- Australia

- /

- Metals and Mining

- /

- ASX:LTR

Liontown Resources And 2 Other ASX Penny Stocks Worth Watching

Reviewed by Simply Wall St

The Australian market has seen mixed performances recently, with the ASX200 closing slightly down and sectors like Telecommunications and Financials showing resilience despite broader challenges. In this context, selecting stocks that balance affordability with growth potential becomes crucial for investors looking to navigate current market conditions. While the term 'penny stocks' may seem outdated, it still refers to smaller or newer companies that can offer significant opportunities when they possess strong financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.61 | A$71.5M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$297.19M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.685 | A$1.92B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$115.48M | ★★★★★★ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Liontown Resources (ASX:LTR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Liontown Resources Limited focuses on the exploration, evaluation, and development of mineral properties in Australia and has a market capitalization of A$2.02 billion.

Operations: Liontown Resources Limited has not reported any revenue segments.

Market Cap: A$2.02B

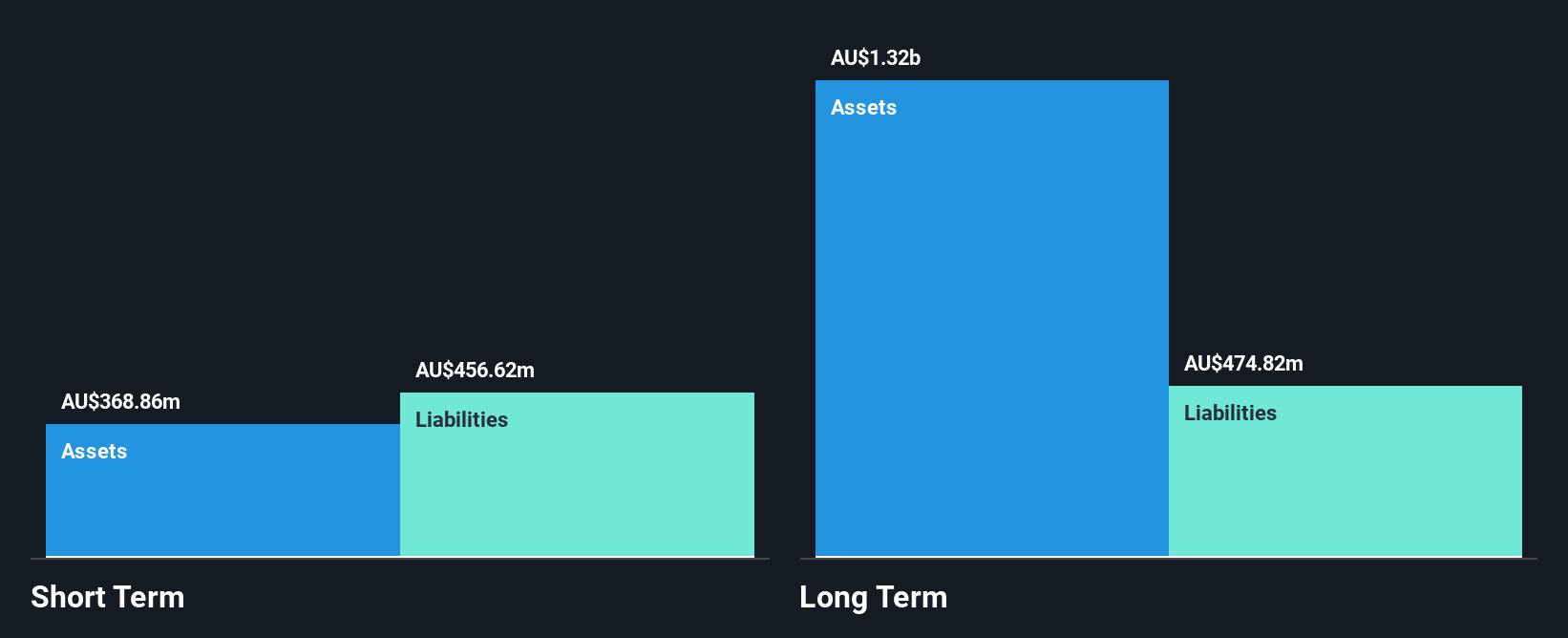

Liontown Resources Limited, with a market capitalization of A$2.02 billion, is pre-revenue and currently unprofitable, reporting a net loss of A$64.92 million for the year ended June 30, 2024. The company has experienced shareholder dilution over the past year with shares outstanding increasing by 10.1%. Despite its challenges, Liontown has strengthened its corporate governance by appointing Ian Wells as Lead Independent Director in September 2024. The company's short-term assets exceed its short-term liabilities; however, long-term liabilities remain uncovered by these assets. It recently raised additional capital to extend its cash runway beyond the initial two months forecasted based on free cash flow estimates.

- Jump into the full analysis health report here for a deeper understanding of Liontown Resources.

- Gain insights into Liontown Resources' outlook and expected performance with our report on the company's earnings estimates.

Orthocell (ASX:OCC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orthocell Limited is a regenerative medicine company that develops and commercializes cell therapies and biological medical devices for repairing bone and soft tissue injuries across Australia, the United States, the United Kingdom, and the European Union, with a market cap of A$144.61 million.

Operations: The company's revenue is derived entirely from the regenerative medicine industry, amounting to A$5.32 million.

Market Cap: A$144.61M

Orthocell Limited, with a market cap of A$144.61 million, operates in the regenerative medicine sector but remains pre-revenue with sales of A$2.3 million for the year ending June 2024. The company is unprofitable, reporting a net loss of A$7.18 million and experiencing shareholder dilution as shares outstanding grew by 6.2%. Despite these challenges, Orthocell maintains financial stability with short-term assets exceeding liabilities and no debt for five years. However, its recent delisting from OTC Equity due to inactivity highlights potential concerns about liquidity or investor interest in its securities on that platform.

- Click here to discover the nuances of Orthocell with our detailed analytical financial health report.

- Explore historical data to track Orthocell's performance over time in our past results report.

United Overseas Australia (ASX:UOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, with a market cap of A$925.86 million, operates in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia.

Operations: The company's revenue is primarily derived from its investment activities, generating A$604.42 million, and land development and resale operations, contributing A$250.14 million.

Market Cap: A$925.86M

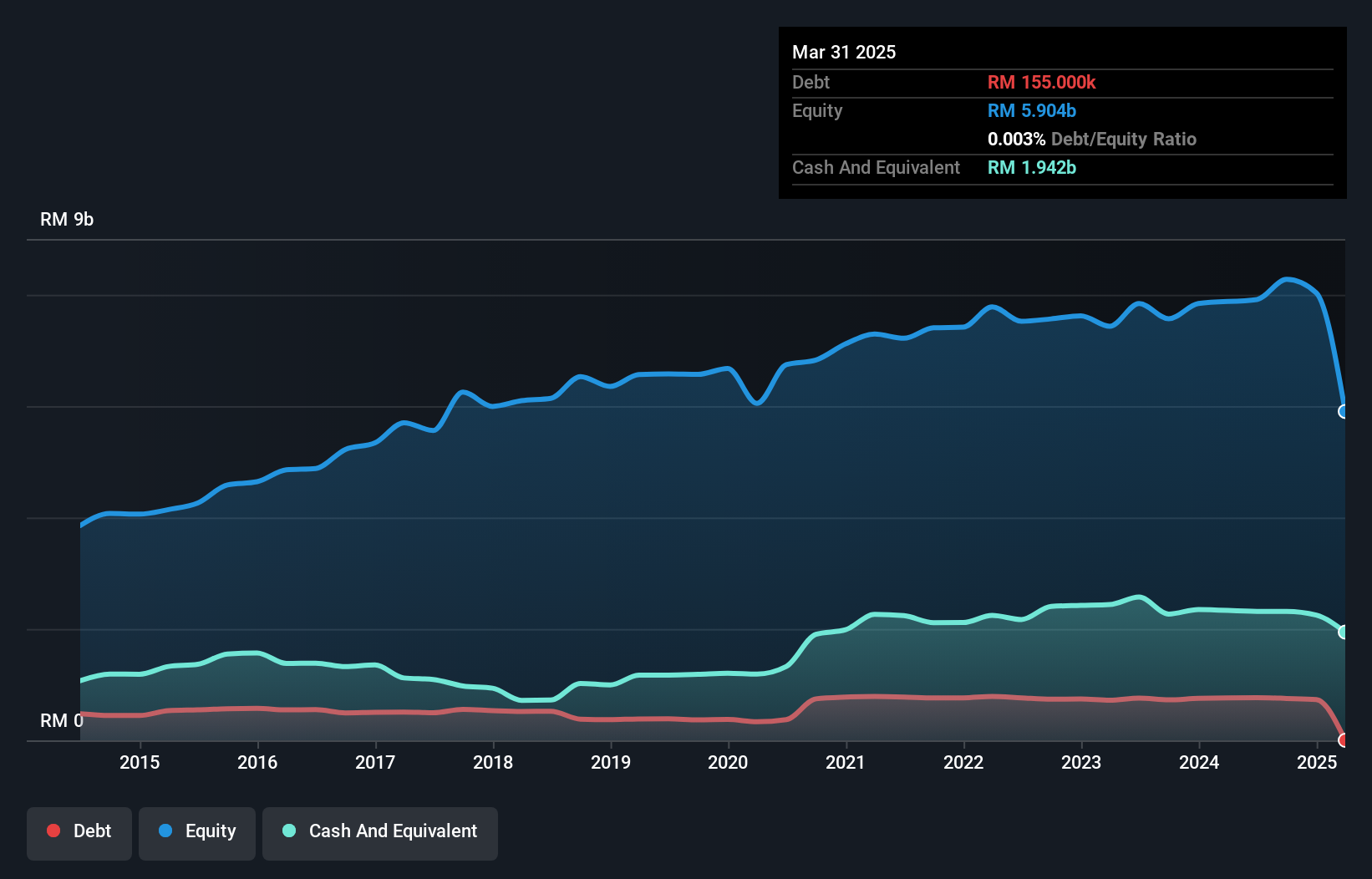

United Overseas Australia Ltd, with a market cap of A$925.86 million, is involved in land development and resale across multiple regions. The company reported a significant one-off gain of A$33.6 million, impacting its recent financial results. Despite earnings growth over the past year surpassing its five-year average decline, the company's return on equity remains low at 4.8%. UOS's short-term assets significantly exceed both short- and long-term liabilities, indicating strong liquidity. Additionally, debt levels are well-covered by operating cash flow and interest payments are manageable. Recent announcements include an interim dividend increase to 0.5 cents per share for shareholders.

- Get an in-depth perspective on United Overseas Australia's performance by reading our balance sheet health report here.

- Examine United Overseas Australia's past performance report to understand how it has performed in prior years.

Where To Now?

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,029 more companies for you to explore.Click here to unveil our expertly curated list of 1,032 ASX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential with adequate balance sheet.