Magontec Limited's (ASX:MGL) investors are due to receive a payment of A$0.006 per share on 30th of April. This means the annual payment will be 3.2% of the current stock price, which is lower than the industry average.

Check out our latest analysis for Magontec

Magontec's Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, prior to this announcement, Magontec's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

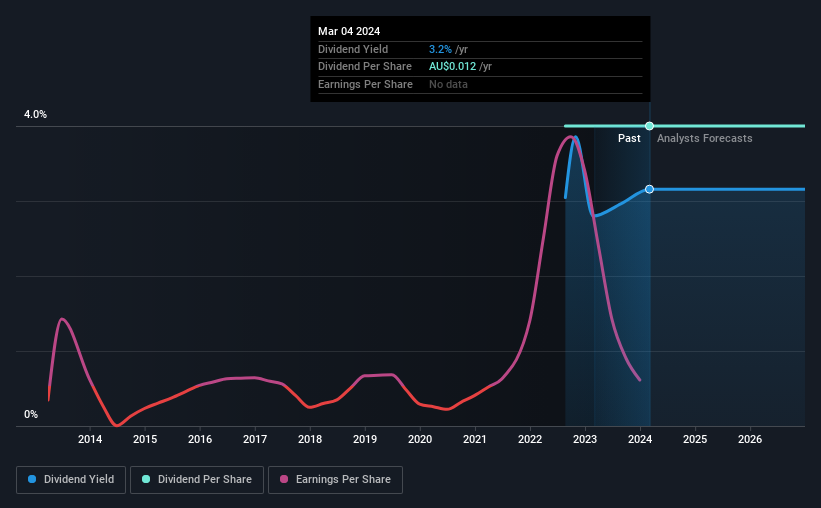

Looking forward, earnings per share is forecast to rise exponentially over the next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 15%, which makes us pretty comfortable with the sustainability of the dividend.

Magontec Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The most recent annual payment of A$0.012 is about the same as the annual payment 2 years ago. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Earnings per share has been sinking by 10% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Magontec's payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 5 warning signs for Magontec that investors need to be conscious of moving forward. Is Magontec not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MGL

Magontec

Researches, develops, manufactures, and sells generic and specialist magnesium alloys in Australia, Europe, China, North America, and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026