- Australia

- /

- Metals and Mining

- /

- ASX:LRS

Here's Why We're Watching Latin Resources' (ASX:LRS) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, Latin Resources ( ASX:LRS ) shareholders have done very well over the last year, with the share price soaring by 182%. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

In light of its strong share price run, we think now is a good time to investigate how risky Latin Resources' cash burn is. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Latin Resources

How Long Is Latin Resources' Cash Runway?

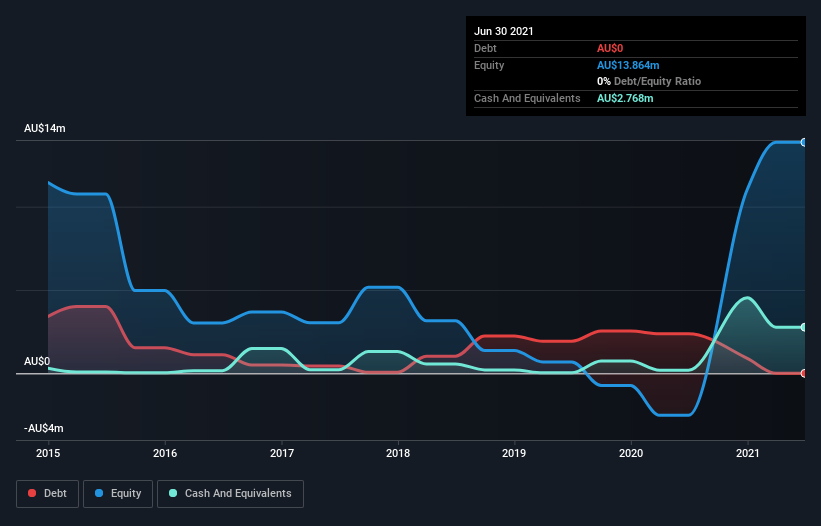

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Latin Resources last reported its balance sheet in June 2021, it had zero debt and cash worth AU$2.8m. Looking at the last year, the company burnt through AU$3.6m. That means it had a cash runway of around 9 months as of June 2021. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Having said that, we would like to note that the company's cash position has been supported by proceeds from the exercise of options and currently about $6m options remain outstanding and which are expected to expire on or before December 2022.

Depicted below, you can see how Latin Resources' cash holdings have changed over time.

How Is Latin Resources' Cash Burn Changing Over Time?

Although Latin Resources reported revenue of AU$166k last year, it didn't actually have any revenue from operations. To us, that makes it a pre-revenue company, so we'll look to its cash burn trajectory as an assessment of its cash burn situation. Remarkably, it actually increased its cash burn by 249% in the last year. With that kind of spending growth its cash runway will shorten quickly, as it simultaneously uses its cash while increasing the burn rate. Admittedly, we're a bit cautious of Latin Resources due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth .

How Easily Can Latin Resources Raise Cash?

Given its cash burn trajectory, Latin Resources shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Again, we would like to note that the company has seen regular cash injections to its balance sheet via the exercise of options. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of AU$67m, Latin Resources' AU$3.6m in cash burn equates to about 5.4% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is Latin Resources' Cash Burn Situation?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Latin Resources' cash burn relative to its market cap was relatively promising. Summing up, we think the Latin Resources' cash burn is a risk, based on the factors we mentioned in this article. Separately, we looked at different risks affecting the company and spotted 4 warning signs for Latin Resources (of which 3 don't sit too well with us!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Latin Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers . Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

* Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:LRS

Latin Resources

Explores and develops mining projects in Australia, Peru, Argentina, and Brazil.

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives