- Australia

- /

- Metals and Mining

- /

- ASX:KAU

Kaiser Reef Limited (ASX:KAU) Surges 30% Yet Its Low P/S Is No Reason For Excitement

Kaiser Reef Limited (ASX:KAU) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 48% in the last year.

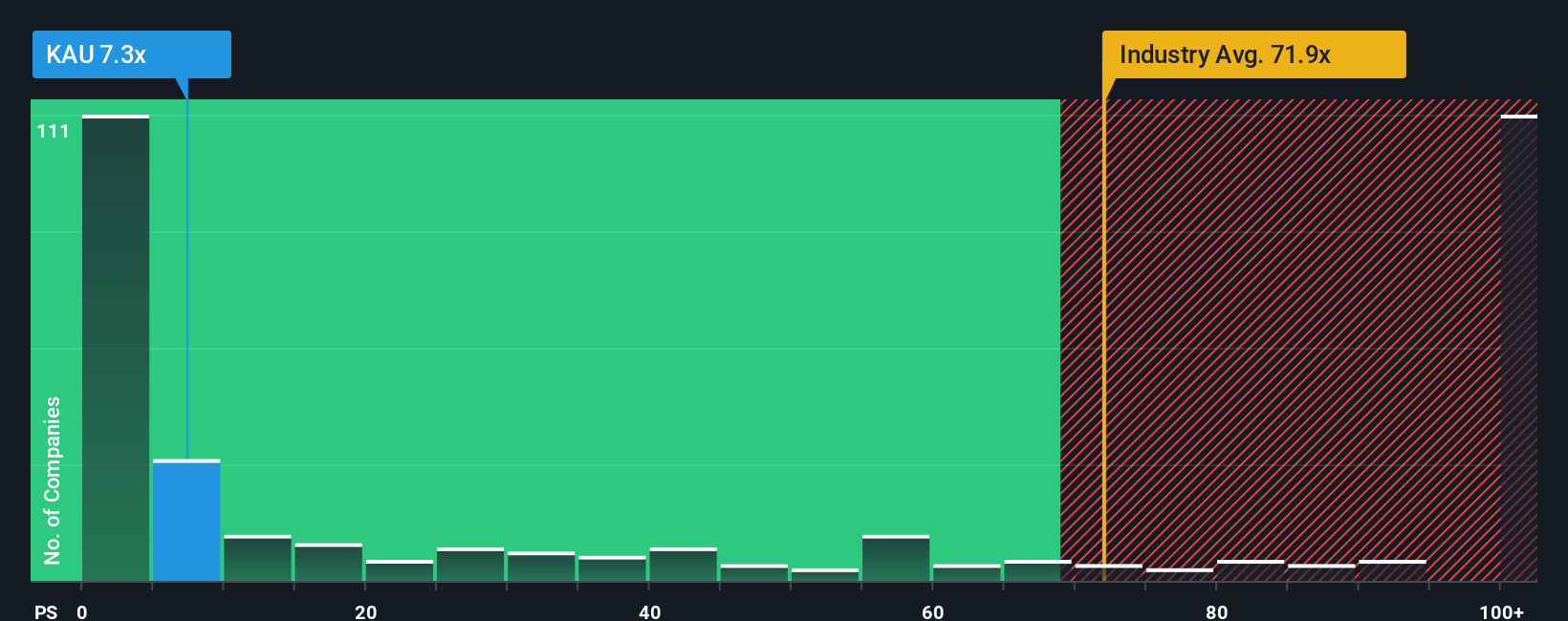

Although its price has surged higher, Kaiser Reef's price-to-sales (or "P/S") ratio of 7.3x might still make it look like a strong buy right now compared to the wider Metals and Mining industry in Australia, where around half of the companies have P/S ratios above 71.9x and even P/S above 633x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Kaiser Reef

What Does Kaiser Reef's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Kaiser Reef over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kaiser Reef will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Kaiser Reef?

In order to justify its P/S ratio, Kaiser Reef would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 41%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 19% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 58% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Kaiser Reef is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Kaiser Reef's P/S?

Even after such a strong price move, Kaiser Reef's P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Kaiser Reef revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Kaiser Reef (1 doesn't sit too well with us!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Reef might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:KAU

Kaiser Reef

Engages in the exploration, development, mining, production, and sale of gold in Australia.

Excellent balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026