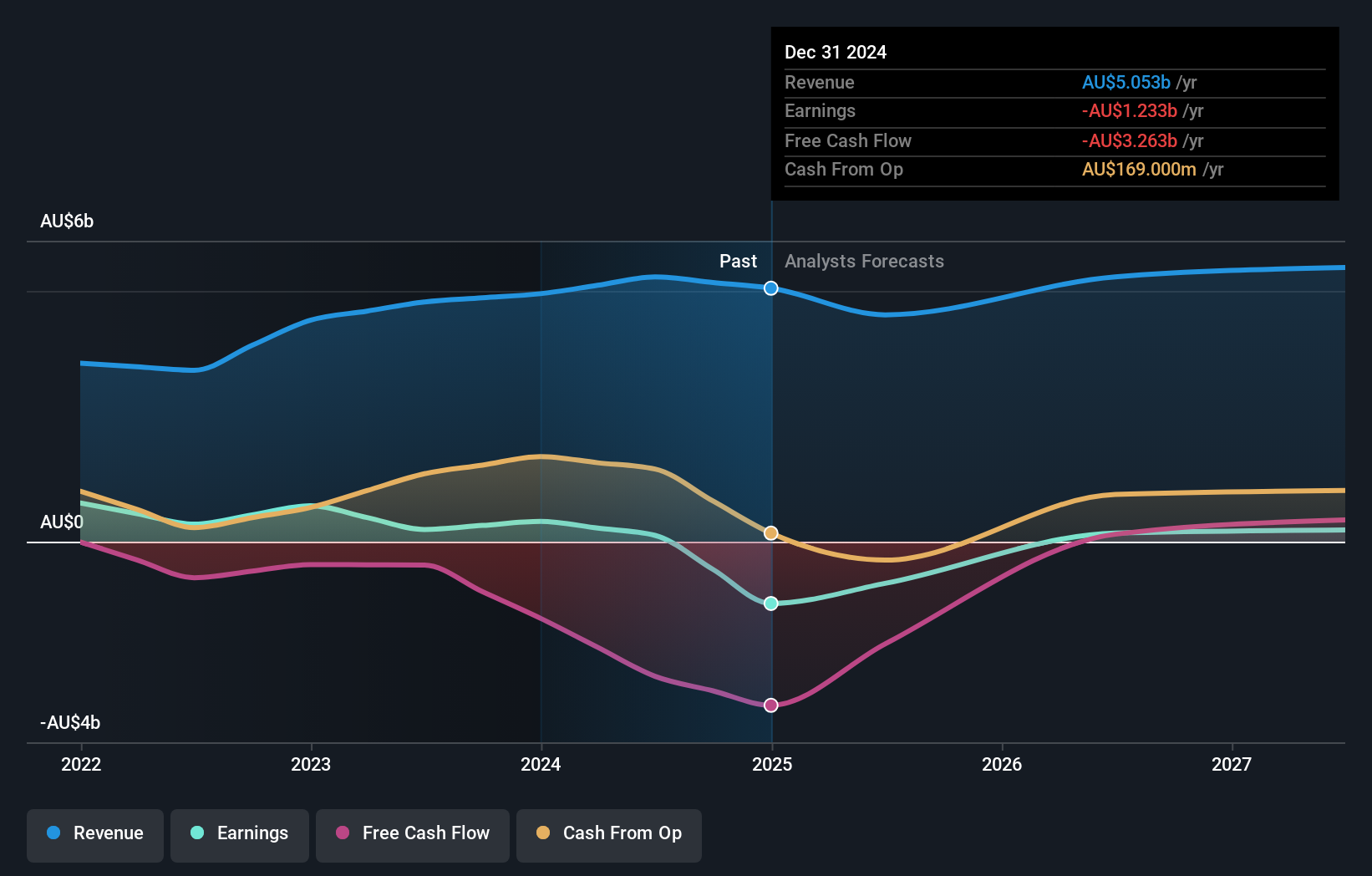

Operations: The company's revenue segments include A$16 million from Energy, A$1.41 billion from Lithium, A$2.58 billion from Iron Ore, A$3.38 billion from Mining Services, and A$19 million from Other Commodities.

