- Australia

- /

- Metals and Mining

- /

- ASX:LTR

3 ASX Growth Stocks With Insider Ownership Up To 16%

Reviewed by Simply Wall St

The Australian market remained flat over the last week, but it has risen 16% over the past 12 months with earnings expected to grow by 12% per annum in the coming years. In this context, identifying growth companies with high insider ownership can be a promising strategy, as it often indicates confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 55.8% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's uncover some gems from our specialized screener.

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Liontown Resources Limited, with a market cap of A$1.95 billion, focuses on the exploration, evaluation, and development of mineral properties in Australia.

Operations: Revenue Segments (in millions of A$): null

Insider Ownership: 16.4%

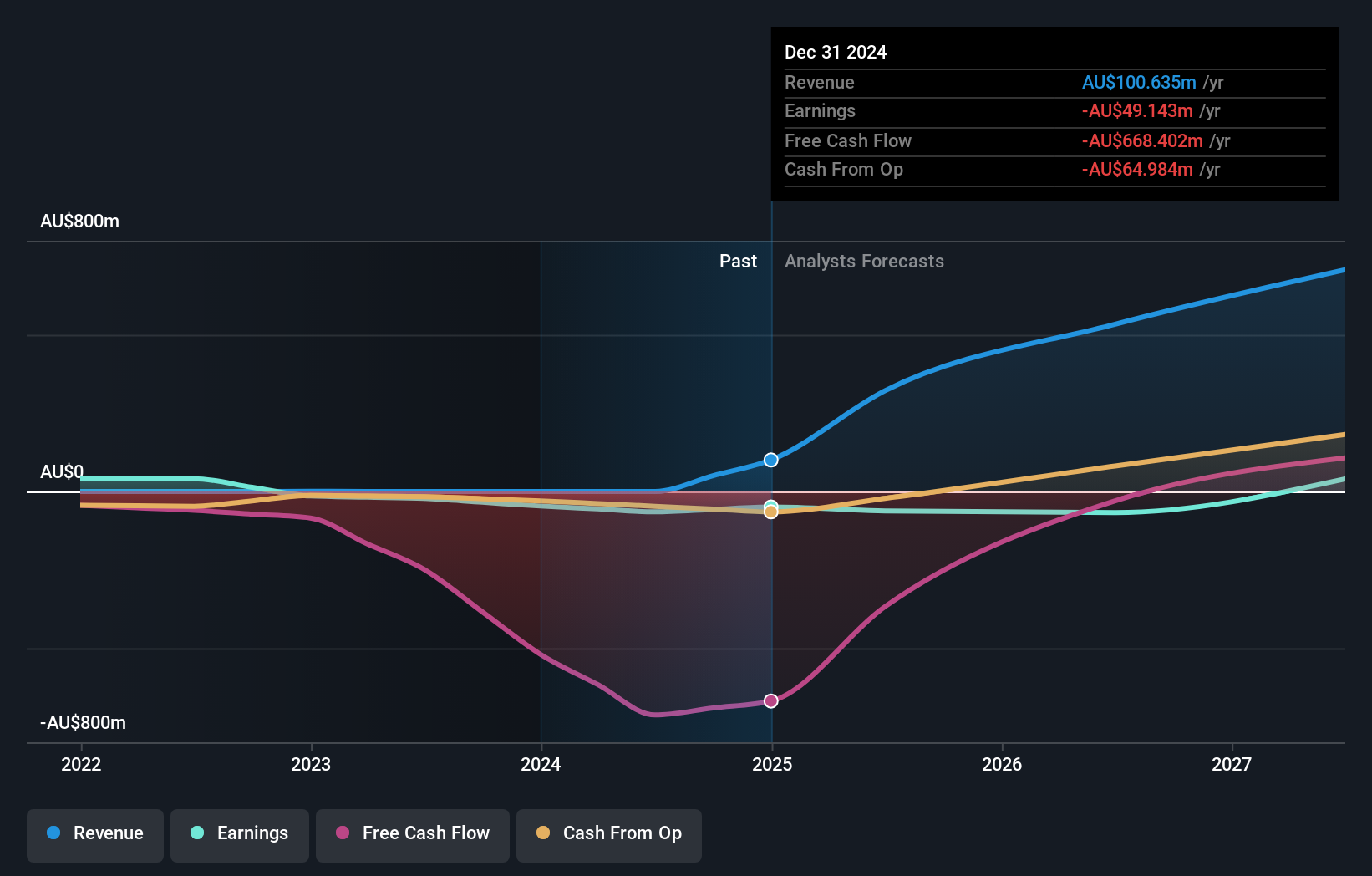

Liontown Resources, a growth company with high insider ownership, recently appointed Ian Wells as Lead Independent Director, enhancing corporate governance. Despite reporting a net loss of A$64.92 million for FY2024, the company forecasts significant revenue growth at 39.2% annually and expects to become profitable within three years. Their strategic partnership with LG Energy Solution includes a US$250 million investment and extended offtake agreements, bolstering long-term value creation from their Kathleen Valley lithium project.

- Get an in-depth perspective on Liontown Resources' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Liontown Resources shares in the market.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$10.15 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: The company's revenue segments include A$16 million from Energy, A$1.41 billion from Lithium, A$2.58 billion from Iron Ore, and A$3.38 billion from Mining Services, along with A$19 million from Other Commodities.

Insider Ownership: 11.7%

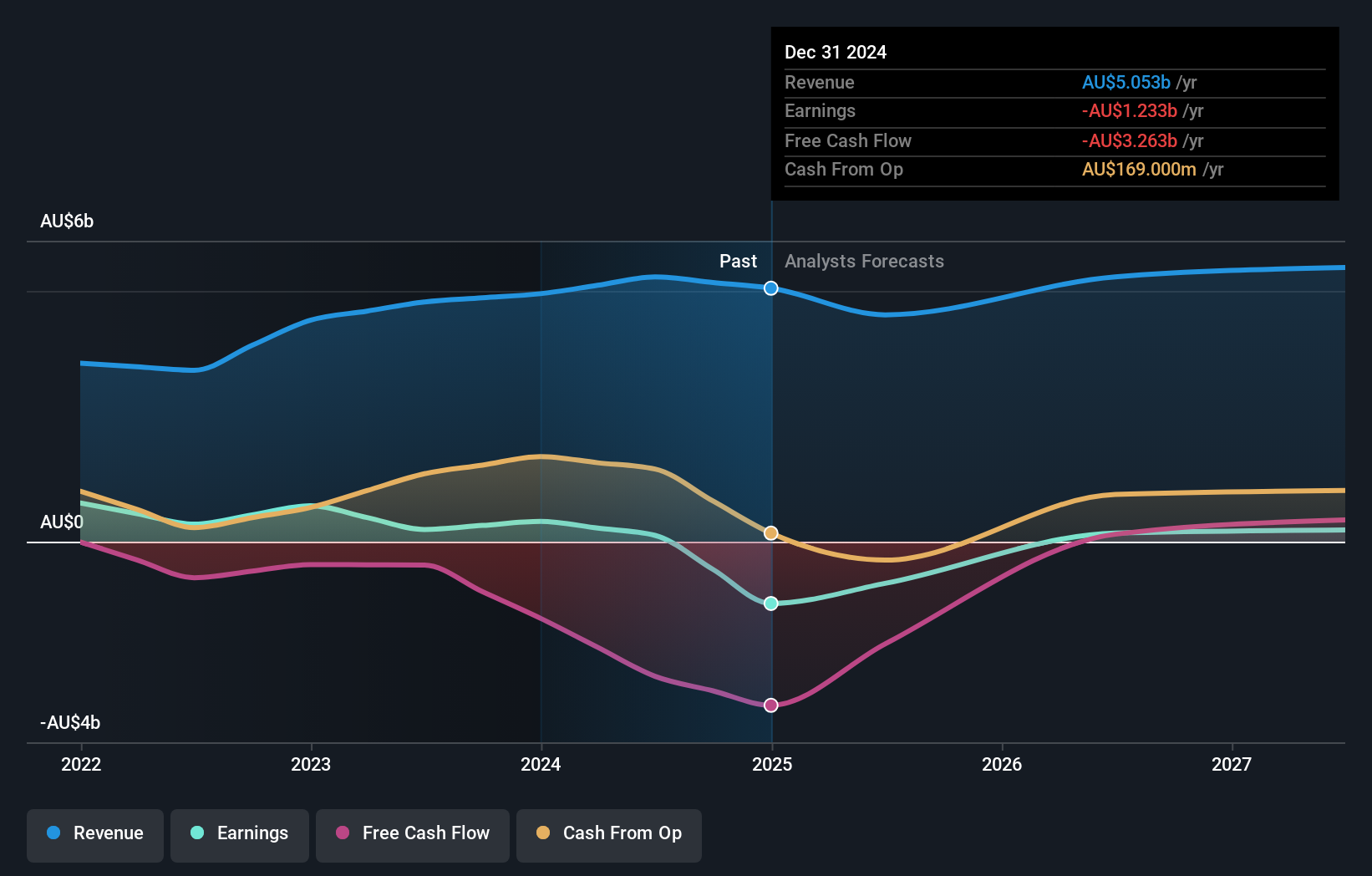

Mineral Resources reported A$5.28 billion in sales for FY2024, up from A$4.78 billion last year, though net income dropped to A$125 million from A$243 million. Earnings are forecast to grow 38.29% annually over the next three years, outpacing the broader Australian market's growth rate of 12.2%. Insiders have been buying shares recently, indicating confidence in future prospects despite lower profit margins and earnings per share compared to last year.

- Delve into the full analysis future growth report here for a deeper understanding of Mineral Resources.

- Upon reviewing our latest valuation report, Mineral Resources' share price might be too optimistic.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited (ASX:SDR) develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.74 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated A$190.84 million.

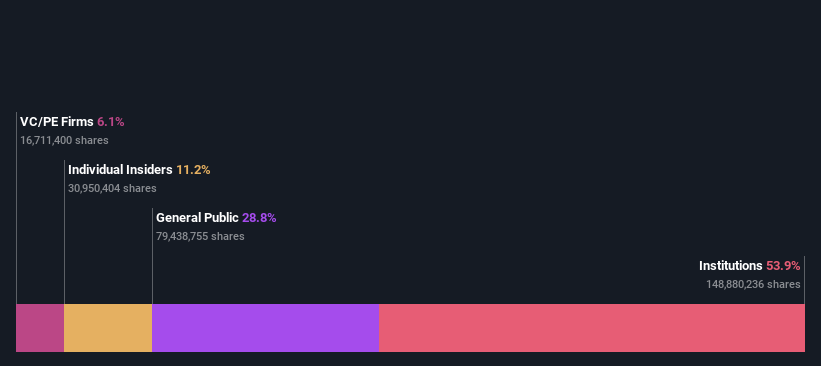

Insider Ownership: 11.2%

SiteMinder reported A$190.67 million in sales for FY2024, up from A$151.38 million last year, and reduced its net loss to A$25.13 million from A$49.3 million. Earnings are forecast to grow 60.52% annually, with revenue growth outpacing the broader Australian market at 19.4% per year. The company is expected to become profitable within three years and currently trades at 14.2% below its fair value estimate, indicating potential undervaluation despite no recent insider trading activity.

- Take a closer look at SiteMinder's potential here in our earnings growth report.

- Our valuation report here indicates SiteMinder may be overvalued.

Where To Now?

- Reveal the 102 hidden gems among our Fast Growing ASX Companies With High Insider Ownership screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

Exceptional growth potential with adequate balance sheet.