- Australia

- /

- Metals and Mining

- /

- ASX:MEI

Does Meteoric Resources' (ASX:MEI) Licensing Delay Clarify or Complicate Its Brazilian Rare Earths Story?

Reviewed by Sasha Jovanovic

- Meteoric Resources has reported that its preliminary environmental licence vote for the Caldeira Rare Earth Project in Brazil was postponed after the state regulator requested more time to address questions from the Federal Public Prosecutor’s Office.

- The company highlighted that it has already submitted extensive technical studies and an Environmental Impact Assessment, arguing these materials should be sufficient to answer the prosecutor’s concerns and keep the project’s permitting sequence largely on track.

- We’ll now examine how this short-term permitting delay, and Meteoric’s confidence in its existing environmental studies, shapes the company’s investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Meteoric Resources' Investment Narrative?

To own Meteoric Resources today, you really have to believe that the Caldeira rare earth project will progress through permitting and eventually justify a company that currently has almost no revenue, recurring losses of about A$36.5 million, a very high price to book and a going concern flag from its auditor. The latest news on the preliminary environmental licence looks like a timing setback rather than a reset of the story, with the regulator simply asking for more time to address questions from the Federal Public Prosecutor’s Office. The sharp pullback in the share price over the past month suggests the market is wary of any slippage in approvals, especially when Meteoric is reliant on fresh equity and the project remains pre revenue. For now, the key near term catalyst still sits with that upcoming licence vote.

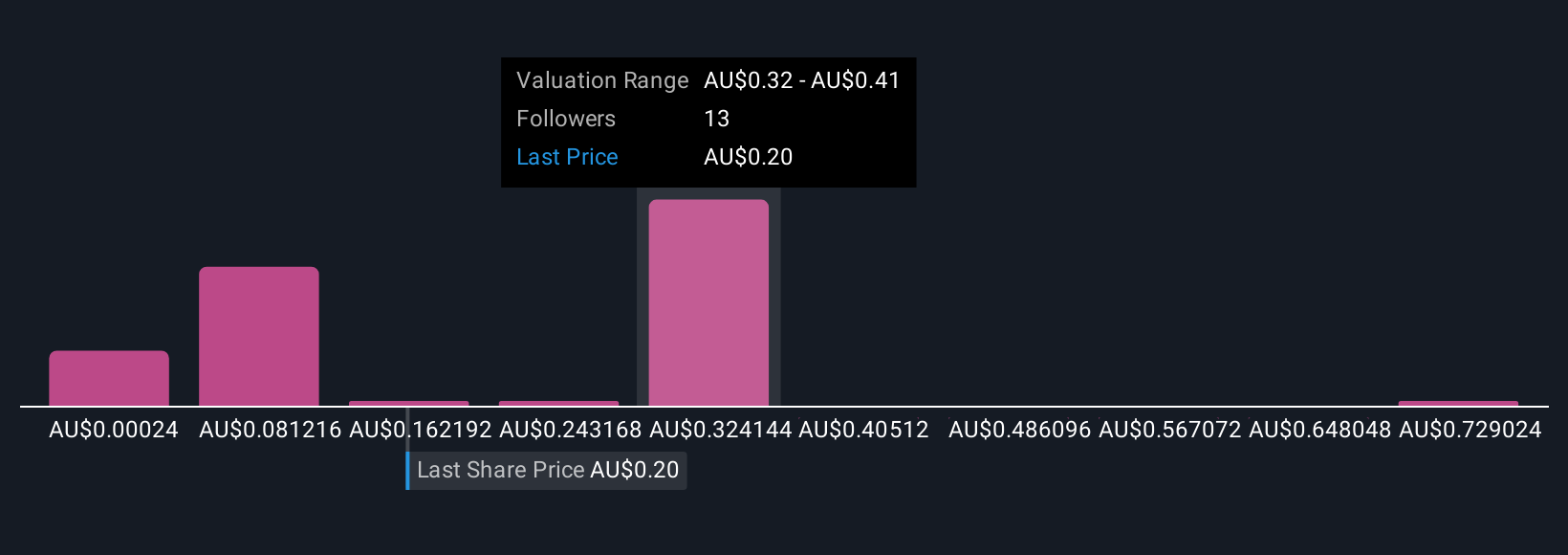

However, one risk investors should not ignore sits squarely on the balance sheet. The valuation report we've compiled suggests that Meteoric Resources' current price could be inflated.Exploring Other Perspectives

Explore 11 other fair value estimates on Meteoric Resources - why the stock might be worth over 5x more than the current price!

Build Your Own Meteoric Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meteoric Resources research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Meteoric Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meteoric Resources' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MEI

Meteoric Resources

Explores for mineral tenements in Brazil, Canada, Western Australia, and Northern Territory.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026