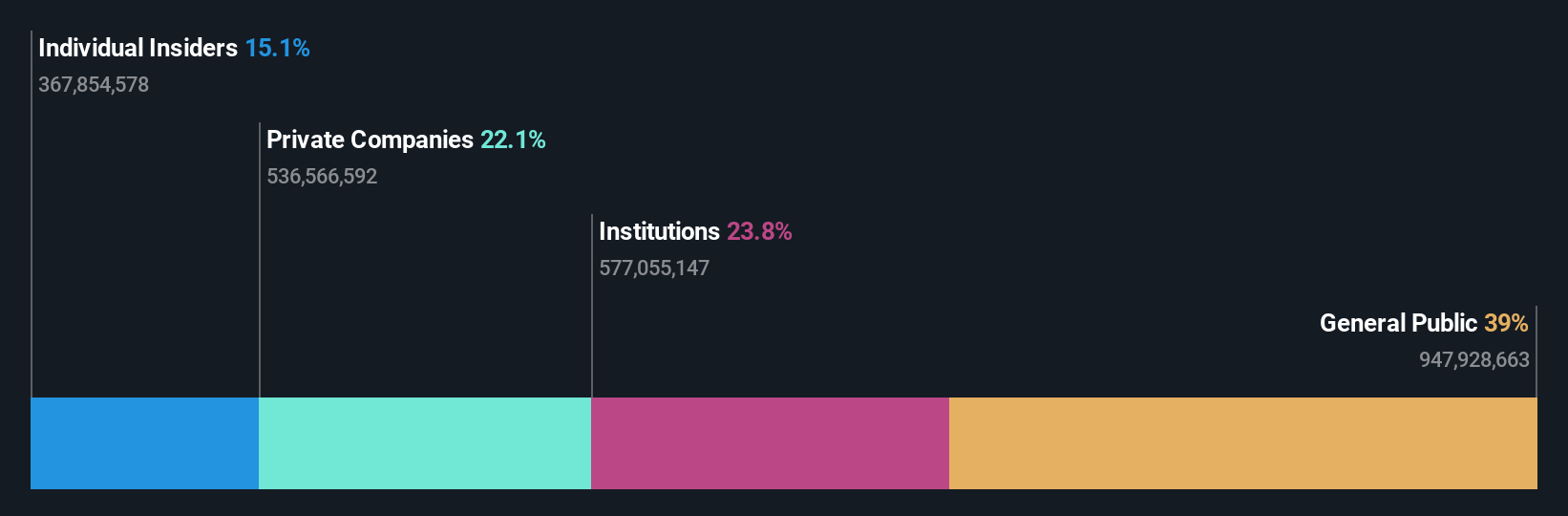

Insider Ownership: 11.7%

Mineral Resources shows strong growth potential with earnings forecasted to grow 38.29% annually, significantly outpacing the Australian market's 12.2%. Despite a decline in profit margins from 5.1% to 2.4% over the past year and net income falling from A$243 million to A$125 million, insider buying has been more prevalent than selling recently. Trading at 46.1% below its estimated fair value, it remains an attractive prospect for growth investors despite some financial challenges like interest coverage issues.

- Click to explore a detailed breakdown of our findings in Mineral Resources' earnings growth report.

- The analysis detailed in our Mineral Resources valuation report hints at an inflated share price compared to its estimated value.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited (ASX:SDR) develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.74 billion.

Operations: Revenue from the Software & Programming segment is A$190.84 million.

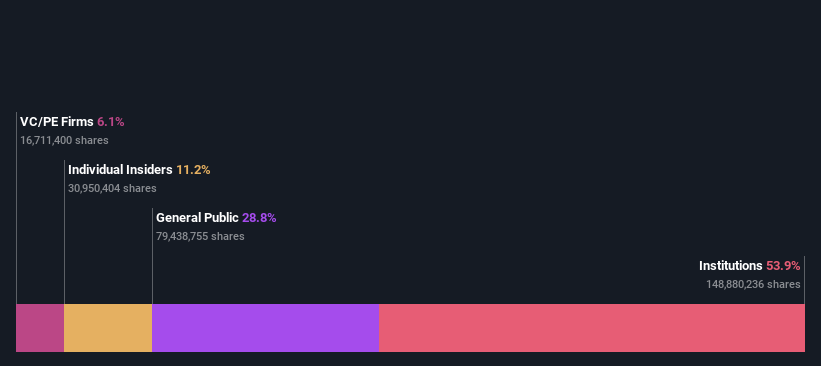

Insider Ownership: 11.2%

SiteMinder has shown substantial growth with earnings increasing 23.5% annually over the past five years and revenue growing to A$190.67 million in 2024 from A$151.38 million a year ago. The company is forecasted to grow earnings by 60.52% per year and become profitable within three years, outpacing market averages. Despite a net loss of A$25.13 million, SiteMinder trades at 14.3% below its estimated fair value, making it an intriguing option for growth-focused investors with high insider ownership considerations.

- Delve into the full analysis future growth report here for a deeper understanding of SiteMinder.

- In light of our recent valuation report, it seems possible that SiteMinder is trading beyond its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 102 Fast Growing ASX Companies With High Insider Ownership selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, operates as a mining services company in Australia, Asia, and internationally.

Reasonable growth potential low.