Discovering Opportunities: 3 ASX Penny Stocks With Market Caps Under A$200M

Reviewed by Simply Wall St

In the last week, the Australian market has been flat, but it is up 20% over the past year with earnings forecast to grow by 12% annually. For investors looking beyond established giants, penny stocks—often smaller or newer companies—can present unique opportunities when backed by solid financials. Despite being an older term, these stocks remain relevant today as they can offer a blend of value and growth potential that larger firms might not provide.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.615 | A$72.09M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.85 | A$102.34M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.79 | A$288.33M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.655 | A$811.08M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.81 | A$2.06B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$61M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.465 | A$91.13M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.07 | A$120.05M | ★★★★★★ |

Click here to see the full list of 1,030 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Pancontinental Energy (ASX:PCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pancontinental Energy NL is involved in the exploration of oil and gas properties across Australia, Namibia, and Kenya, with a market cap of A$121.97 million.

Operations: The company has not reported any revenue segments.

Market Cap: A$121.97M

Pancontinental Energy NL, with a market cap of A$121.97 million, is pre-revenue and unprofitable, reporting a net loss of A$2.34 million for the year ended June 30, 2024. Despite these challenges, the company benefits from an experienced board with an average tenure of 15.8 years and has not diluted shareholders recently. It maintains a stable cash runway exceeding one year and holds no debt, having reduced its liabilities over time. Additionally, Pancontinental's inclusion in the S&P/ASX Emerging Companies Index highlights its potential visibility among investors despite current financial hurdles.

- Click here to discover the nuances of Pancontinental Energy with our detailed analytical financial health report.

- Gain insights into Pancontinental Energy's historical outcomes by reviewing our past performance report.

PPK Group (ASX:PPK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PPK Group Limited, along with its subsidiaries, operates in the fields of nanomaterials, artificial intelligence, and energy solutions mainly in Australia, with a market cap of A$42.56 million.

Operations: PPK Group's revenue is primarily derived from its Energy Storage segment, which generated A$27.47 million, and its Technology - Subsidiary Companies segment, contributing A$0.01 million.

Market Cap: A$42.56M

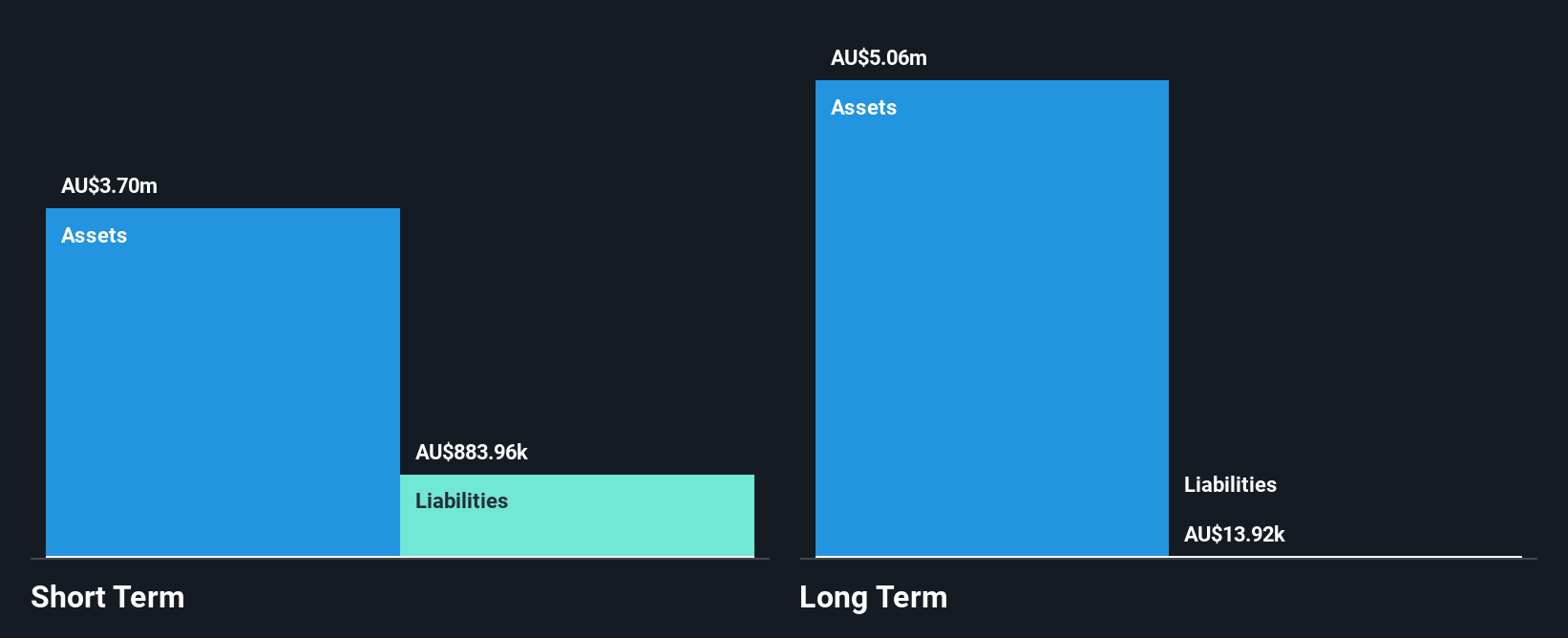

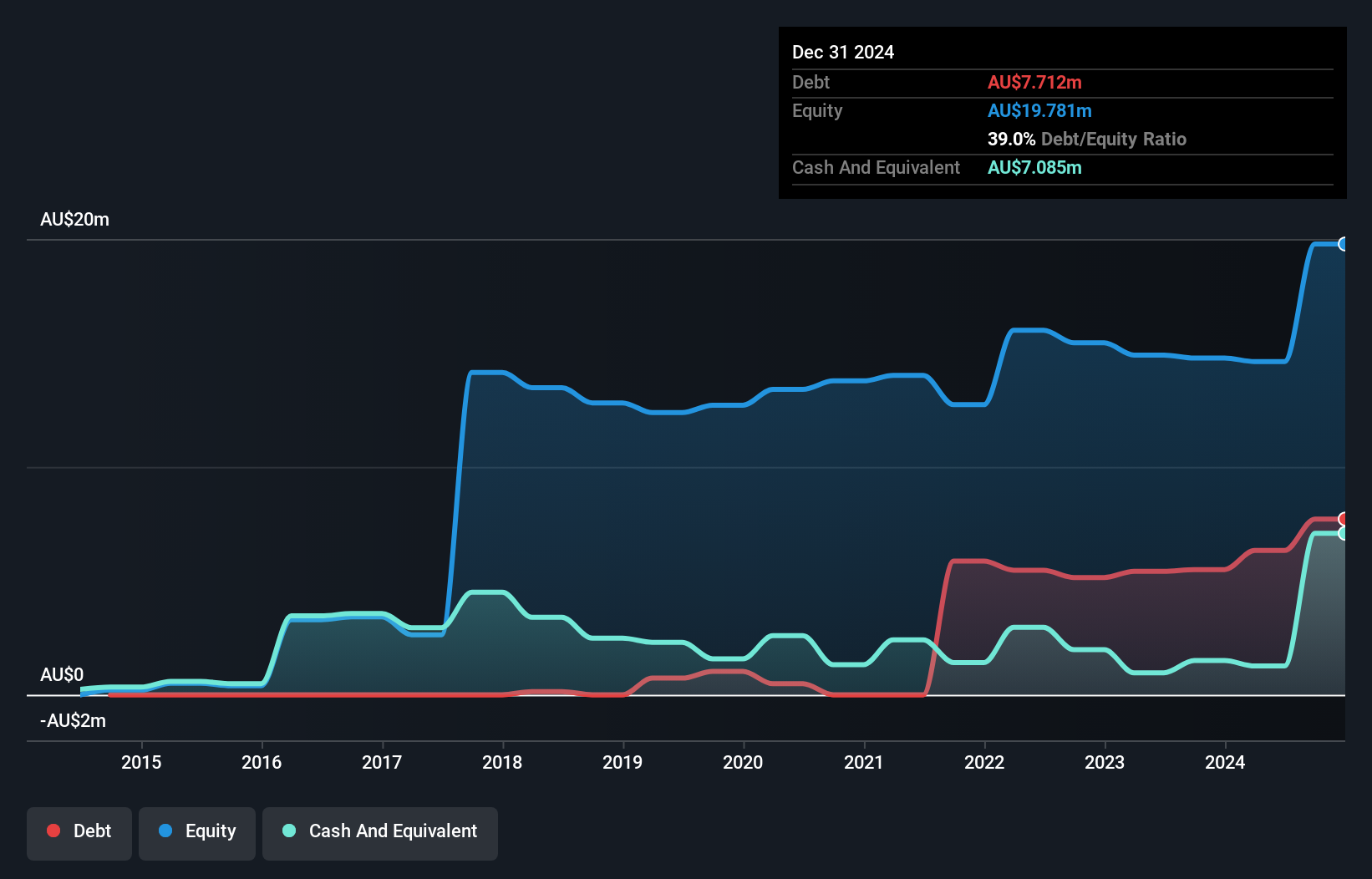

PPK Group, with a market cap of A$42.56 million, is unprofitable and reported a net loss of A$10.74 million for the year ended June 30, 2024. Despite this, PPK's short-term assets significantly exceed both its short- and long-term liabilities, indicating strong liquidity. The company has not diluted shareholders over the past year and holds more cash than debt. However, it faces challenges with less than one year of cash runway if current free cash flow trends persist and an inexperienced management team averaging 1.9 years in tenure contributes to operational uncertainty amidst high share price volatility recently observed.

- Dive into the specifics of PPK Group here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into PPK Group's track record.

Structural Monitoring Systems (ASX:SMN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Structural Monitoring Systems Plc designs, develops, manufactures, and sells structural health monitoring systems for the aviation industry across multiple regions including Australia, the UK, Europe, Asia, and more; it has a market cap of A$89.28 million.

Operations: The company's revenue is derived from three segments: AEM CVM generating A$0.13 million, AEM Avionics contributing A$11.13 million, and AEM Contract Manufacturing accounting for A$16.69 million.

Market Cap: A$89.28M

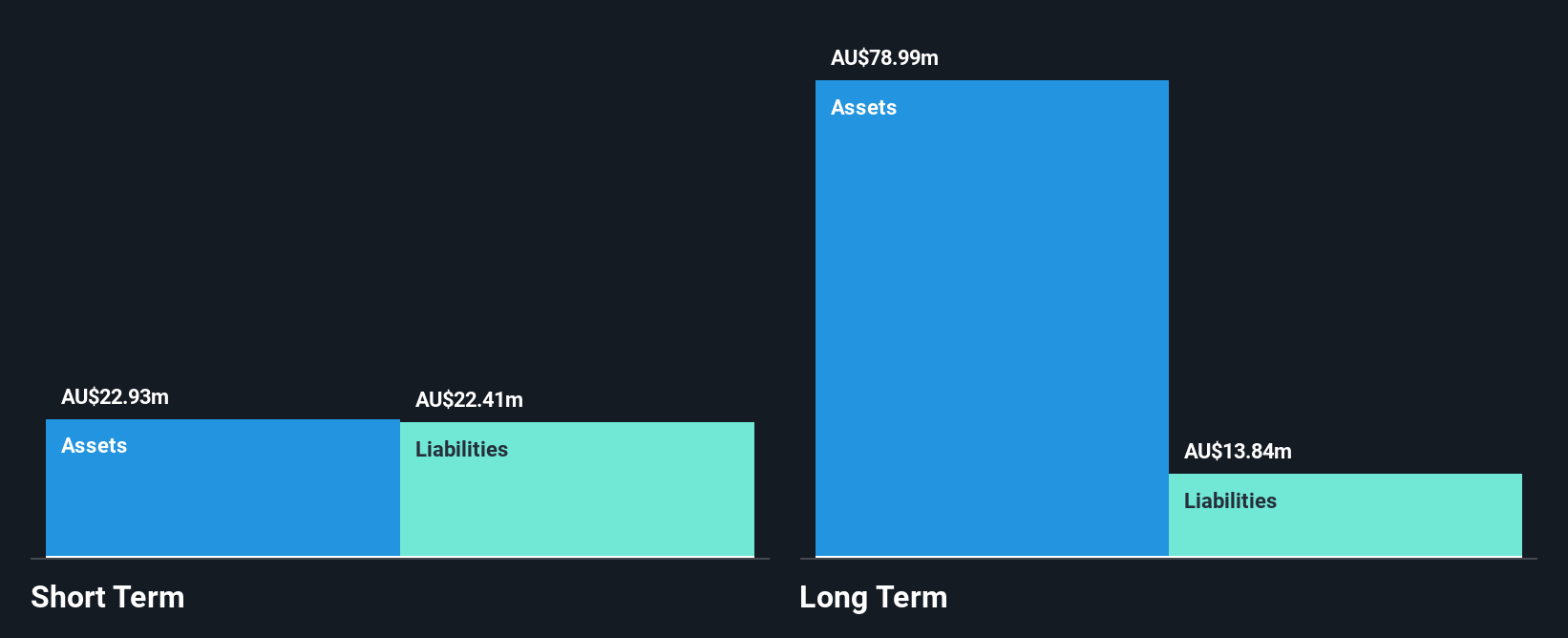

Structural Monitoring Systems, with a market cap of A$89.28 million, has shown revenue growth, reporting A$27.95 million for the year ending June 30, 2024. Despite being unprofitable with a net loss of A$1.04 million, it maintains strong liquidity as short-term assets exceed liabilities and has a satisfactory net debt to equity ratio at 34.7%. The company benefits from an experienced management team but faces challenges due to shareholder dilution and increasing debt levels over five years. Recent executive changes include the resignation of non-executive director Miro Miletic due to other commitments.

- Jump into the full analysis health report here for a deeper understanding of Structural Monitoring Systems.

- Explore Structural Monitoring Systems' analyst forecasts in our growth report.

Taking Advantage

- Embark on your investment journey to our 1,030 ASX Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPK

PPK Group

Provides nanomaterials, artificial intelligence, and energy solutions primarily in Australia.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion