- Australia

- /

- Metals and Mining

- /

- ASX:LTR

Liontown Resources (ASX:LTR): Valuation Check After New Canmax Offtake Deal Expands Lithium Supply Commitments

Reviewed by Simply Wall St

Liontown (ASX:LTR) has grabbed attention after signing a binding offtake deal with Canmax Technologies, locking in spodumene concentrate supply for 2027 and 2028 and deepening its ties into the global battery supply chain.

See our latest analysis for Liontown.

The market seems to like the story, with a 45.10% 1 month share price return and a 159.65% year to date share price return contributing to a 142.62% 1 year total shareholder return. This suggests strong momentum despite a weaker 3 year total shareholder result.

If this lithium deal has you thinking about where the next wave of growth might come from, it could be worth exploring fast growing stocks with high insider ownership.

Yet with Liontown still lossmaking, trading above analyst targets but with significant potential from Kathleen Valley, is the recent share price surge a sign of a buying opportunity, or are markets already pricing in future growth?

Most Popular Narrative: 55.9% Overvalued

With Liontown last closing at A$1.48 against a narrative fair value of A$0.95 per share, expectations appear stretched and heavily dependent on execution.

The analysts have a consensus price target of A$0.626 for Liontown Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.15, and the most bearish reporting a price target of just A$0.35.

Want to see what kind of revenue surge and margin shift might justify such a rich future earnings multiple for a miner at this stage? The narrative examines an aggressive growth runway, a potential profitability swing, and a premium valuation that is usually associated with more mature sectors. Curious which financial levers would need to move in sequence for that fair value to be supported? Read on to see the numbers behind the story.

Result: Fair Value of $0.95 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating costs and weaker lithium prices could squeeze margins and cash flow. This may challenge the upbeat growth assumptions baked into the current valuation.

Find out about the key risks to this Liontown narrative.

Another Lens on Value

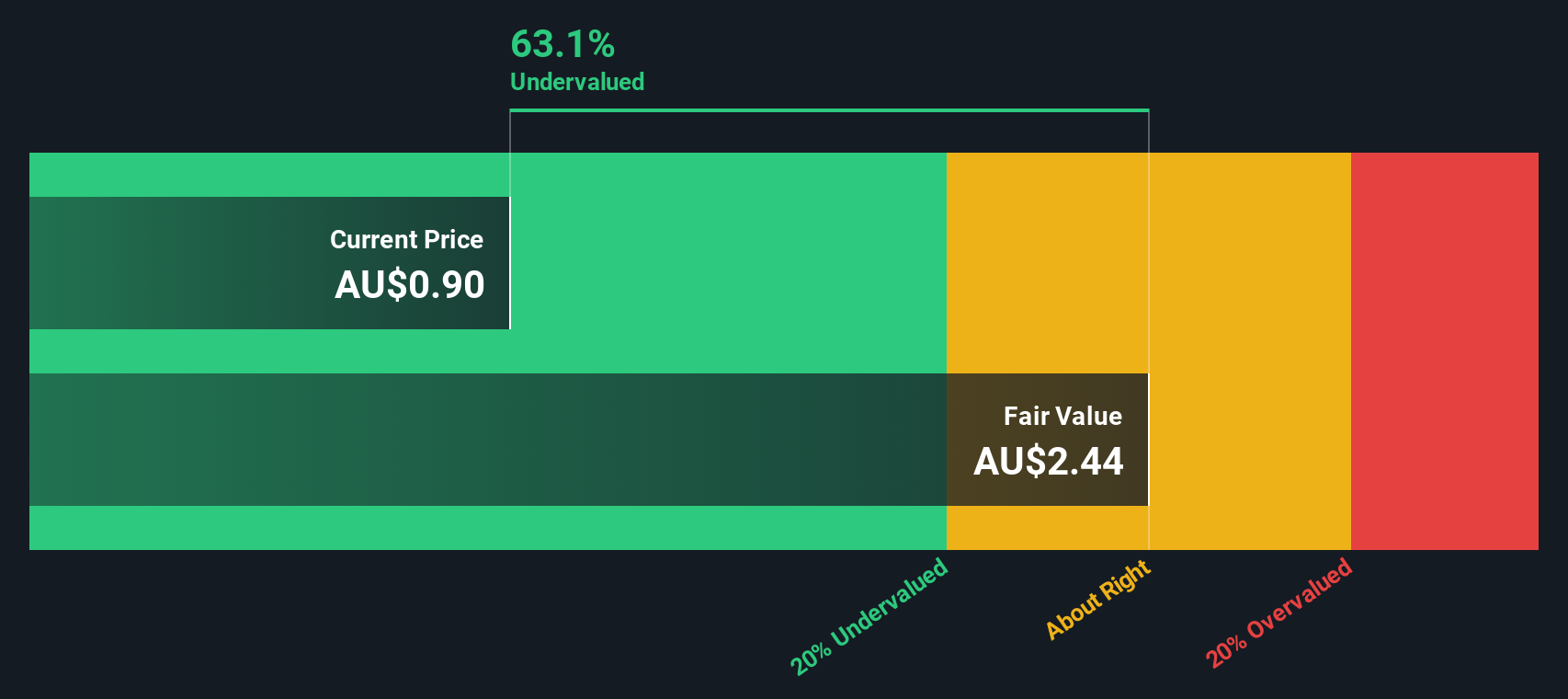

While the narrative fair value suggests Liontown is overvalued, our DCF model paints a very different picture, with shares trading about 72.8% below its A$5.45 fair value estimate. Could the market be underestimating Kathleen Valley’s long term cash generation potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Liontown Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a personalised view in just a few minutes. To start, use Do it your way.

A great starting point for your Liontown research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

If you stop at Liontown, you could miss compelling opportunities elsewhere, so use the Simply Wall Street Screener to uncover your next high conviction ideas today.

- Capture potential mispricings by targeting companies trading below intrinsic value through these 909 undervalued stocks based on cash flows that highlight strong cash flow stories the market may be overlooking.

- Position yourself at the forefront of technological change by screening for innovators shaping the future of automation and machine learning with these 27 AI penny stocks.

- Strengthen your portfolio’s income engine by zeroing in on reliable payers via these 15 dividend stocks with yields > 3% that focus on yields above 3% with supporting fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026