- Australia

- /

- Metals and Mining

- /

- ASX:AR3

Australian Rare Earths And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market has been closely watching the Reserve Bank of Australia's recent interest rate cut, a move that reflects ongoing economic adjustments amid a strong labor market and fluctuating sector performances. For investors looking beyond the major players, penny stocks present intriguing opportunities, often representing smaller or newer companies with potential for growth. Despite being an older term, penny stocks remain relevant as they can offer value and growth prospects that larger firms might overlook.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.97 | A$92.93M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.24 | A$346.95M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$3.02 | A$250.39M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.08 | A$67.25M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.09 | A$340.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.84 | A$101.78M | ★★★★★★ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Australian Rare Earths (ASX:AR3)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Australian Rare Earths Limited focuses on the exploration and development of rare earths and uranium mineral resources in Australia, with a market cap of A$15.71 million.

Operations: Australian Rare Earths Limited does not have any reported revenue segments.

Market Cap: A$15.71M

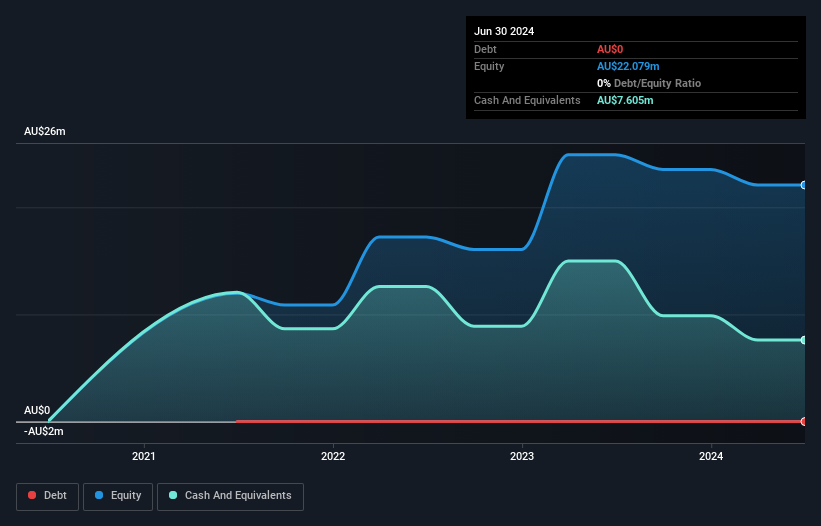

Australian Rare Earths Limited, with a market cap of A$15.71 million, is pre-revenue and debt-free, but it has a volatile share price. The company recently secured A$5 million from the Australian Government's IPCM Program to advance its Koppamurra Rare Earths Project, matched by AR3 for a total planned expenditure of A$10 million over 2025-2026. This funding supports metallurgical testwork and the construction of a demonstration plant, enhancing project viability. Although unprofitable with limited cash runway if free cash flow reduces further, AR3's short-term assets cover liabilities and it benefits from strategic partnerships like Neo's technical support.

- Jump into the full analysis health report here for a deeper understanding of Australian Rare Earths.

- Review our historical performance report to gain insights into Australian Rare Earths' track record.

GWR Group (ASX:GWR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GWR Group Limited is involved in the exploration, evaluation, and development of mining projects in Australia, with a market cap of A$29.55 million.

Operations: GWR Group Limited's revenue is derived from its corporate activities, amounting to A$1.69 million.

Market Cap: A$29.55M

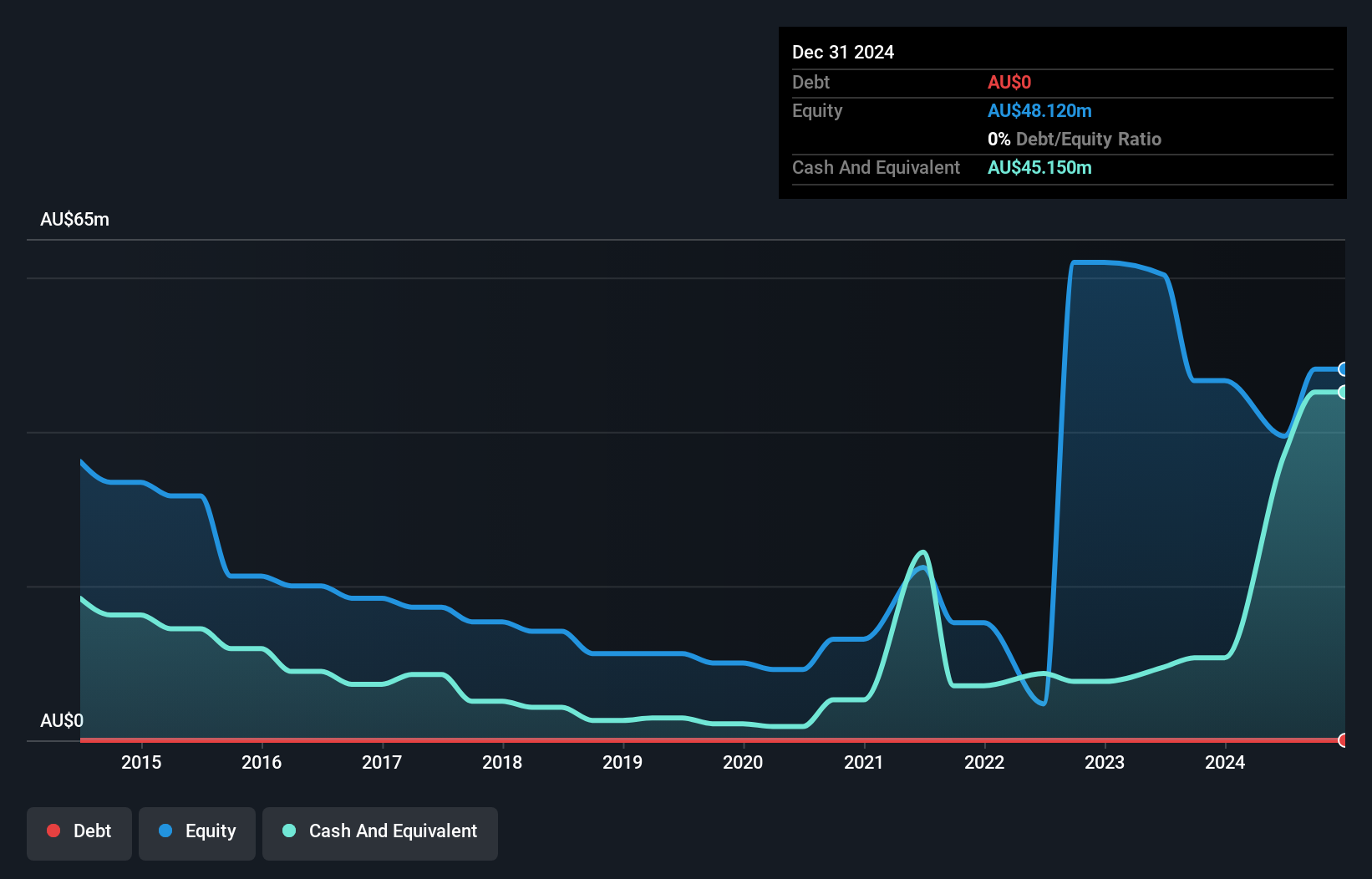

GWR Group Limited, with a market cap of A$29.55 million, is pre-revenue and debt-free, focusing on mining project development in Australia. Despite being unprofitable, it has reduced losses by 1.2% annually over five years and maintains a stable weekly volatility of 7%. The company boasts short-term assets of A$40.4 million that cover both its long-term liabilities (A$4.5K) and short-term liabilities (A$2.3M). Recent executive changes include the appointment of Simon Borck as CFO and Joint Company Secretary, enhancing financial leadership amidst board transitions like the resignation of long-serving director Michael Wilson.

- Take a closer look at GWR Group's potential here in our financial health report.

- Gain insights into GWR Group's past trends and performance with our report on the company's historical track record.

Legend Mining (ASX:LEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Legend Mining Limited focuses on the exploration of nickel and copper deposits in Australia, with a market capitalization of A$29.09 million.

Operations: Legend Mining Limited has not reported any specific revenue segments.

Market Cap: A$29.09M

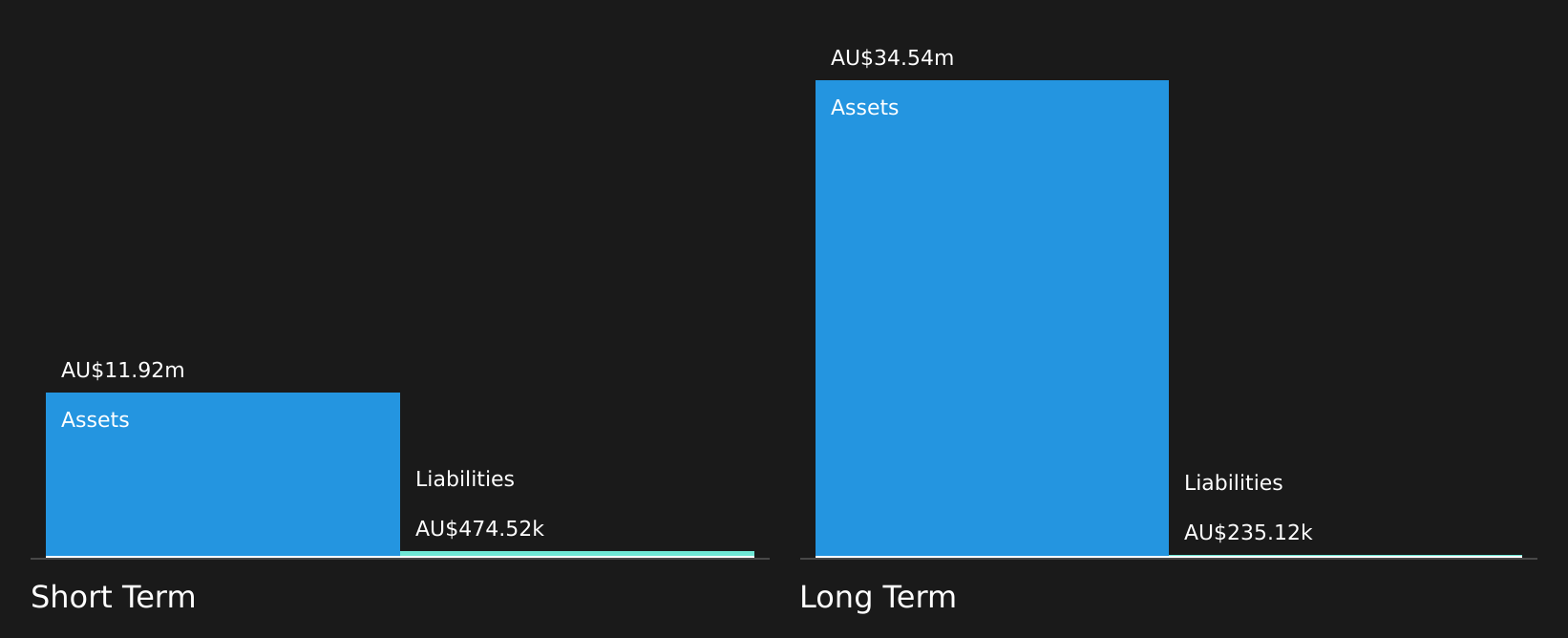

Legend Mining Limited, with a market cap of A$29.09 million, is pre-revenue and debt-free, focusing on nickel and copper exploration in Australia. Despite being unprofitable with increasing losses over five years at 62.1% annually, it trades 17.4% below estimated fair value. The company benefits from a stable cash runway exceeding three years due to positive free cash flow growth of 24.2% per year and has short-term assets (A$13.3M) that cover both short-term (A$417.3K) and long-term liabilities (A$165.3K). Management is experienced with an average tenure of 3.1 years, while the board averages 4.5 years in tenure.

- Click to explore a detailed breakdown of our findings in Legend Mining's financial health report.

- Evaluate Legend Mining's historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,029 more companies for you to explore.Click here to unveil our expertly curated list of 1,032 ASX Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AR3

Australian Rare Earths

Engages in the exploration and development of rare earths and uranium mineral resources in Australia.

Flawless balance sheet moderate.

Market Insights

Community Narratives