We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Lepidico (ASX:LPD) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Lepidico

Does Lepidico Have A Long Cash Runway?

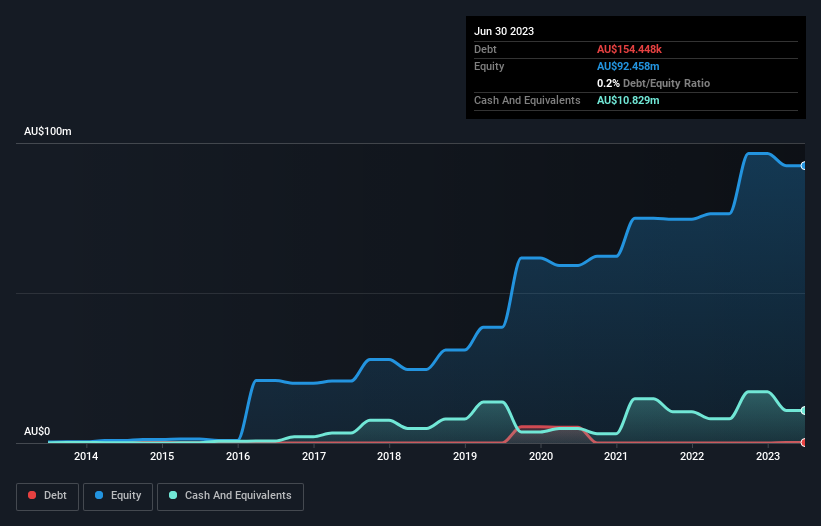

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at June 2023, Lepidico had cash of AU$11m and such minimal debt that we can ignore it for the purposes of this analysis. Importantly, its cash burn was AU$19m over the trailing twelve months. Therefore, from June 2023 it had roughly 7 months of cash runway. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

How Is Lepidico's Cash Burn Changing Over Time?

Because Lepidico isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Over the last year its cash burn actually increased by 33%, which suggests that management are increasing investment in future growth, but not too quickly. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Lepidico Raise More Cash Easily?

Given its cash burn trajectory, Lepidico shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of AU$69m, Lepidico's AU$19m in cash burn equates to about 27% of its market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Lepidico's Cash Burn A Worry?

Lepidico is not in a great position when it comes to its cash burn situation. Although we can understand if some shareholders find its cash burn relative to its market cap acceptable, we can't ignore the fact that we consider its cash runway to be downright troublesome. After looking at that range of measures, we think shareholders should be extremely attentive to how the company is using its cash, as the cash burn makes us uncomfortable. Taking a deeper dive, we've spotted 4 warning signs for Lepidico you should be aware of, and 2 of them shouldn't be ignored.

Of course Lepidico may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LPD

Lepidico

Engages in the exploration, development, and production of lithium chemicals in Australia, Canada, Africa, the United Arab Emirates, Europe, and internationally.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives