- Australia

- /

- Metals and Mining

- /

- ASX:MAH

3 Undiscovered Australian Gems with Promising Potential

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 climbing 10% over the past ten months, driven in part by renewed interest in critical minerals as geopolitical tensions influence global supply dynamics. In this environment, identifying stocks with strong fundamentals and strategic positioning in emerging sectors like rare earths and healthcare can offer intriguing opportunities for investors seeking to navigate these evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Mayfield Group Holdings | 0.21% | 11.99% | 30.07% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Cobram Estate Olives (ASX:CBO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cobram Estate Olives Limited is involved in the production and marketing of olive oil across Australia, the United States, and internationally, with a market cap of A$1.69 billion.

Operations: Cobram Estate Olives generates revenue primarily from its Australian olive oil operations, contributing A$183.82 million, and its US operation, adding A$64.97 million. The company incurs a deduction of A$7.13 million from eliminations and corporate activities.

Cobram Estate Olives, a notable player in the olive oil industry, showcases impressive earnings growth of 167.8% over the past year, outpacing the food industry's average of 8.7%. Despite this robust performance, challenges loom with a high net debt to equity ratio of 72%, though it has improved from 119.5% over five years. Recent follow-on equity offerings totaling A$183 million indicate strategic capital raising efforts amid rising water costs and significant U.S. expansion expenses. With EBIT covering interest payments by 8 times and trading below fair value estimates by nearly 70%, Cobram remains an intriguing investment consideration amidst market volatility.

Macmahon Holdings (ASX:MAH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining services, as well as civil infrastructure support, to mining companies in Australia and Southeast Asia, with a market cap of A$1.02 billion.

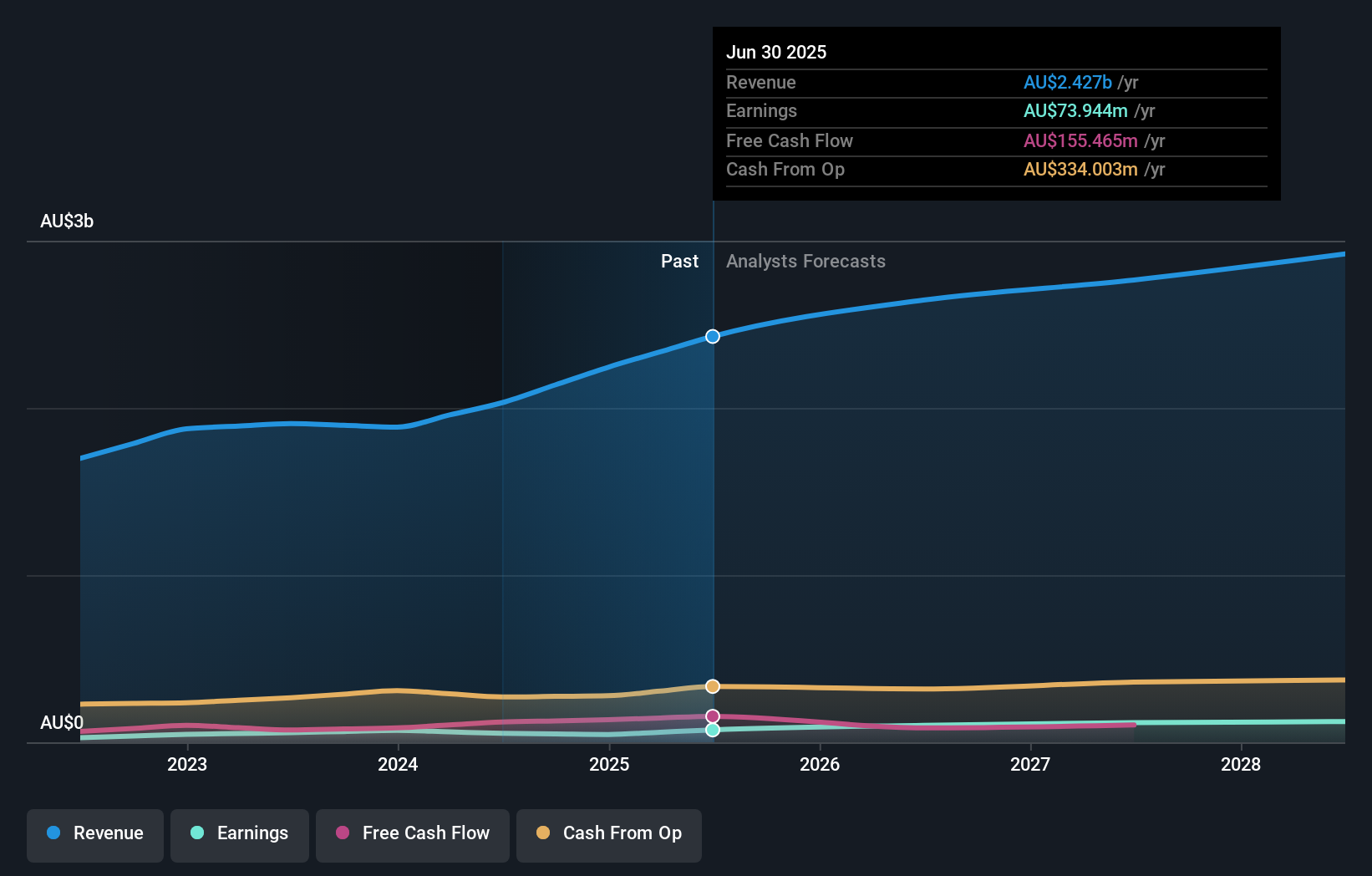

Operations: Macmahon Holdings generates revenue primarily from its mining segment, which accounts for A$1.97 billion, and its civil segment, contributing A$436.97 million.

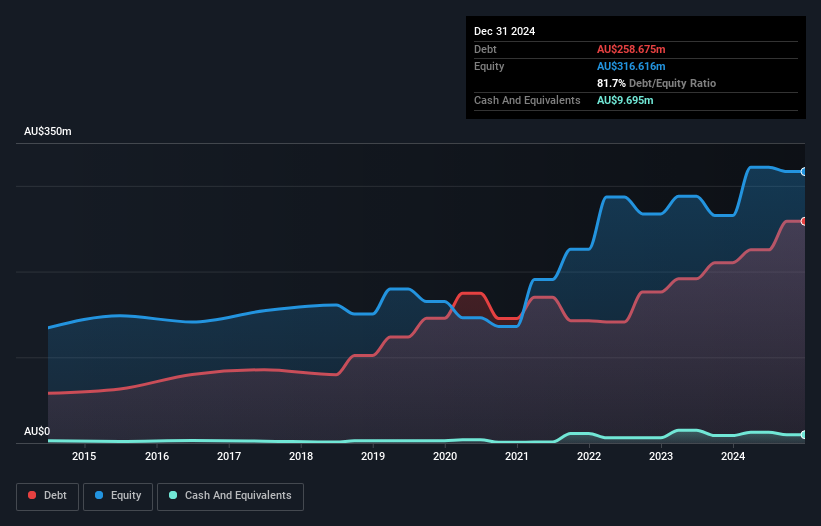

Macmahon Holdings, a player in the mining services sector, is expanding its operations into underground mining and civil infrastructure to diversify revenue streams. The company's recent earnings report showed a net income of A$73.94 million, up from A$53.23 million the previous year, with sales reaching A$2.43 billion compared to A$2.03 billion earlier. Despite a rise in debt-to-equity ratio from 3.7% to 43.9% over five years, interest payments are well-covered by EBIT at 4.4 times coverage, indicating solid financial health amid growth strategies and market challenges ahead for this emerging entity in Australia's landscape.

Tribune Resources (ASX:TBR)

Simply Wall St Value Rating: ★★★★★★

Overview: Tribune Resources Limited, along with its subsidiaries, focuses on the development, exploration, and production of mineral properties in Australia and has a market capitalization of A$393.51 million.

Operations: Tribune Resources generates revenue primarily from its mining and exploration operations, amounting to A$160.34 million.

