- Australia

- /

- Metals and Mining

- /

- ASX:LYC

Is Lynas Rare Earths Still Worth Watching After a 192% Rally in 2025?

Reviewed by Bailey Pemberton

If you are eyeing Lynas Rare Earths and wondering whether now is the right time to jump in or take some profits, you are definitely not alone. The share price has been on a wild ride lately. While the stock pulled back by 6.5% over the last week, it’s hard to ignore its massive gains: up 15.4% in the past month, and an astonishing 192% year-to-date. Zoom out further, and the numbers are just as striking, with a 156.3% return over the last year and more than 576% over five years.

These moves have not happened in a vacuum. Recent headlines around global supply chain re-shuffling and a renewed focus on critical minerals have put the spotlight firmly back on rare earth producers. For Lynas, a major player outside China, regulatory developments and shifting demand in clean energy and tech have fueled investor interest, propelling the stock higher. But as with most growth stories, volatility follows closely behind whenever doubts creep in, such as questions about project timelines or political hurdles.

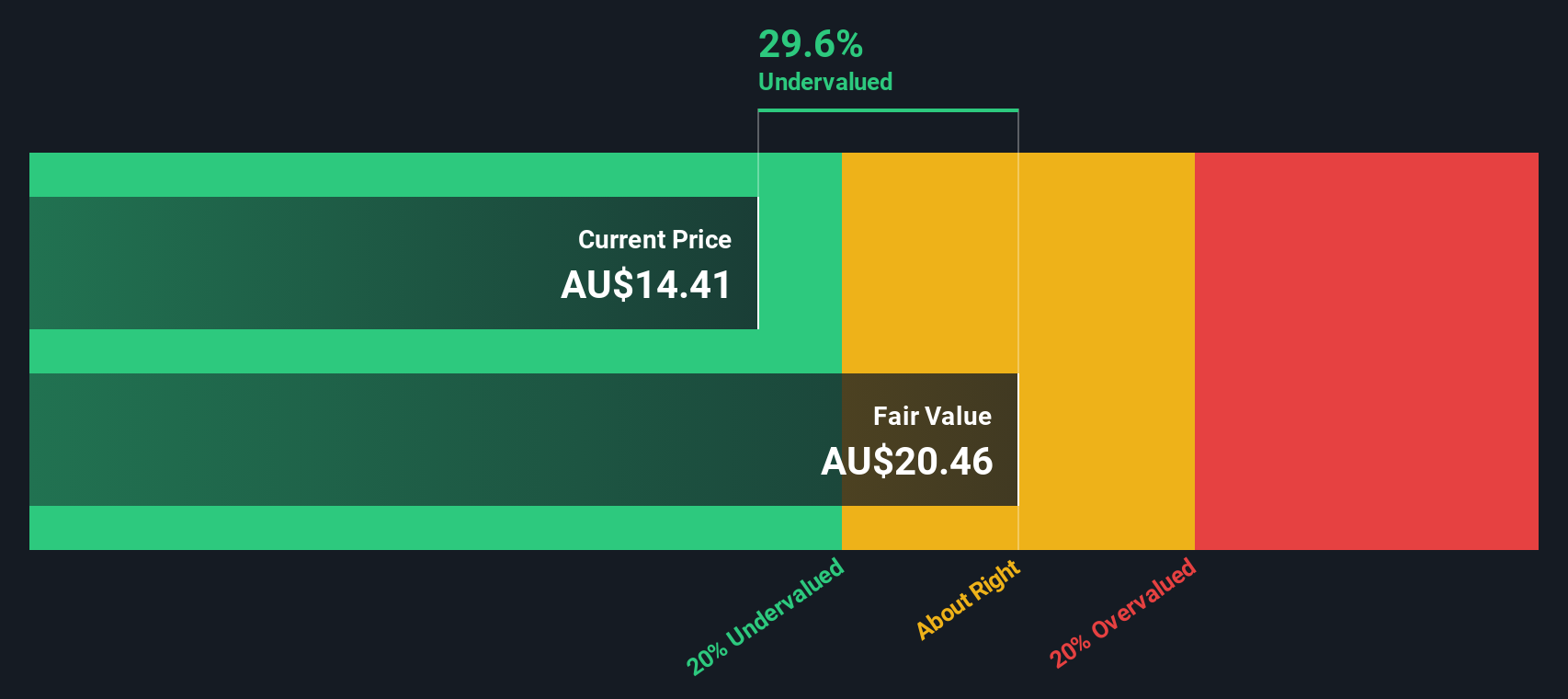

With the share price still riding high on the back of industry buzz, the next question naturally turns to value: is the current price justified, or is the excitement running ahead of the fundamentals? In our analysis, Lynas Rare Earths scores a 1 out of 6 on key undervaluation checks, which is a signal that merits a closer look at how the company stacks up under different valuation methods. Let’s break down those valuation models first, before digging into a smarter way to think about what this company could really be worth.

Lynas Rare Earths scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lynas Rare Earths Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company’s future free cash flows and then discounts them back to today’s value, providing an estimate of what the company is really worth. This approach is widely used because it focuses on real cash generation potential, not just accounting earnings.

For Lynas Rare Earths, current trailing twelve-month free cash flow (FCF) stands at negative A$403.82 million. Analyst estimates expect a swift turnaround, projecting FCF to grow into positive territory over the coming years, reaching A$645.57 million by 2028. Looking further ahead, ten-year projections based on both analyst forecasts and a gradual, slowing growth assumption see FCF continuing to increase, but remaining under A$1 billion annually. All projections here are denominated in Australian Dollars (A$).

Applying these cash flow estimates, the DCF model arrives at an intrinsic value of A$18.29 per share. Compared to the current share price, this implies the stock is 4.3% overvalued, which is pretty close to fair value when considering typical market swings.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Lynas Rare Earths's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Lynas Rare Earths Price vs Sales

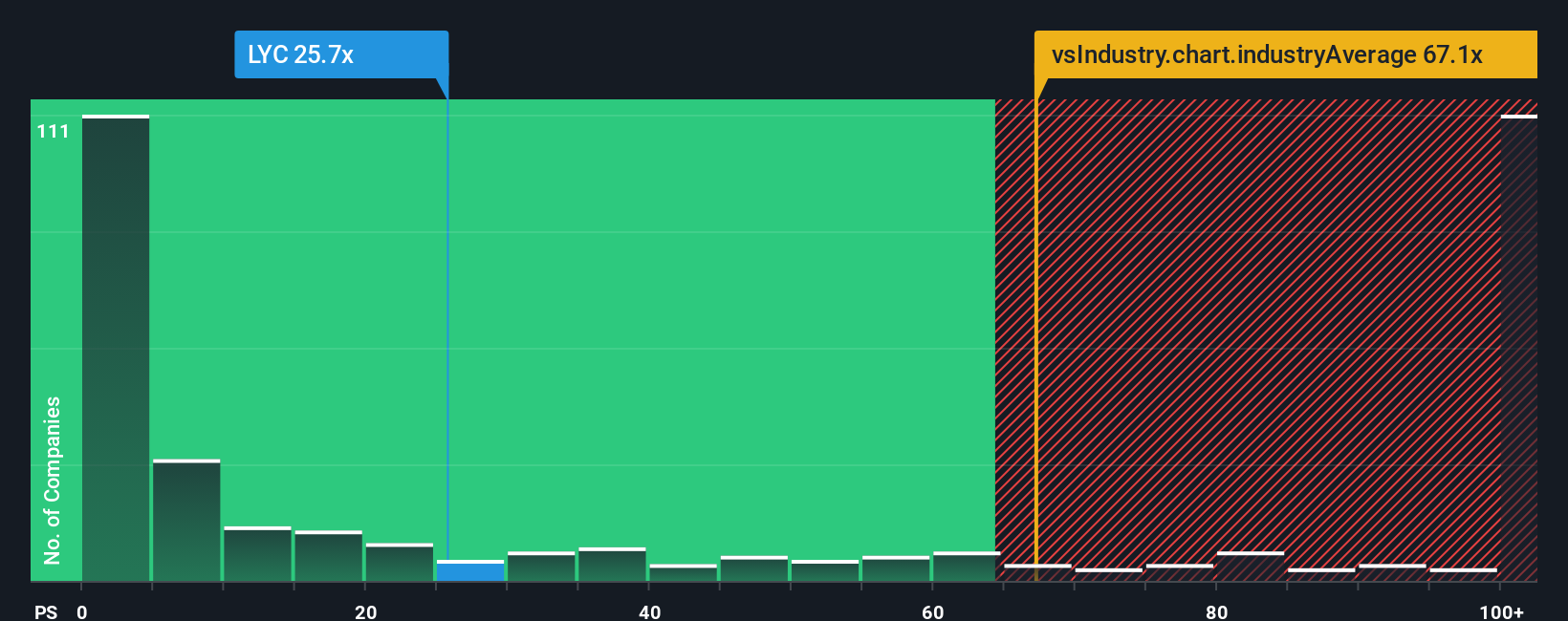

For companies like Lynas Rare Earths that have yet to show consistent net profitability, the price-to-sales (P/S) multiple is a practical choice for valuation. This ratio gives a sense of how much investors are willing to pay for every dollar of revenue. This measure can be particularly meaningful for businesses investing heavily in future growth or operating within cyclical sectors such as mining.

Growth prospects and risk levels play a big role in what counts as a “normal” P/S ratio. Companies with strong sales growth or robust margins typically deserve a higher multiple, while those with more uncertainty or weaker outlooks tend to trade lower. As of now, Lynas Rare Earths trades at a lofty P/S ratio of 34.49x. For context, the global metals and mining industry averages 125.76x, and direct peers sit at about 5.88x.

Rather than rely solely on these broad benchmarks, we can look at Simply Wall St’s proprietary “Fair Ratio.” This metric tailors the expected P/S multiple for Lynas by factoring in its business model, earnings growth outlook, profit margin, risks, and market capitalisation. This approach provides a more relevant lens on valuation compared to basic peer or industry comparisons. For Lynas, the Fair Ratio comes in at 4.01x, suggesting a much lower P/S multiple is justified.

Comparing the current P/S of 34.49x to the Fair Ratio of 4.01x, the stock appears significantly overvalued on a sales basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lynas Rare Earths Narrative

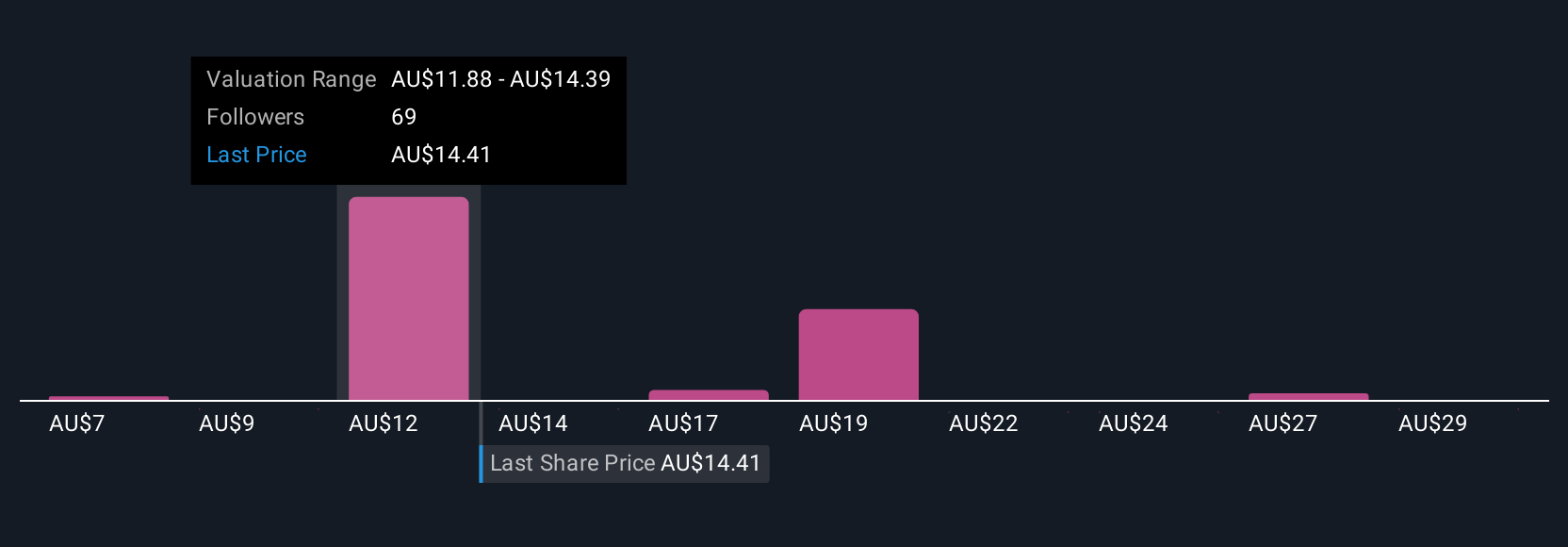

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, a simple but powerful approach that lets you form your own evidence-backed opinion about Lynas Rare Earths by pairing your beliefs about the company's future with concrete numbers.

A Narrative is your story about the company, explaining why you think it will succeed or struggle. This perspective directly informs the forecasts you use for key metrics like revenue, earnings, and margins, and links these views to a calculated fair value.

Narratives on Simply Wall St’s Community page make this process easy and accessible, allowing you to weigh the company's potential in your own words and numbers. You can then see immediately how your story compares with current prices and the views of millions of other investors.

By comparing the Fair Value from your Narrative with the latest share price, you can quickly see whether your assumptions signal a buy, hold, or sell. Narratives update automatically as new news or earnings report data becomes available, so your view stays relevant.

For example, with Lynas Rare Earths, one investor may create a bullish Narrative assuming $959 million in earnings and a price target of A$17.50, while another may take a cautious stance with $521 million in earnings and a target of just A$7.65. Narratives let you easily visualise and track these different viewpoints as the facts evolve.

Do you think there's more to the story for Lynas Rare Earths? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives