- Australia

- /

- Metals and Mining

- /

- ASX:IPX

Did Rising Net Losses Just Shift IperionX's (ASX:IPX) Investment Narrative?

Reviewed by Sasha Jovanovic

- IperionX Limited recently reported its earnings results for the full year ended June 30, 2025, revealing a net loss of US$35.35 million, which was higher than the previous year's net loss of US$21.84 million.

- This widening loss, accompanied by an increase in both basic and diluted loss per share, reflects ongoing financial pressures for the company.

- We'll explore how the increase in annual net loss may reshape IperionX's investment narrative and prospects going forward.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is IperionX's Investment Narrative?

For anyone considering IperionX as an investment, much hinges on the belief in the company’s ability to become a major supplier of low-cost, sustainably produced titanium at scale, particularly as it executes ambitious expansion plans and partners with leading automotive and defense companies. The newly reported widening net loss of US$35.35 million, revealed in the recent earnings announcement, could give pause regarding near-term financial stability, especially against a backdrop of rapid capacity buildout and ongoing capital needs. Short-term catalysts, such as securing further defense contracts or accelerating commercial shipments, may see increased scrutiny since higher operating losses could temper confidence in the company’s timelines or execution. Additionally, while the share price has been robust over the past year, the increased losses place greater emphasis on operational risk and the need for continued external funding, meaning the risk profile for IperionX shareholders may have shifted meaningfully following this update. But with losses deepening, the pressure to hit production targets and secure new revenue streams is now even higher for IperionX.

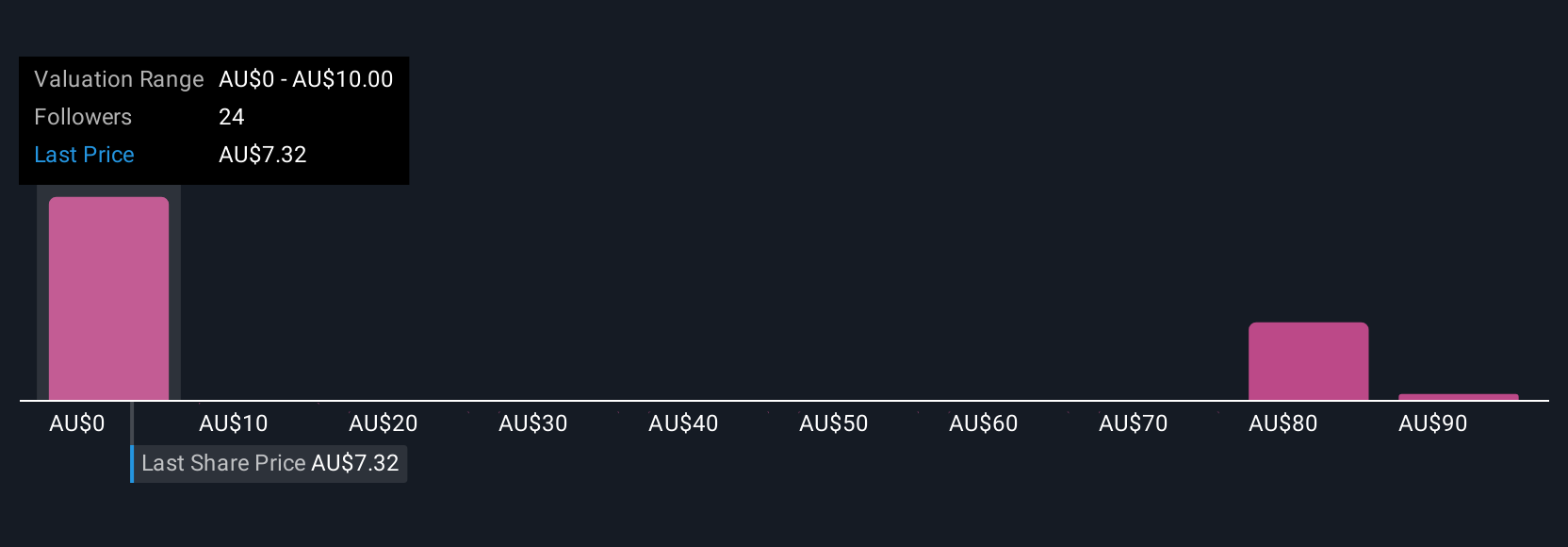

IperionX's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 13 other fair value estimates on IperionX - why the stock might be a potential multi-bagger!

Build Your Own IperionX Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IperionX research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free IperionX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IperionX's overall financial health at a glance.

No Opportunity In IperionX?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPX

IperionX

Engages in the development of its mineral properties in the United States.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives