- Australia

- /

- Capital Markets

- /

- ASX:NGI

EZZ Life Science Holdings And 2 Other Promising ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market has experienced a mix of bullish sentiment and consolidation, with recent gains driven by factors such as the U.S. government shutdown and rising gold prices. For investors interested in smaller or newer companies, penny stocks offer a unique blend of affordability and growth potential, despite their somewhat outdated name. These stocks can present surprising value when backed by strong financials, making them an intriguing option for those looking to explore under-the-radar opportunities in the current market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.49 | A$140.43M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.53 | A$119.35M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.795 | A$49.5M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.80 | A$431.86M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.00 | A$221.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.042 | A$49.13M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.0735 | A$38.05M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.775 | A$370.23M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.26 | A$1.38B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 421 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

EZZ Life Science Holdings (ASX:EZZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EZZ Life Science Holdings Limited formulates, produces, markets, and sells health and wellbeing products across Australia, New Zealand, Mainland China, and South-East Asia with a market cap of A$119.35 million.

Operations: The company's revenue is derived from Company Owned products contributing A$63.21 million and Brought in Lines generating A$3.66 million.

Market Cap: A$119.35M

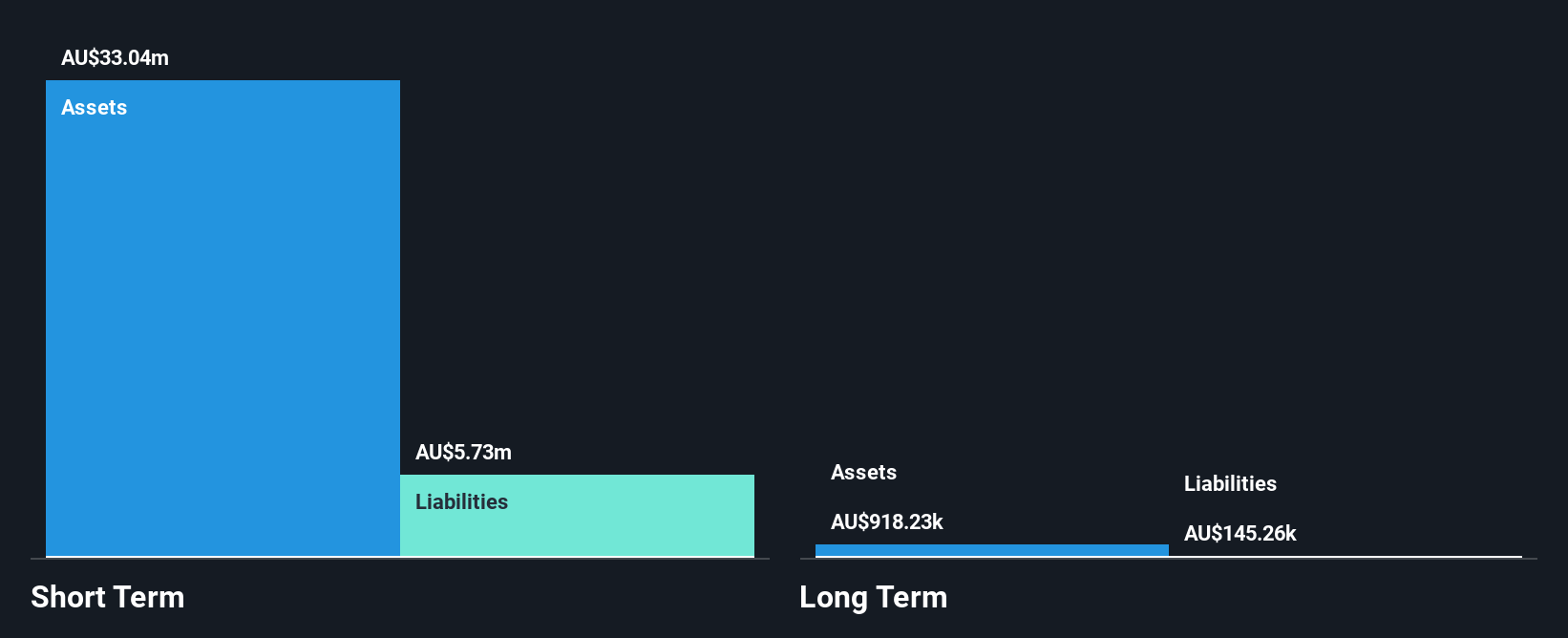

EZZ Life Science Holdings, with a market cap of A$119.35 million, operates debt-free and has stable weekly volatility at 10%. Despite a high return on equity of 24%, the company reported negative earnings growth over the past year, with net income slightly decreasing to A$6.73 million from A$6.96 million. Short-term assets of A$33 million comfortably cover both short-term and long-term liabilities. However, its recent removal from the S&P/ASX Emerging Companies Index may raise concerns for investors seeking stability in penny stocks. The company's shares are trading significantly below estimated fair value, suggesting potential undervaluation opportunities.

- Get an in-depth perspective on EZZ Life Science Holdings' performance by reading our balance sheet health report here.

- Understand EZZ Life Science Holdings' earnings outlook by examining our growth report.

Kairos Minerals (ASX:KAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kairos Minerals Limited, with a market cap of A$102.37 million, operates as a resource exploration company in Australia through its subsidiaries.

Operations: Kairos Minerals Limited does not report any revenue segments.

Market Cap: A$102.37M

Kairos Minerals Limited, with a market cap of A$102.37 million, remains pre-revenue, reporting only A$583K in revenue for the year ended June 30, 2025. Despite being debt-free and having short-term assets of A$10.6 million exceeding liabilities, the company faces challenges with a net loss of A$10.53 million and negative return on equity at -39.01%. The recent acquisition of a 10.03% stake by an undisclosed buyer for A$7.1 million highlights interest in its potential, particularly regarding the Manna Lithium Project focus, but financial performance pressures persist amidst stable weekly volatility at 13%.

- Click here to discover the nuances of Kairos Minerals with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Kairos Minerals' track record.

Navigator Global Investments (ASX:NGI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Navigator Global Investments, operating as HFA Holdings Limited, is a fund management company based in Australia with a market capitalization of A$1.05 billion.

Operations: The company's revenue is primarily derived from its Lighthouse segment, which generated $122.84 million.

Market Cap: A$1.05B

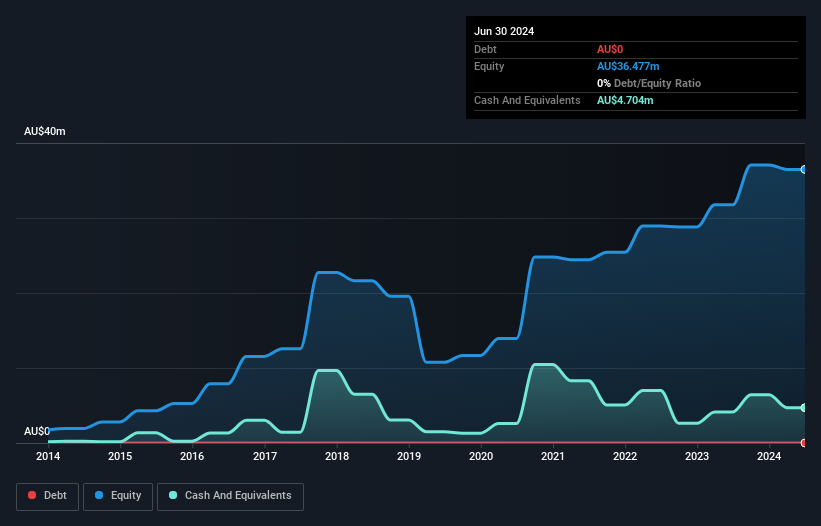

Navigator Global Investments, with a market cap of A$1.05 billion, has shown robust financial performance, reporting US$365.79 million in revenue and US$119.36 million in net income for the year ended June 30, 2025. The company's earnings have grown significantly by 80% over the past year, outpacing industry growth rates. Despite a large one-off gain impacting recent results, Navigator maintains more cash than debt and covers interest payments comfortably with profits. Recent leadership changes include Roger Davis' appointment as Chair following Michael Shepherd's retirement after years of strategic transformation efforts within the company’s global asset management operations.

- Dive into the specifics of Navigator Global Investments here with our thorough balance sheet health report.

- Learn about Navigator Global Investments' future growth trajectory here.

Turning Ideas Into Actions

- Access the full spectrum of 421 ASX Penny Stocks by clicking on this link.

- Ready To Venture Into Other Investment Styles? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Global Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NGI

Navigator Global Investments

HFA Holdings Limited operates as a fund management company in Australia.

Very undervalued with proven track record.

Market Insights

Community Narratives