- Australia

- /

- Metals and Mining

- /

- ASX:JMS

3 ASX Penny Stocks With Market Caps Larger Than A$10M

Reviewed by Simply Wall St

Australian shares are poised for further gains this week, buoyed by a surge in copper prices, with the ASX futures indicating an upward trend. While penny stocks might seem like a throwback to earlier trading days, they remain relevant for investors seeking opportunities beyond the well-known giants. These smaller or newer companies can offer surprising value when backed by solid financial foundations, and we've identified three such stocks on the ASX that combine balance sheet strength with potential growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$111.77M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.62 | A$76.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.80 | A$49.81M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$444.16M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.34 | A$246.7M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.071 | A$37.4M | ✅ 3 ⚠️ 2 View Analysis > |

| Steadfast Group (ASX:SDF) | A$4.94 | A$5.48B | ✅ 5 ⚠️ 3 View Analysis > |

| West African Resources (ASX:WAF) | A$2.82 | A$3.22B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.30 | A$1.41B | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.48 | A$650.45M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 413 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Jupiter Mines (ASX:JMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jupiter Mines Limited is an independent mining company based in Australia with a market capitalization of A$540.32 million.

Operations: The company generates revenue from its manganese operations in South Africa, amounting to A$9.43 million.

Market Cap: A$540.32M

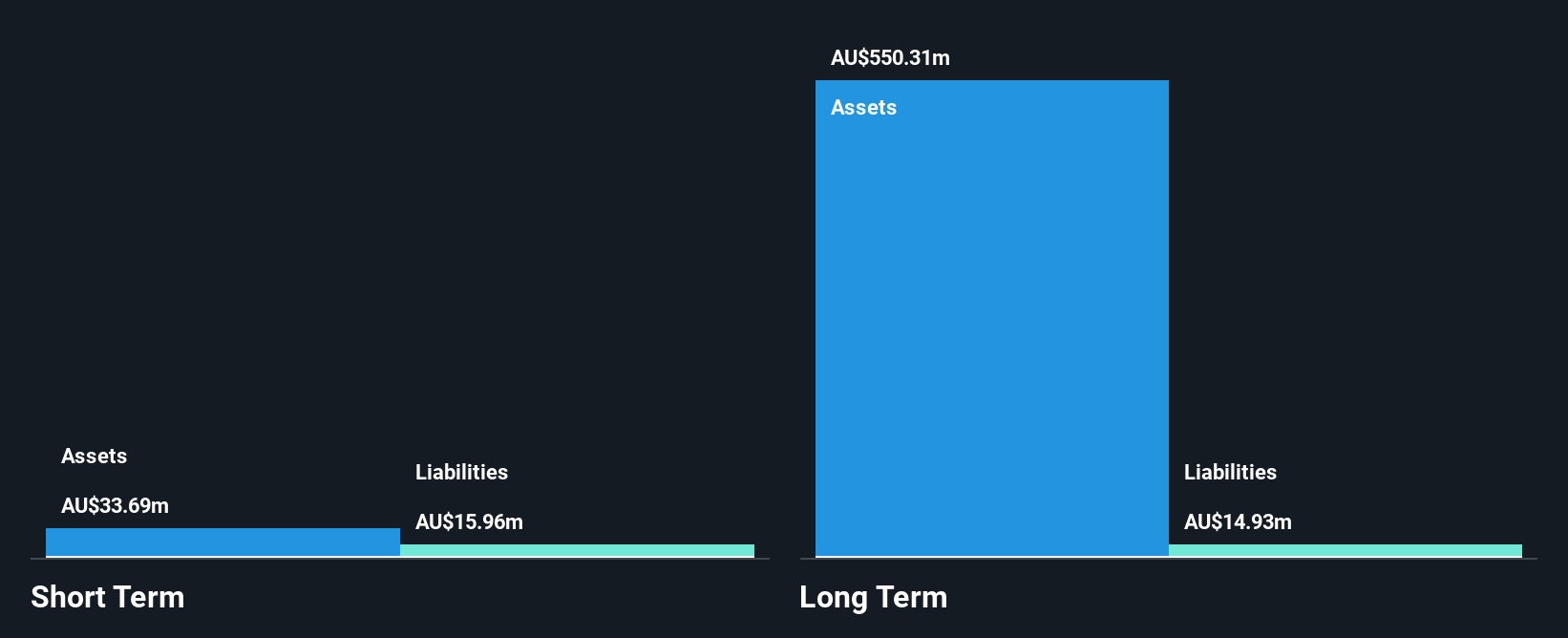

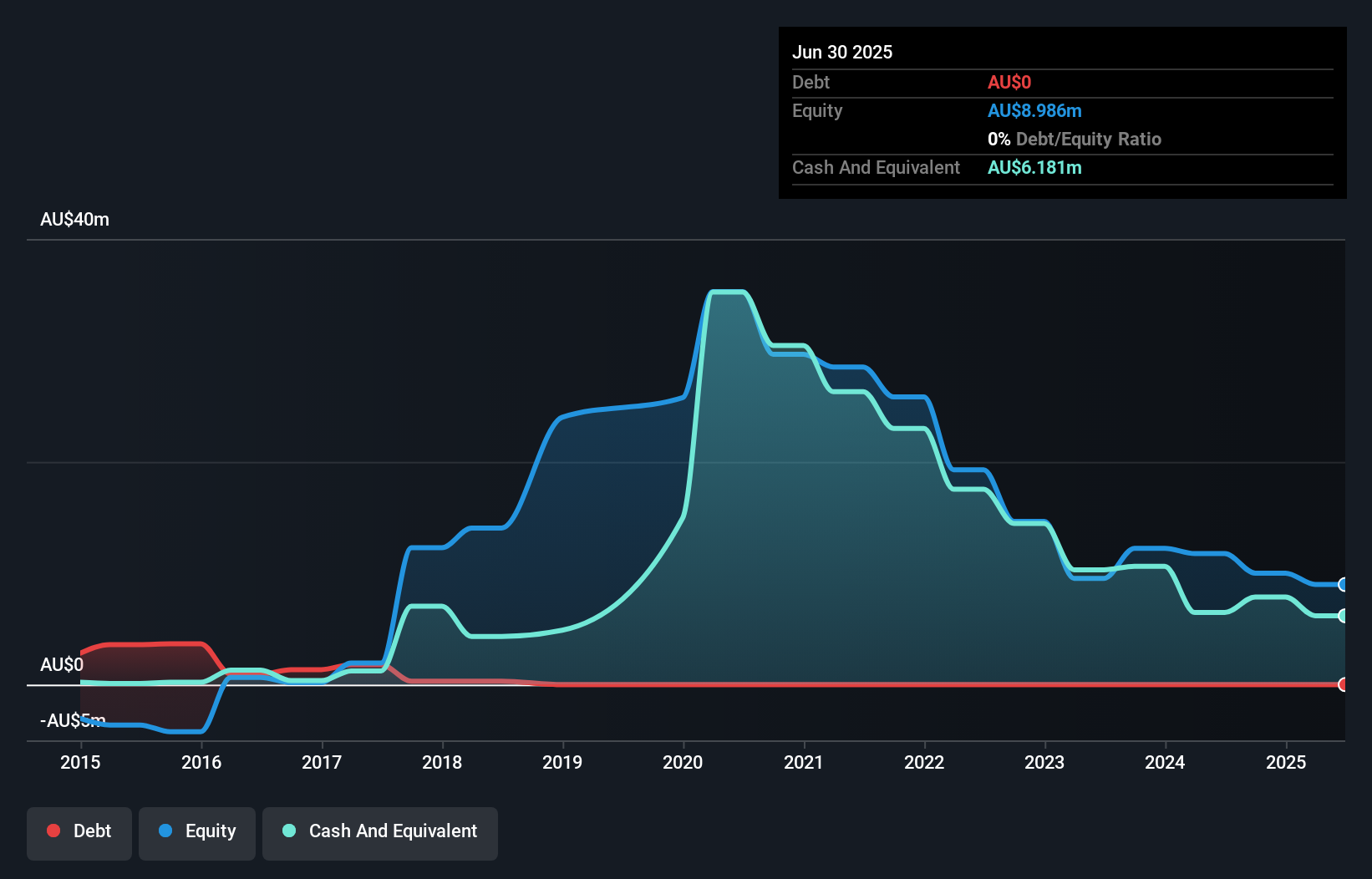

Jupiter Mines, with a market cap of A$540.32 million, presents a mixed picture as a penny stock investment. The company is debt-free and has stable weekly volatility at 5%. Its short-term assets (A$37.4M) comfortably cover both its short and long-term liabilities. However, the Return on Equity is low at 7.1%, and earnings have declined by an average of 9.9% annually over five years despite recent growth improvements to 2.8%. While the Price-to-Earnings ratio of 13.5x suggests good value compared to the broader Australian market, dividend sustainability remains questionable due to insufficient free cash flow coverage.

- Dive into the specifics of Jupiter Mines here with our thorough balance sheet health report.

- Gain insights into Jupiter Mines' historical outcomes by reviewing our past performance report.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of mineral properties, with a market cap of A$1.22 billion.

Operations: The company generates revenue primarily from its Chatree segment, amounting to A$336.75 million.

Market Cap: A$1.22B

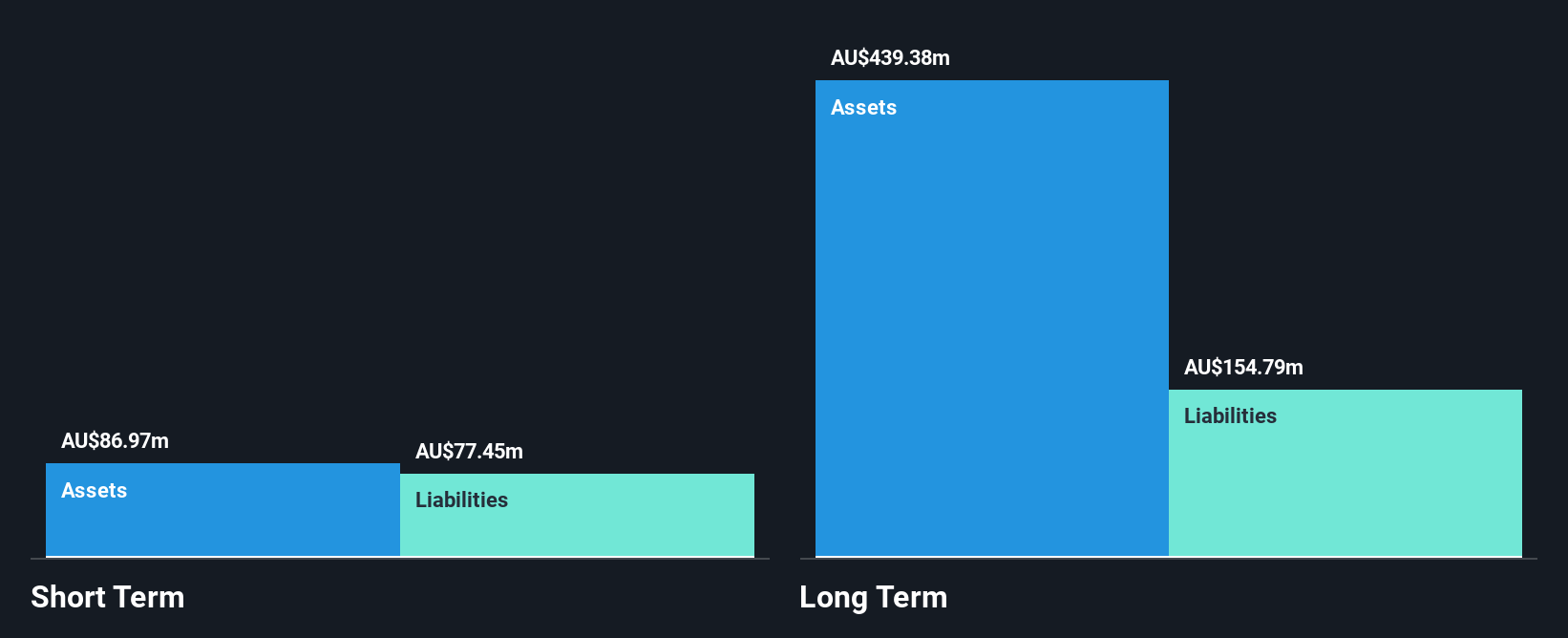

Kingsgate Consolidated, with a market cap of A$1.22 billion, shows potential yet faces challenges as an investment option. The company's revenue from its Chatree segment stands at A$336.75 million, but recent negative earnings growth of -85.3% and a low Return on Equity of 9.2% highlight performance concerns. While the debt-to-equity ratio has improved significantly over five years to 20%, interest coverage remains inadequate at 2.7x EBIT. Recent board changes include the resignation of Mrs. Nucharee Sailasuta, and the company was added to the S&P/ASX Small Ordinaries and ASX 300 Indexes in September 2025, reflecting increased visibility in the market.

- Click here to discover the nuances of Kingsgate Consolidated with our detailed analytical financial health report.

- Gain insights into Kingsgate Consolidated's future direction by reviewing our growth report.

Phoslock Environmental Technologies (ASX:PET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Phoslock Environmental Technologies Limited provides design, engineering, and project implementation solutions for water-related projects and water treatment products, with a market cap of A$16.23 million.

Operations: The company's revenue is primarily derived from its Pollution and Treatment Control Products segment, totaling A$1.61 million.

Market Cap: A$16.23M

Phoslock Environmental Technologies, with a market cap of A$16.23 million, faces both opportunities and challenges as a penny stock. It is currently pre-revenue with limited income from its Pollution and Treatment Control Products segment at A$1.61 million. Despite being unprofitable, Phoslock has reduced losses by 47.6% annually over the past five years and remains debt-free with sufficient cash runway for over three years based on current free cash flow levels. However, the management team is relatively inexperienced with an average tenure of 1.8 years, which may impact strategic execution moving forward.

- Jump into the full analysis health report here for a deeper understanding of Phoslock Environmental Technologies.

- Assess Phoslock Environmental Technologies' previous results with our detailed historical performance reports.

Key Takeaways

- Embark on your investment journey to our 413 ASX Penny Stocks selection here.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JMS

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026