Stock Analysis

The Australian market has shown robust growth, climbing 1.1% over the past week and achieving a 9.4% increase over the last year, with earnings expected to grow by 14% annually. In this environment, stocks with high insider ownership can be particularly compelling as they often indicate that company leaders have a vested interest in the business's success.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Gratifii (ASX:GTI) | 15.6% | 112.4% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

| Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

| Plenti Group (ASX:PLT) | 12.6% | 106.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

| Argosy Minerals (ASX:AGY) | 15.1% | 129.6% |

We're going to check out a few of the best picks from our screener tool.

IperionX (ASX:IPX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$543.31 million.

Operations: The firm is primarily involved in the exploration and development of mineral properties, with no detailed revenue segments provided.

Insider Ownership: 15.3%

IperionX, an Australian growth company with significant insider ownership, recently raised A$50 million through a follow-on equity offering priced at A$1.91 per share. This capital infusion supports its ambitious partnerships, like the recent agreement with Vegas Fastener Manufacturing to supply the U.S. Army with advanced titanium products, and a 10-year framework agreement with United Stars Holdings for up to 80 metric tons annually of titanium products. Despite generating less than US$1m in revenue and experiencing a net loss of US$10.5 million in the last half-year, IperionX is poised for substantial growth with expected revenue increases of 76.5% per year and forecasts indicating profitability within three years.

- Unlock comprehensive insights into our analysis of IperionX stock in this growth report.

- Our expertly prepared valuation report IperionX implies its share price may be too high.

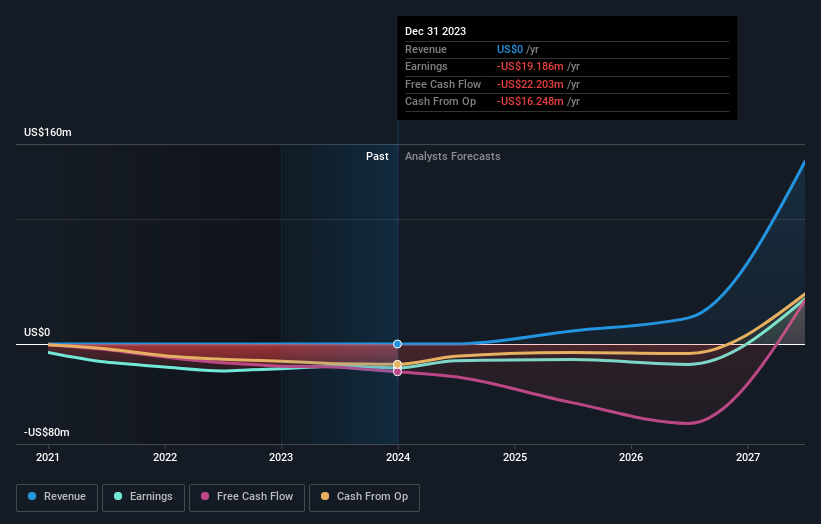

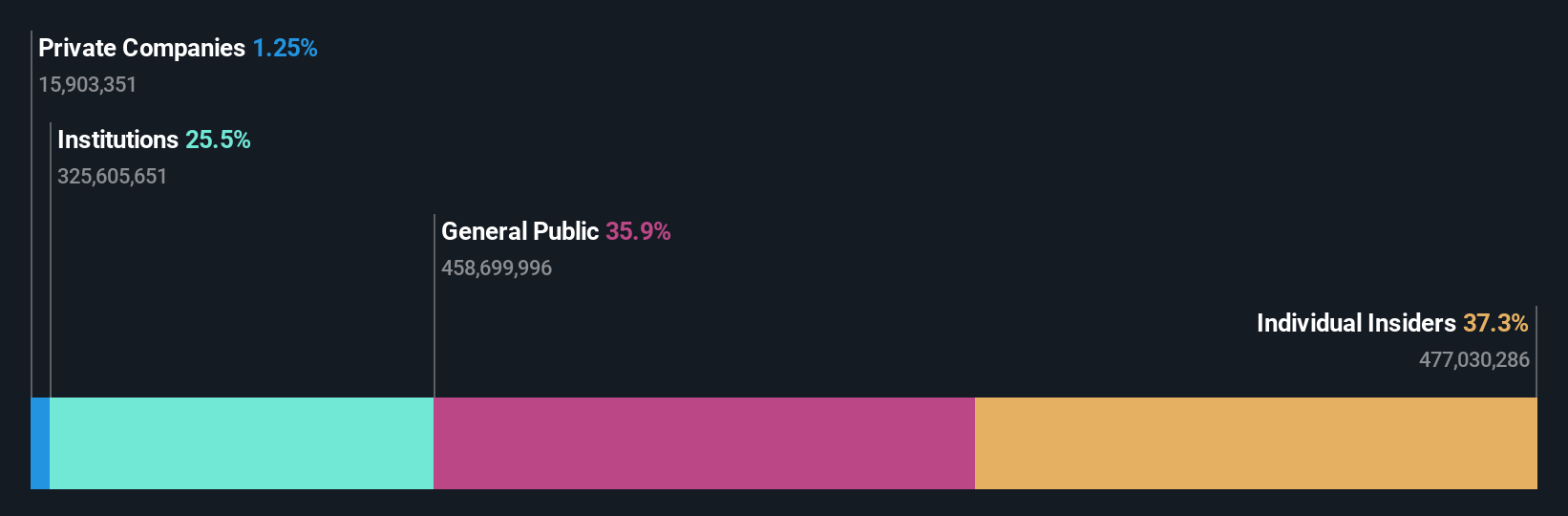

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mesoblast Limited is a biotechnology company focused on developing regenerative medicine products, operating in Australia, the United States, Singapore, and Switzerland with a market capitalization of approximately A$1.35 billion.

Operations: The company generates revenue primarily from its development of adult stem cell technology platform, totaling $7.47 million.

Insider Ownership: 22.2%

Mesoblast, an Australian biotech firm with significant insider buying in the past three months, is navigating a volatile share price. Despite shareholder dilution over the last year, Mesoblast's revenue growth is projected at a robust 55.3% annually, outpacing the broader Australian market significantly. The company is expected to turn profitable within three years, supported by promising clinical advancements such as the potential accelerated FDA approval for its heart failure treatment, rexlemestrocel-L.

- Click here and access our complete growth analysis report to understand the dynamics of Mesoblast.

- Our expertly prepared valuation report Mesoblast implies its share price may be lower than expected.

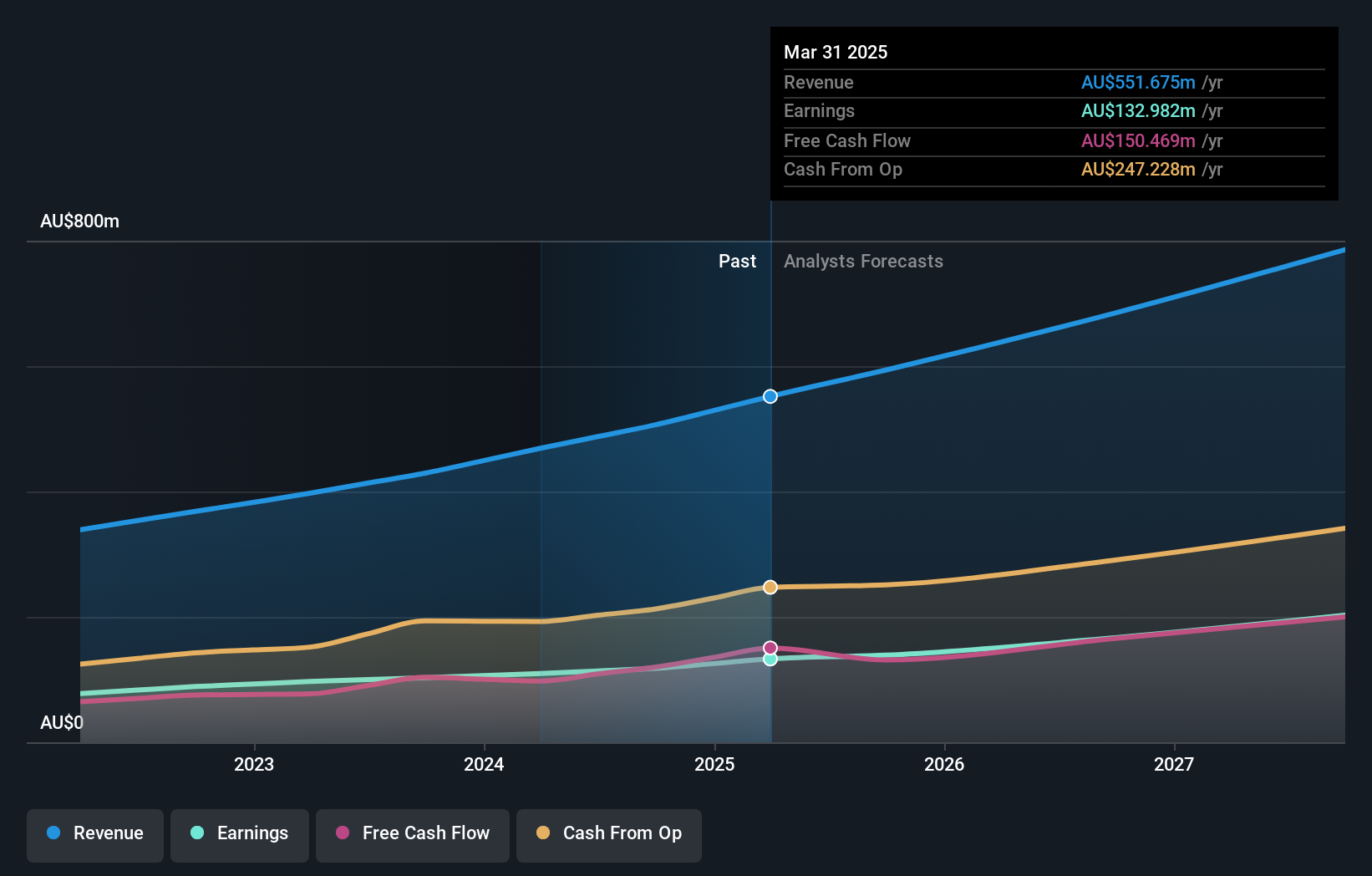

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an enterprise software company that develops, markets, sells, implements, and supports integrated business solutions in Australia and internationally, with a market capitalization of approximately A$5.79 billion.

Operations: The company generates revenue through software sales (A$317.24 million), corporate services (A$83.83 million), and consulting (A$68.13 million).

Insider Ownership: 12.3%

Technology One, an Australian software company, shows moderate growth with forecasted revenue and earnings increases of 11.1% and 13.8% per year respectively, outpacing the broader Australian market. Despite a high P/E ratio of 52.8x compared to its industry average, the firm benefits from substantial insider ownership which aligns management's interests with shareholders. Recent financial results highlighted a significant year-over-year growth in net income and earnings per share, underscoring its operational strength amidst competitive pressures.

- Click here to discover the nuances of Technology One with our detailed analytical future growth report.

- According our valuation report, there's an indication that Technology One's share price might be on the expensive side.

Turning Ideas Into Actions

- Click here to access our complete index of 90 Fast Growing ASX Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Technology One is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.