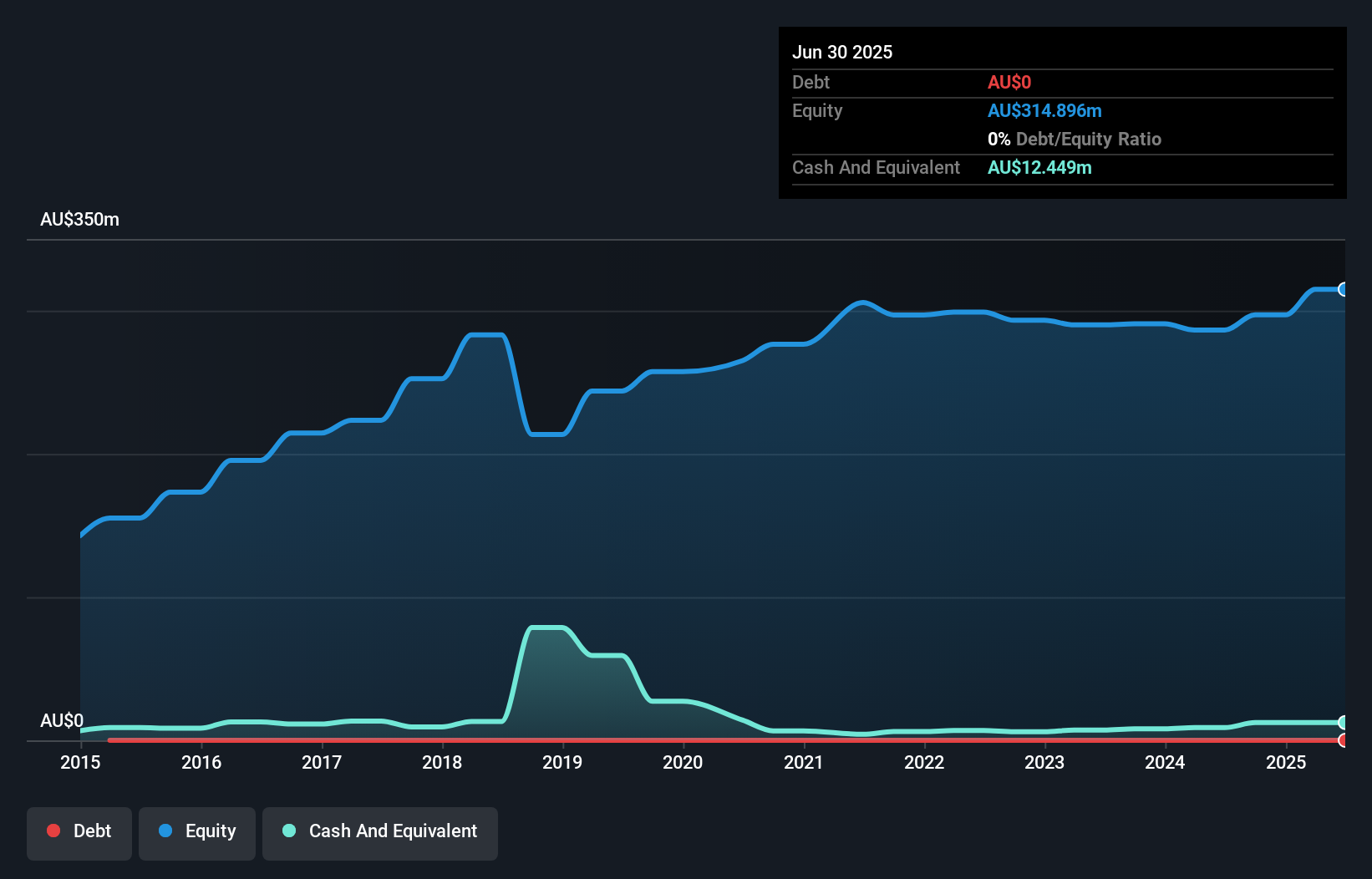

Tribune Resources, a nimble player in the metals and mining sector, has shown an impressive earnings surge of 666.9% over the past year, dwarfing the industry average of 10.6%. With no debt on its books for five years, this company is trading at a significant discount—73.8% below estimated fair value—making it an intriguing prospect for those eyeing undervalued assets. Tribune's recent financial results highlight robust growth, with sales jumping to A$160.34 million from A$107.94 million and net income soaring to A$33.24 million from A$4.33 million compared to last year’s figures, showcasing its potential despite historical earnings decline trends over five years at 36.9% per annum.

- Delve into the full analysis health report here for a deeper understanding of Tribune Resources.

Gain insights into Tribune Resources' past trends and performance with our Past report.

Taking Advantage

- Investigate our full lineup of 57 ASX Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAH

Macmahon Holdings

Provides surface mining, underground mining and mining support, and civil infrastructure services to mining companies in Australia and Southeast Asia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion