- Australia

- /

- Healthtech

- /

- ASX:CGS

Spotlight On 3 ASX Penny Stocks With Market Caps Over A$10M

Reviewed by Simply Wall St

The Australian stock market has shown resilience with the ASX200 rising by 1% to 8,491 points, as easing tariff concerns and a stronger Aussie dollar support investor sentiment. In such a climate, identifying stocks that combine affordability with growth potential is key. While the term "penny stocks" might seem outdated, these smaller or newer companies can still offer intriguing opportunities for investors seeking value beyond the mainstream market leaders.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.505 | A$313.17M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$2.02 | A$328.89M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.5425 | A$106.53M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$248.73M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.18 | A$337.66M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$243.19M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.315 | A$62.65M | ★★★★★☆ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cogstate (ASX:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience technology company focused on developing and commercializing digital brain health assessments for academic and industry-sponsored research, with a market cap of A$202.16 million.

Operations: The company's revenue is derived from two main segments: Healthcare (including Sport) generating $3.99 million and Clinical Trials (including Precision Recruitment Tool & Research) contributing $39.44 million.

Market Cap: A$202.16M

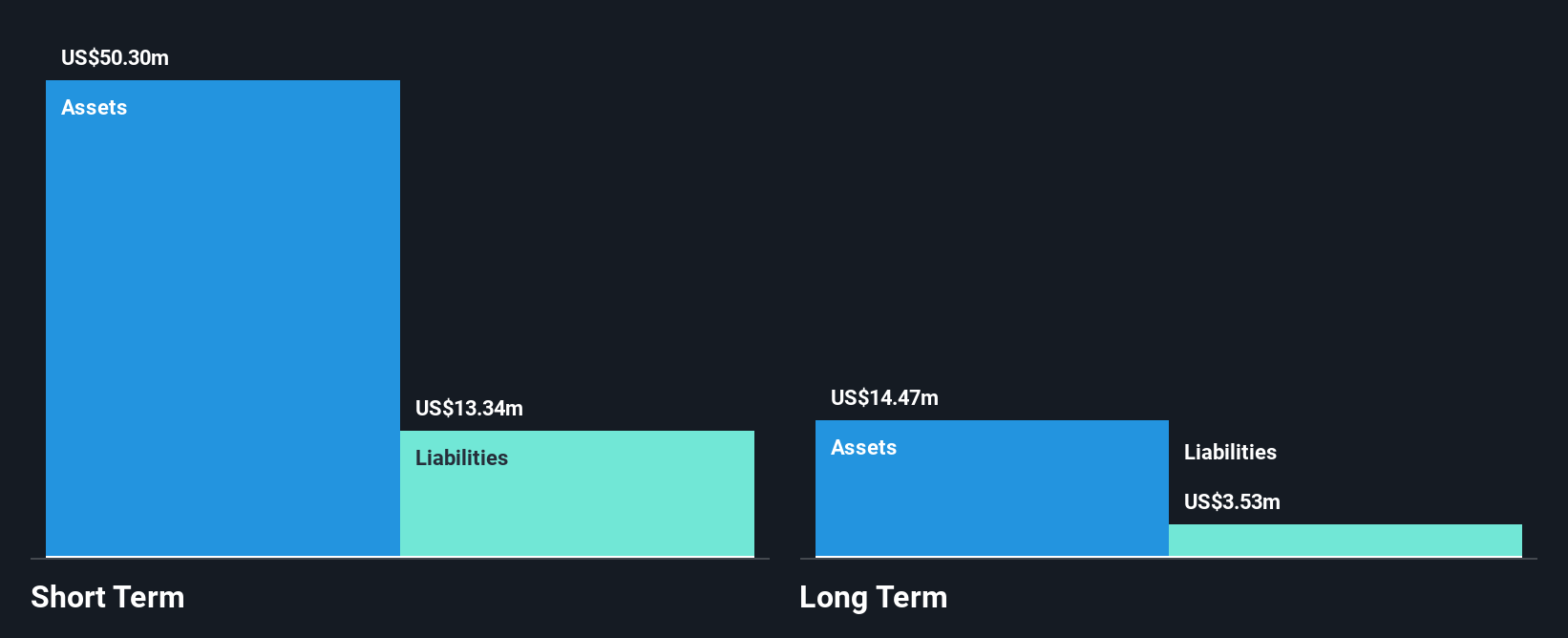

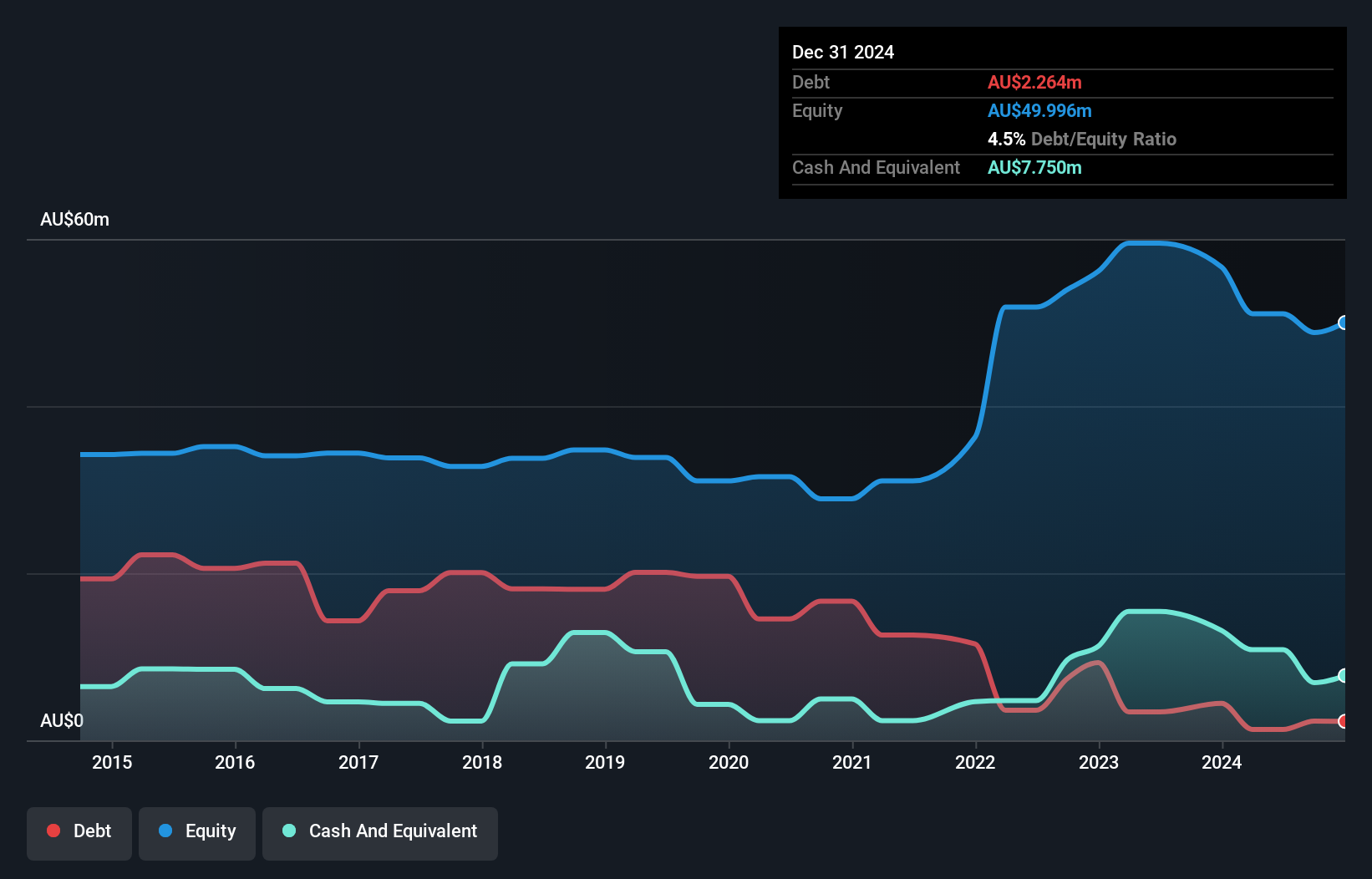

Cogstate Limited, with a market cap of A$202.16 million, has shown robust financial health and growth potential in the penny stock segment. The company reported significant earnings growth of 52.8% over the past year, surpassing its five-year average of 41.9% annually, and maintains high-quality earnings with a net profit margin improvement to 12.5%. Its short-term assets exceed both short-term and long-term liabilities significantly, indicating strong liquidity management. Cogstate's debt level is minimal compared to its cash reserves, ensuring interest payments are well-covered by EBIT (120.5x coverage), reflecting sound financial stability for investors considering penny stocks in Australia.

- Dive into the specifics of Cogstate here with our thorough balance sheet health report.

- Understand Cogstate's earnings outlook by examining our growth report.

Magontec (ASX:MGL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Magontec Limited researches, develops, manufactures, and sells generic and specialist magnesium alloys across Europe, China, North America, and internationally with a market cap of A$19.91 million.

Operations: Magontec Limited has not reported any specific revenue segments.

Market Cap: A$19.91M

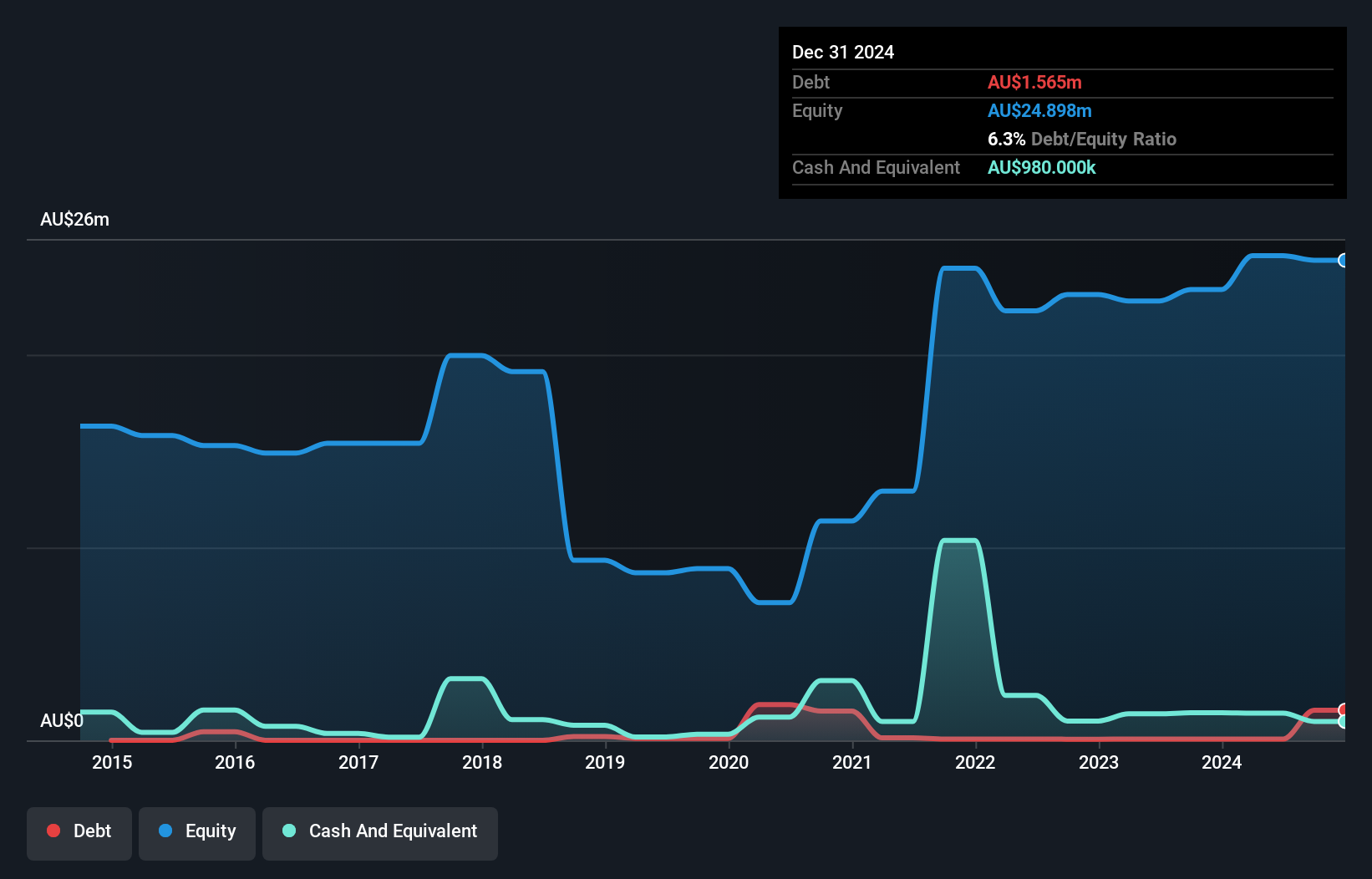

Magontec Limited, with a market cap of A$19.91 million, operates in the magnesium alloys sector and is currently unprofitable but has reduced losses by 5.3% annually over five years. Despite high volatility, its short-term assets of A$49.9 million comfortably cover both short-term (A$8.3 million) and long-term liabilities (A$10.4 million). The company benefits from an experienced management team with an average tenure of 8.9 years and a seasoned board averaging 11.6 years, which may provide stability amid share price fluctuations common in penny stocks. Recent shareholder meetings focused on strategic agreements could impact future operations positively or negatively depending on outcomes.

- Unlock comprehensive insights into our analysis of Magontec stock in this financial health report.

- Examine Magontec's earnings growth report to understand how analysts expect it to perform.

West Wits Mining (ASX:WWI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: West Wits Mining Limited is involved in the exploration, development, and production of mineral properties in South Africa and Australia with a market cap of A$45.77 million.

Operations: The company's revenue is derived solely from its Mining & Exploration segment, amounting to A$0.03 million.

Market Cap: A$45.77M

West Wits Mining Limited, with a market cap of A$45.77 million, is currently pre-revenue and unprofitable, with losses increasing by 26% annually over the past five years. Despite this, the company has managed to reduce its debt-to-equity ratio from 1.2% to 0.2%, and its cash reserves exceed total debt levels. The management team and board are experienced, averaging tenures of 3.4 and 4.8 years respectively, which may provide some stability amid high share price volatility observed recently. Short-term assets (A$1.5M) fall short of covering short-term liabilities (A$2.4M), indicating potential liquidity challenges ahead.

- Navigate through the intricacies of West Wits Mining with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into West Wits Mining's track record.

Where To Now?

- Explore the 1,031 names from our ASX Penny Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CGS

Cogstate

A neuroscience technology company, engages in the creation, validation, and commercialization of digital brain health assessments used in both academic and industry sponsored research.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives