- Australia

- /

- Metals and Mining

- /

- ASX:MGX

IPD Group And 2 Other ASX Penny Stocks To Consider

Reviewed by Simply Wall St

The Australian market is facing a potential decline, influenced by the rising gold prices and weaker-than-expected jobs data, which could keep the indices within the 9,000 range. Amid these conditions, investors often look for opportunities that balance risk and reward, making penny stocks an intriguing option. Although considered a vintage term, penny stocks can still offer significant value when backed by robust financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.44 | A$126.1M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.66 | A$125.48M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.905 | A$56.35M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$410.95M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.32 | A$245.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.041 | A$47.96M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$38.45M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.83 | A$396.5M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 424 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

IPD Group (ASX:IPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IPD Group Limited is an Australian company that distributes electrical infrastructure, with a market cap of A$375.94 million.

Operations: The company's revenue is primarily derived from its Products Division, which generated A$334.53 million, complemented by A$20.16 million from its Services Division.

Market Cap: A$375.94M

IPD Group Limited, with a market cap of A$375.94 million, presents both opportunities and challenges for investors interested in penny stocks. The company has demonstrated significant revenue growth, reporting A$354.68 million in sales for the year ending June 30, 2025. Despite its low Return on Equity at 16%, IPD's short-term assets comfortably exceed liabilities, and its debt is well covered by operating cash flow. Recent executive changes may impact strategic development but are unlikely to affect day-to-day operations significantly. The stock trades below estimated fair value and analyst price targets suggest potential upside movement.

- Navigate through the intricacies of IPD Group with our comprehensive balance sheet health report here.

- Learn about IPD Group's future growth trajectory here.

Mount Gibson Iron (ASX:MGX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mount Gibson Iron Limited, with a market cap of A$554.80 million, is involved in the mining, processing, shipment, export, and sale of hematite iron ore primarily in Australia and China.

Operations: Mount Gibson Iron's revenue is primarily derived from its Koolan Island operations, generating A$330.53 million.

Market Cap: A$554.8M

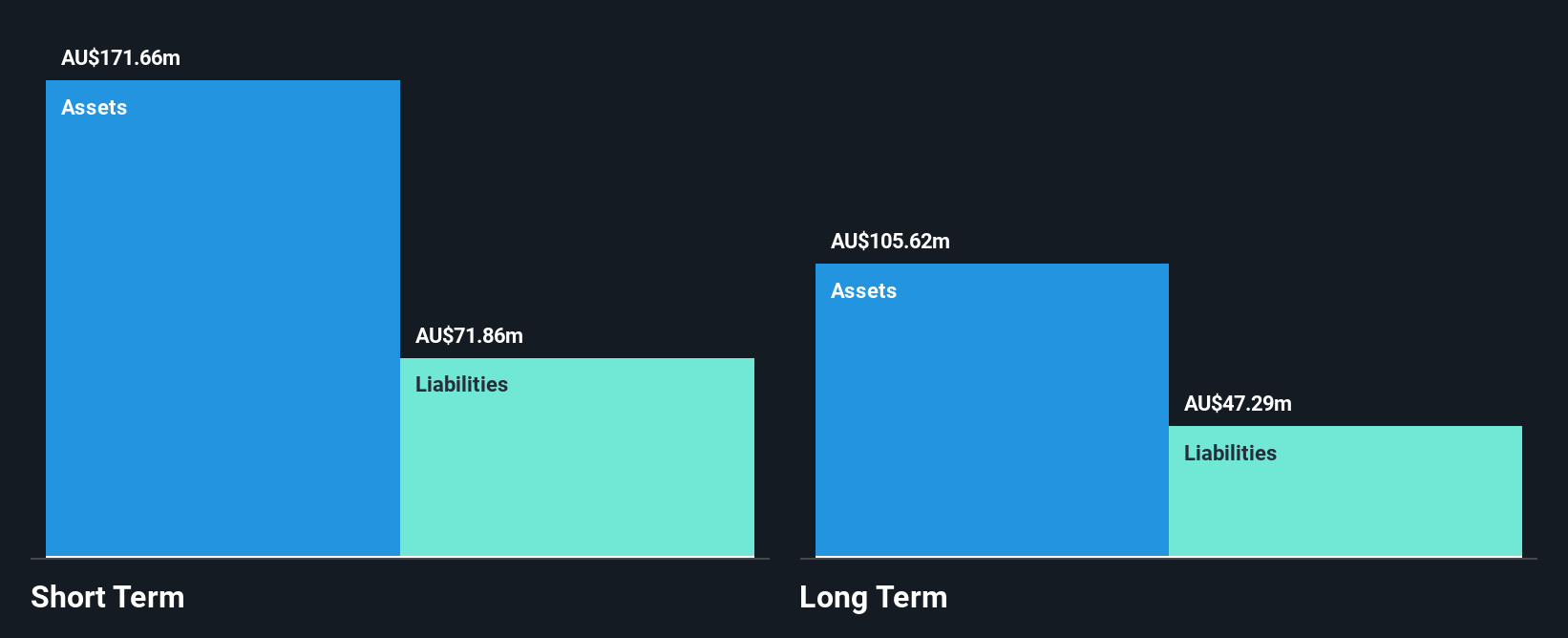

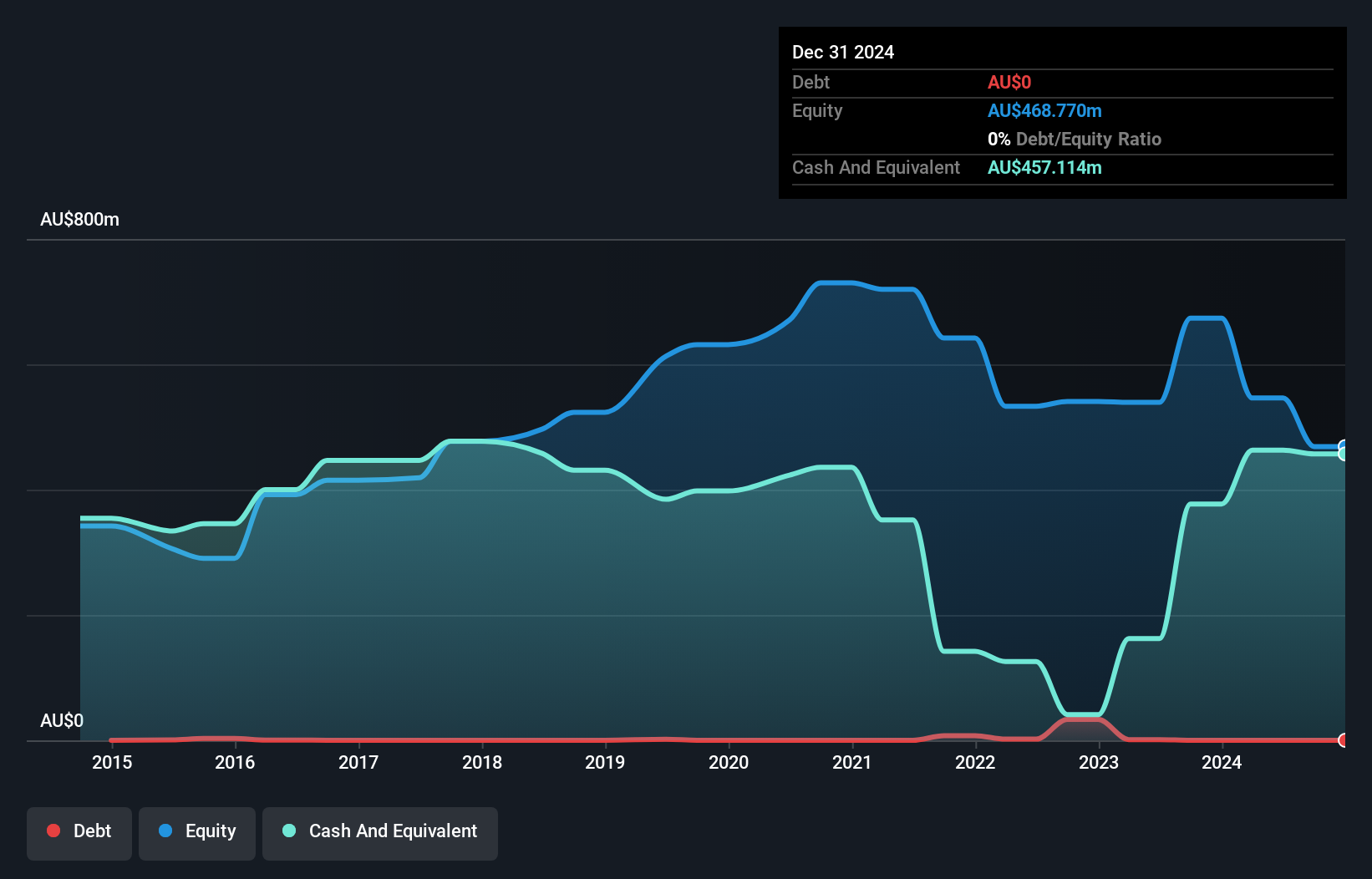

Mount Gibson Iron Limited, with a market cap of A$554.80 million, presents a complex picture for penny stock investors. Despite being unprofitable, the company maintains a strong cash position with sufficient runway for over three years due to positive free cash flow. Recent financials show a decline in revenue and an increased net loss of A$82.19 million for the year ended June 30, 2025. The company has initiated a share buyback program aiming to repurchase up to 10% of its issued share capital by September 2026, signaling confidence in its long-term value despite current challenges.

- Unlock comprehensive insights into our analysis of Mount Gibson Iron stock in this financial health report.

- Gain insights into Mount Gibson Iron's historical outcomes by reviewing our past performance report.

MotorCycle Holdings (ASX:MTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MotorCycle Holdings Limited owns and operates motorcycle dealerships in Australia, with a market capitalization of A$245.04 million.

Operations: The company generates revenue primarily from Motorcycle Retailing, which accounts for A$454.38 million, and Motorcycle and Accessories Wholesaling, contributing A$243.54 million.

Market Cap: A$245.04M

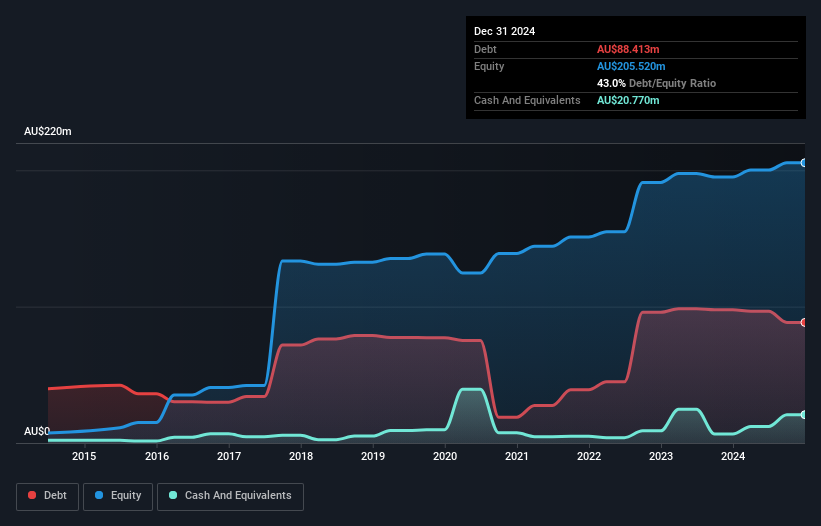

MotorCycle Holdings Limited, with a market cap of A$245.04 million, shows both strengths and challenges for penny stock investors. Recent financial results demonstrate revenue growth to A$649.99 million and an increase in net income to A$18.02 million for the year ended June 30, 2025. The company’s short-term assets exceed liabilities, indicating solid liquidity management, while its debt level is well covered by operating cash flow. Despite a low return on equity and unstable dividend history, earnings growth outpaces industry averages significantly at 27.5%. The recent addition to the S&P/ASX All Ordinaries Index reflects positive market sentiment amidst executive board changes.

- Click here to discover the nuances of MotorCycle Holdings with our detailed analytical financial health report.

- Explore MotorCycle Holdings' analyst forecasts in our growth report.

Seize The Opportunity

- Investigate our full lineup of 424 ASX Penny Stocks right here.

- Ready For A Different Approach? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MGX

Mount Gibson Iron

Engages in the mining, processing, shipment, export, and sale of hematite iron ore in Australia and China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives