- Australia

- /

- Metals and Mining

- /

- ASX:LYC

Could Lynas Rare Earths’ (ASX:LYC) US Magnet Supply Chain Push Reshape Its Competitive Positioning?

Reviewed by Sasha Jovanovic

- Earlier this month, Noveon Magnetics and Lynas Rare Earths signed a Memorandum of Understanding to create a scalable U.S. supply chain for rare earth permanent magnets, targeting defense and commercial sectors and responding to recent supply chain disruptions.

- This collaboration signals a commitment to building a fully traceable and transparent magnet supply chain in the U.S., prioritizing national defense and critical infrastructure needs while engaging policymakers to align with national interests.

- Now, we'll explore how this planned U.S.-focused supply chain partnership could influence Lynas Rare Earths' investment narrative amid global supply chain shifts.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lynas Rare Earths Investment Narrative Recap

To own Lynas Rare Earths, an investor needs to believe in long-term Western government backing for independent critical minerals supply and ongoing growth from downstream expansion. The recent MoU with Noveon Magnetics strengthens Lynas’s U.S. supply chain ambitions, yet remains a preliminary agreement unlikely to alter the dominant near-term catalyst: government policy support. The largest risk continues to be any shift in Western policy that could undermine strategic pricing and offtake assumptions, and this latest development has not fundamentally reduced that vulnerability.

Among recent announcements, Lynas’s sizeable follow-on equity offerings (A$182.57 million completed in September and others filed around A$825 million) stand out. While capital raising supports planned growth initiatives like the U.S. magnet value chain, investors still look to U.S. policy momentum as a bigger, immediate driver of demand and margin certainty.

By contrast, investors should be aware that any reversal or stalling of government support for non-Chinese rare earths could still ...

Read the full narrative on Lynas Rare Earths (it's free!)

Lynas Rare Earths' narrative projects A$1.9 billion in revenue and A$732.6 million in earnings by 2028. This requires 50.1% yearly revenue growth and a rise in earnings of A$724.6 million from the current A$8.0 million.

Uncover how Lynas Rare Earths' forecasts yield a A$14.23 fair value, a 25% downside to its current price.

Exploring Other Perspectives

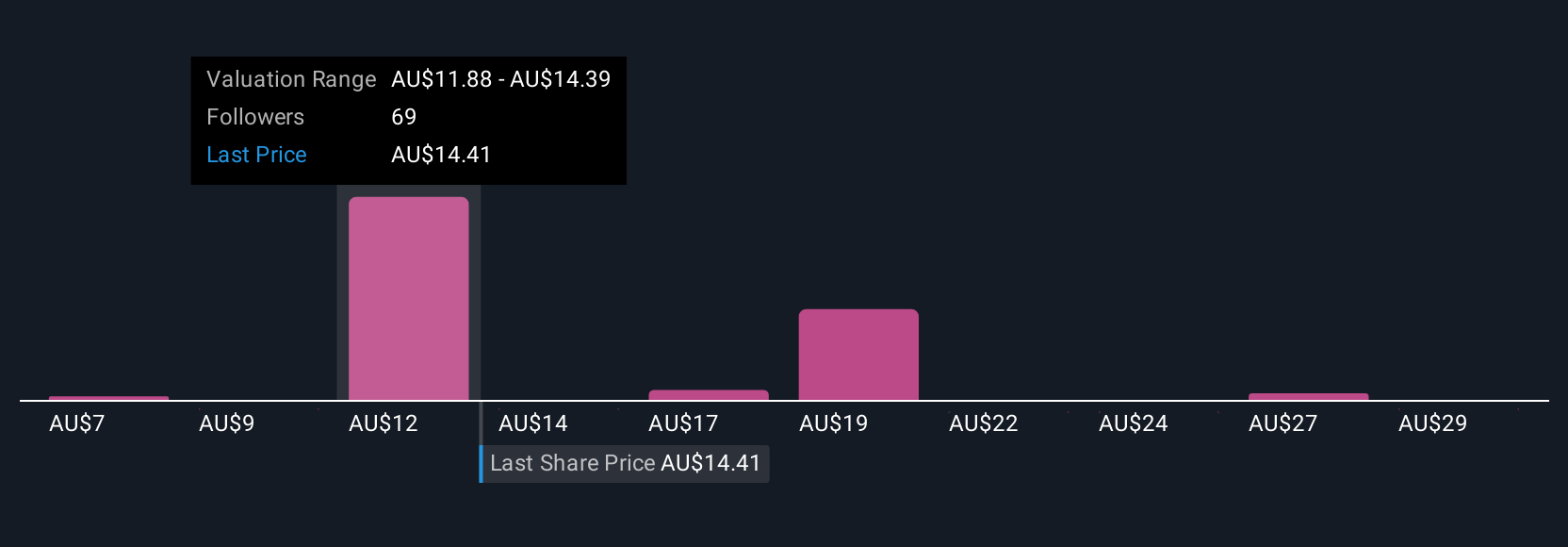

Nineteen Simply Wall St Community members estimate Lynas’s fair value between A$8.90 and A$49.32 per share. While current optimism focuses on Western policy support anchoring demand, this range shows you how widely opinions differ, see how others are weighing the policy risks.

Explore 19 other fair value estimates on Lynas Rare Earths - why the stock might be worth less than half the current price!

Build Your Own Lynas Rare Earths Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lynas Rare Earths research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Lynas Rare Earths research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lynas Rare Earths' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives