- Australia

- /

- Metals and Mining

- /

- ASX:MEK

Meeka Metals (ASX:MEK) Valuation: Assessing Prospects After Latest Full-Year Earnings Loss

Reviewed by Kshitija Bhandaru

Meeka Metals (ASX:MEK) just released its full-year earnings, showing a net loss of AUD 4.24 million for the year ended June 2025, up from AUD 2.94 million the prior year. The latest financials could spark fresh conversations about the company’s operational progress and market prospects.

See our latest analysis for Meeka Metals.

While Meeka Metals reported a wider annual loss, the share price has rallied significantly, with a 48% gain over the past three months and an eye-catching 138% rise year-to-date. The company’s 1-year total shareholder return of 233% reflects building momentum and renewed investor optimism amid recent operational updates.

If moves like this have you rethinking your strategy, now is a perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

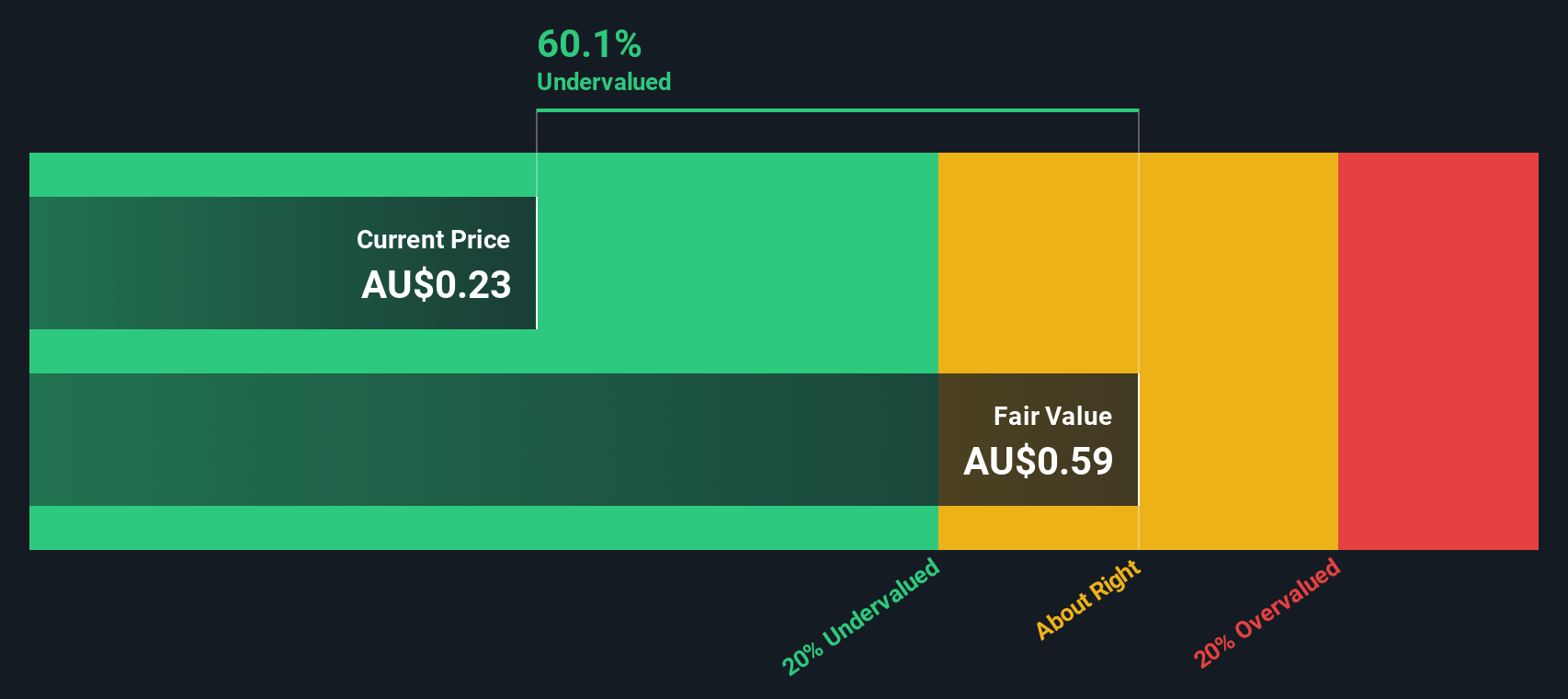

With shares rocketing higher despite widening losses, the big question now is whether Meeka Metals remains undervalued and offers more upside, or if the market has already priced in its future growth potential.

Price-to-Book Ratio of 3.9x: Is it justified?

Meeka Metals is currently trading at a price-to-book ratio of 3.9x, which places its shares below the peer group average of 4.5x and above the industry average of 2.2x.

The price-to-book ratio compares a company’s share price to its net assets and is a common gauge for metals and mining companies since earnings are often unpredictable. For Meeka, this multiple suggests the market is attaching a premium to its assets relative to many industry peers, signaling investor confidence in its future growth prospects.

However, when compared to other companies in the Australian Metals and Mining sector, Meeka appears relatively expensive, with investors currently paying more for each dollar of book value. This divergence may reflect the company’s ambitious revenue forecasts and recent momentum, which could justify a higher valuation. If a fair ratio were available, it would offer an additional reference point for whether the current premium is sustainable.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 3.9x (ABOUT RIGHT)

However, sustained losses and a sharp price surge could mean that any operational setbacks or missed forecasts might prompt a swift reversal in sentiment.

Find out about the key risks to this Meeka Metals narrative.

Another View: SWS DCF Model Paints a Different Picture

Contrasting the price-to-book valuation, our DCF model takes a deeper dive into Meeka Metals’ cash flow prospects. The SWS DCF model suggests shares are trading at a 65.8% discount to fair value. This signals significant upside, but does it capture the right long-term assumptions about future profits?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Meeka Metals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Meeka Metals Narrative

If you'd like to challenge these findings or take a hands-on approach, creating your personal research narrative is quick and straightforward. Do it your way

A great starting point for your Meeka Metals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines while others act. Unlock top opportunities that could shape your portfolio for the better using our handpicked lists below.

- Turbocharge your returns with these 898 undervalued stocks based on cash flows, which are priced below their true worth for those hunting bargains before the market catches on.

- Tap into steady cash flow and attractive yields by checking out these 19 dividend stocks with yields > 3%, offering strong payouts for income-focused investors.

- Capitalize on rapid advancements in medical technology with these 33 healthcare AI stocks, transforming the future of healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MEK

Meeka Metals

Engages in the exploration and development of gold properties in Western Australia.

Exceptional growth potential and fair value.

Market Insights

Community Narratives